Pet health insurance covers a wide range of veterinary expenses including routine check-ups, vaccinations, and chronic condition treatments, providing comprehensive care for your pet's overall well-being. Accident insurance, however, focuses specifically on injuries resulting from accidents, such as fractures or poisonings, offering targeted financial protection for unexpected incidents. Explore the differences in coverage to determine the best option for safeguarding your pet's health and your budget.

Why it is important

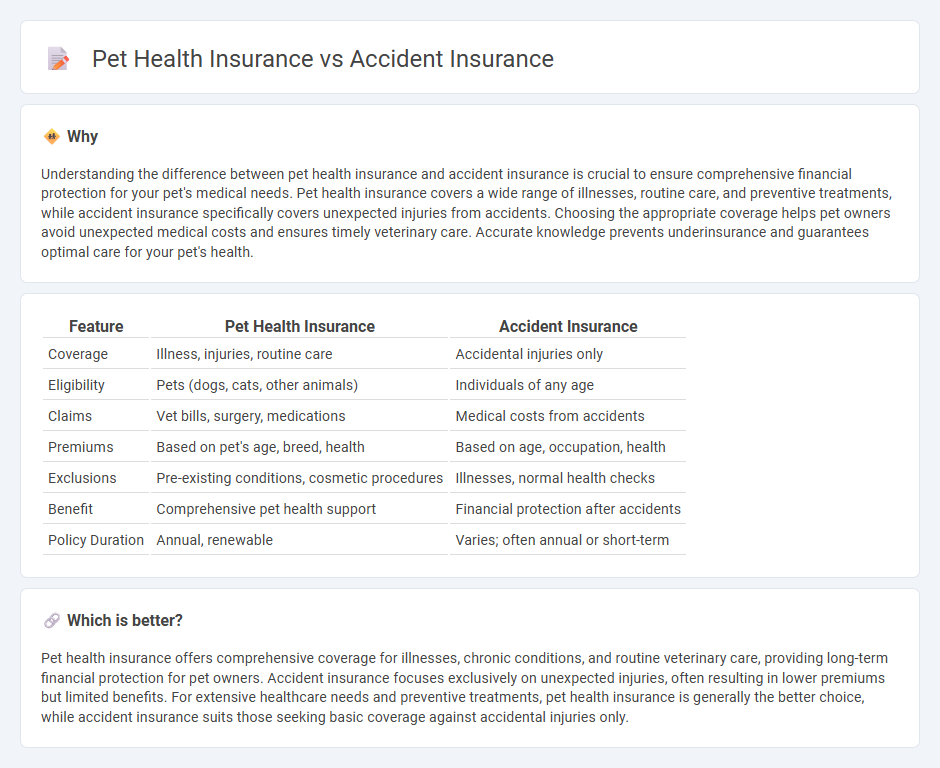

Understanding the difference between pet health insurance and accident insurance is crucial to ensure comprehensive financial protection for your pet's medical needs. Pet health insurance covers a wide range of illnesses, routine care, and preventive treatments, while accident insurance specifically covers unexpected injuries from accidents. Choosing the appropriate coverage helps pet owners avoid unexpected medical costs and ensures timely veterinary care. Accurate knowledge prevents underinsurance and guarantees optimal care for your pet's health.

Comparison Table

| Feature | Pet Health Insurance | Accident Insurance |

|---|---|---|

| Coverage | Illness, injuries, routine care | Accidental injuries only |

| Eligibility | Pets (dogs, cats, other animals) | Individuals of any age |

| Claims | Vet bills, surgery, medications | Medical costs from accidents |

| Premiums | Based on pet's age, breed, health | Based on age, occupation, health |

| Exclusions | Pre-existing conditions, cosmetic procedures | Illnesses, normal health checks |

| Benefit | Comprehensive pet health support | Financial protection after accidents |

| Policy Duration | Annual, renewable | Varies; often annual or short-term |

Which is better?

Pet health insurance offers comprehensive coverage for illnesses, chronic conditions, and routine veterinary care, providing long-term financial protection for pet owners. Accident insurance focuses exclusively on unexpected injuries, often resulting in lower premiums but limited benefits. For extensive healthcare needs and preventive treatments, pet health insurance is generally the better choice, while accident insurance suits those seeking basic coverage against accidental injuries only.

Connection

Pet health insurance and accident insurance both provide financial protection against unexpected medical expenses, covering treatments for injuries and illnesses in pets. While pet health insurance typically includes coverage for routine care, chronic conditions, and preventive services, accident insurance focuses exclusively on injuries resulting from accidents, such as fractures or poisoning. Combining both types of insurance ensures comprehensive protection, reducing out-of-pocket costs and improving access to timely veterinary care.

Key Terms

Accident Insurance:

Accident insurance provides financial coverage for unexpected injuries resulting from accidents such as fractures, burns, or emergency room visits, covering medical expenses and hospitalization costs. It offers peace of mind with lump-sum payments or reimbursements for treatment related to accidents, distinct from pet health insurance which typically includes illness and routine care. Explore how accident insurance can specifically protect your pet and your finances by learning more about its benefits and limitations.

Personal Injury

Accident insurance covers medical expenses related to unexpected personal injuries, while pet health insurance primarily addresses illness and routine care for animals. Personal injury protection under accident insurance often includes hospitalization, surgery, and rehabilitation costs, ensuring financial support when injuries occur. Explore the differences in coverage and benefits to determine which insurance fits your needs better.

Accidental Death Benefit

Accident insurance primarily provides financial compensation for accidental injuries and includes an Accidental Death Benefit that pays a lump sum to beneficiaries if the insured dies due to an accident. In contrast, pet health insurance covers veterinary expenses related to illnesses and injuries but typically does not offer an Accidental Death Benefit. Explore the key differences and benefits to choose the right coverage for your family's needs.

Source and External Links

Accident insurance: What It Is, Coverage, and Is It Worth It | Guardian - Accident insurance provides fixed benefit payments to help cover expenses from accidental injuries such as broken bones or burns, and can be used for medical and non-medical costs like rent or groceries, paying directly to the insured rather than providers.

Accident Insurance - What Is It | Anthem - Accident insurance pays cash benefits for injuries from accidents, covering things like ambulance services, emergency care, diagnostic testing, and rehab, supplementing health insurance to protect finances during recovery.

Accident insurance | Supplemental | UnitedHealthcare - Accident insurance offers cash benefits to cover unexpected expenses such as ambulance care, lost wages, deductibles, and various treatments related to accidental injuries, helping reduce financial strain.

dowidth.com

dowidth.com