Silent cyber coverage addresses the growing risk of cyber incidents not explicitly covered under traditional property and casualty insurance policies, filling gaps in protection against cyber-related losses. Traditional P&C insurance typically excludes or limits coverage for cyber threats, creating exposure for businesses facing ransomware, data breaches, or network interruptions. Explore the distinctions and benefits of silent cyber coverage to ensure comprehensive risk management in today's digital landscape.

Why it is important

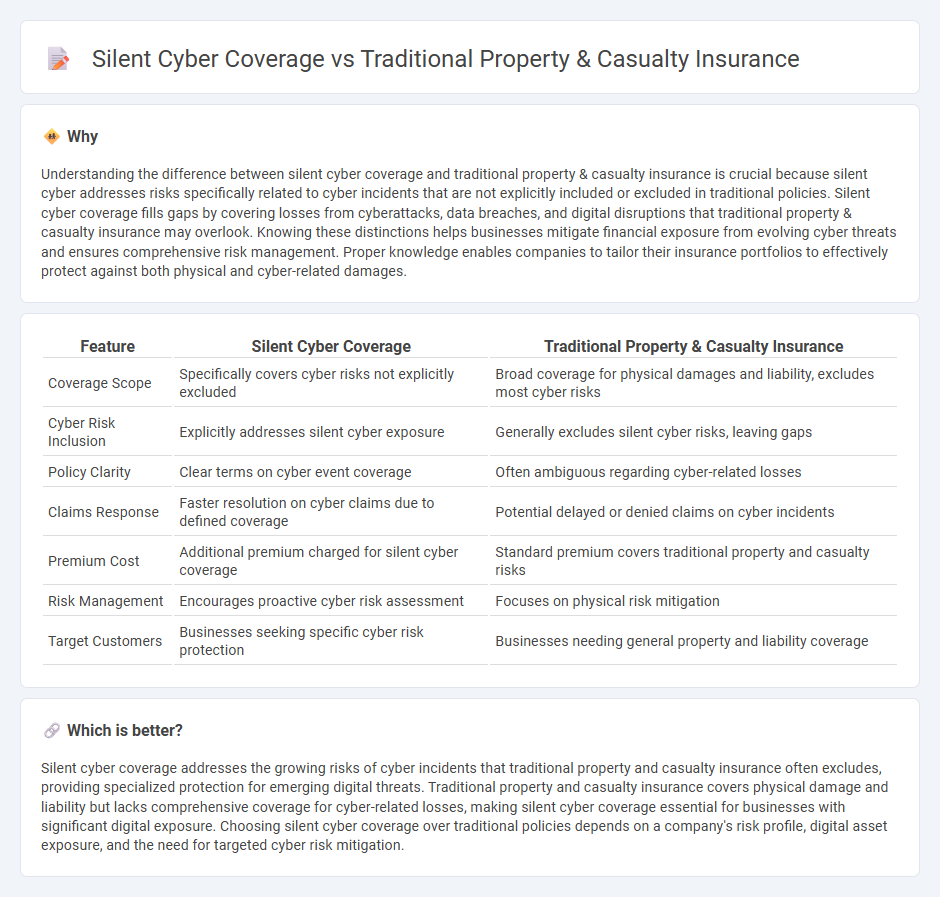

Understanding the difference between silent cyber coverage and traditional property & casualty insurance is crucial because silent cyber addresses risks specifically related to cyber incidents that are not explicitly included or excluded in traditional policies. Silent cyber coverage fills gaps by covering losses from cyberattacks, data breaches, and digital disruptions that traditional property & casualty insurance may overlook. Knowing these distinctions helps businesses mitigate financial exposure from evolving cyber threats and ensures comprehensive risk management. Proper knowledge enables companies to tailor their insurance portfolios to effectively protect against both physical and cyber-related damages.

Comparison Table

| Feature | Silent Cyber Coverage | Traditional Property & Casualty Insurance |

|---|---|---|

| Coverage Scope | Specifically covers cyber risks not explicitly excluded | Broad coverage for physical damages and liability, excludes most cyber risks |

| Cyber Risk Inclusion | Explicitly addresses silent cyber exposure | Generally excludes silent cyber risks, leaving gaps |

| Policy Clarity | Clear terms on cyber event coverage | Often ambiguous regarding cyber-related losses |

| Claims Response | Faster resolution on cyber claims due to defined coverage | Potential delayed or denied claims on cyber incidents |

| Premium Cost | Additional premium charged for silent cyber coverage | Standard premium covers traditional property and casualty risks |

| Risk Management | Encourages proactive cyber risk assessment | Focuses on physical risk mitigation |

| Target Customers | Businesses seeking specific cyber risk protection | Businesses needing general property and liability coverage |

Which is better?

Silent cyber coverage addresses the growing risks of cyber incidents that traditional property and casualty insurance often excludes, providing specialized protection for emerging digital threats. Traditional property and casualty insurance covers physical damage and liability but lacks comprehensive coverage for cyber-related losses, making silent cyber coverage essential for businesses with significant digital exposure. Choosing silent cyber coverage over traditional policies depends on a company's risk profile, digital asset exposure, and the need for targeted cyber risk mitigation.

Connection

Silent cyber coverage addresses gaps in traditional property and casualty (P&C) insurance by covering cyber-related losses that P&C policies typically exclude. While traditional P&C insurance protects against physical damages and liability risks, it often lacks explicit provisions for cyber incidents, leading to coverage ambiguities. Integrating silent cyber coverage with P&C insurance enhances risk management strategies by providing clarity and protection against cyber threats without requiring separate cyber policies.

Key Terms

Traditional Property & Casualty Insurance:

Traditional property & casualty insurance primarily covers tangible risks like fire, theft, and natural disasters impacting physical assets and liability claims. This insurance excludes cyber-related incidents, leaving gaps in protection against evolving digital threats and silent cyber risks embedded in standard policies. Explore how integrating silent cyber coverage can enhance risk management in the digital age.

Physical Perils

Traditional property & casualty insurance typically covers physical perils such as fire, windstorm, and theft, providing indemnity for tangible damages to assets. Silent cyber coverage addresses cyber-related incidents that manifest as physical damage but are often excluded in traditional policies due to ambiguous language. Explore detailed analyses of coverage gaps and emerging risk management strategies in silent cyber insurance to better understand these evolving challenges.

Exclusions

Traditional property and casualty insurance policies typically exclude coverage for silent cyber risks, which are cyber incidents not explicitly mentioned in policy language. These exclusions highlight gaps in protection, leaving insured parties vulnerable to losses from data breaches, ransomware, or cyber-attacks that are not clearly defined within conventional policy terms. Explore detailed insights on how silent cyber coverage bridges these gaps and provides comprehensive risk management.

Source and External Links

What is Property and Casualty Insurance? A Guide | Charles Schwab - Traditional property and casualty (P&C) insurance protects physical property and covers liability against accidents, helping prevent financial losses related to home, car, business, or valuables damage or legal responsibility.

An Overview of Property and Casualty Insurance - P&C insurance consists of property insurance, which covers loss or damage to assets, and casualty insurance, which covers legal liabilities from accidents or injuries involving others.

What Types of Property and Casualty Insurance Are There? - Common traditional P&C insurance types include auto, homeowners, renters, business, flood, earthquake, and umbrella insurance, which provide protection against loss, damage, or liability risks.

dowidth.com

dowidth.com