Parametric insurance provides coverage based on predefined triggers measured by specific parameters such as rainfall levels or wind speed, offering quick payouts without the need for loss assessment. Index-based insurance relies on an index derived from aggregated data like weather conditions or crop yields to determine compensation, reducing claim disputes and administrative costs. Explore the differences and benefits of these innovative insurance models to enhance risk management strategies.

Why it is important

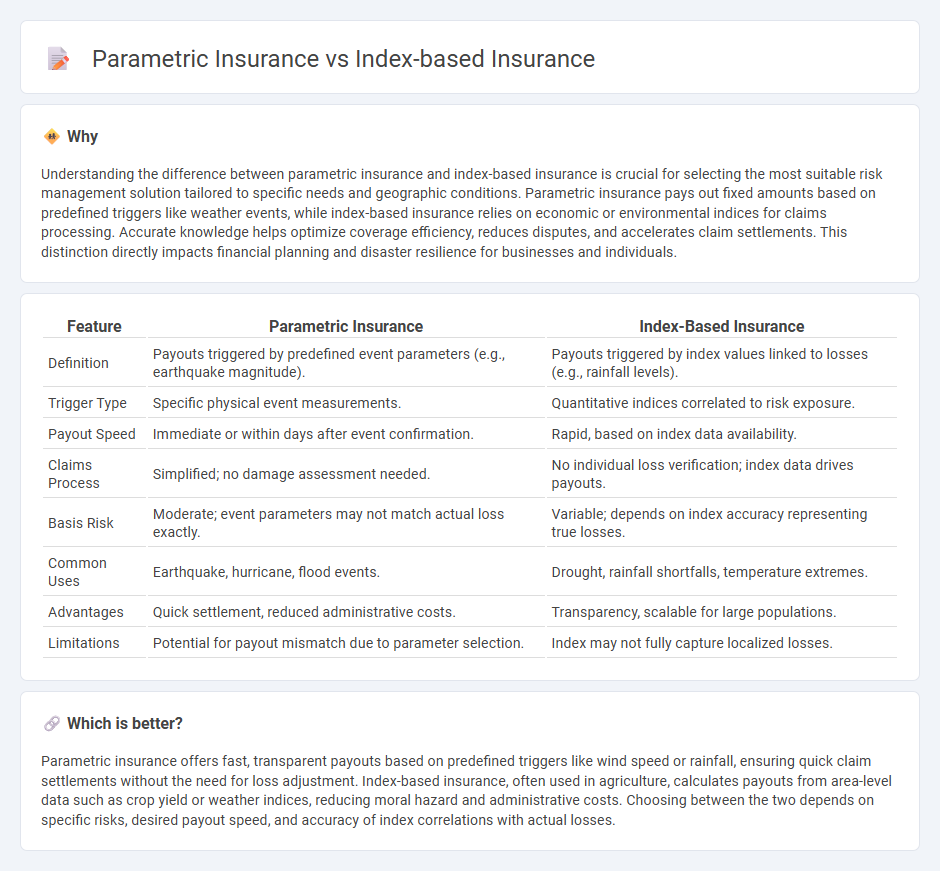

Understanding the difference between parametric insurance and index-based insurance is crucial for selecting the most suitable risk management solution tailored to specific needs and geographic conditions. Parametric insurance pays out fixed amounts based on predefined triggers like weather events, while index-based insurance relies on economic or environmental indices for claims processing. Accurate knowledge helps optimize coverage efficiency, reduces disputes, and accelerates claim settlements. This distinction directly impacts financial planning and disaster resilience for businesses and individuals.

Comparison Table

| Feature | Parametric Insurance | Index-Based Insurance |

|---|---|---|

| Definition | Payouts triggered by predefined event parameters (e.g., earthquake magnitude). | Payouts triggered by index values linked to losses (e.g., rainfall levels). |

| Trigger Type | Specific physical event measurements. | Quantitative indices correlated to risk exposure. |

| Payout Speed | Immediate or within days after event confirmation. | Rapid, based on index data availability. |

| Claims Process | Simplified; no damage assessment needed. | No individual loss verification; index data drives payouts. |

| Basis Risk | Moderate; event parameters may not match actual loss exactly. | Variable; depends on index accuracy representing true losses. |

| Common Uses | Earthquake, hurricane, flood events. | Drought, rainfall shortfalls, temperature extremes. |

| Advantages | Quick settlement, reduced administrative costs. | Transparency, scalable for large populations. |

| Limitations | Potential for payout mismatch due to parameter selection. | Index may not fully capture localized losses. |

Which is better?

Parametric insurance offers fast, transparent payouts based on predefined triggers like wind speed or rainfall, ensuring quick claim settlements without the need for loss adjustment. Index-based insurance, often used in agriculture, calculates payouts from area-level data such as crop yield or weather indices, reducing moral hazard and administrative costs. Choosing between the two depends on specific risks, desired payout speed, and accuracy of index correlations with actual losses.

Connection

Parametric insurance and index-based insurance are connected through their reliance on predefined parameters or indices such as weather data, seismic activity, or crop yields to trigger payouts. These insurance models offer faster claims processing by eliminating the need for traditional loss assessments, using objective thresholds like rainfall levels or temperature indexes. Both approaches enhance risk management in sectors vulnerable to natural disasters by providing transparent, data-driven compensation mechanisms.

Key Terms

**Index-Based Insurance:**

Index-based insurance offers coverage linked to predefined indices such as rainfall levels, temperature, or crop yields, enabling swift and transparent claim settlements. It reduces the need for on-site loss assessment by using measurable data triggers, minimizing claims disputes and administrative costs. Explore more to understand how index-based insurance can enhance risk management and financial security in agriculture and disaster-prone sectors.

Index Trigger

Index-based insurance relies on a predetermined index, such as rainfall levels or crop yields, to trigger payouts when losses correlate with index thresholds. Parametric insurance also uses specific parameters like weather events or earthquake magnitude as triggers, ensuring rapid claims processing without the need for individual loss assessment. Explore more to understand how index triggers drive efficiency and risk management in these insurance models.

Payout Scale

Index-based insurance determines payouts based on predefined indices such as rainfall levels or crop yields, offering objective and transparent claim settlements without individual loss assessment. Parametric insurance triggers payouts when specific parameters or thresholds, like wind speed during a hurricane, are surpassed, enabling faster compensation but potentially leading to basis risk if actual losses differ. Explore detailed comparisons and applications to understand which payout scale suits your risk management needs.

Source and External Links

What is index insurance? - Index Insurance Forum - Index insurance is an innovative approach that pays out benefits based on a predetermined index (e.g., rainfall, temperature), allowing for quick and objective claims settlement without requiring individual loss assessments.

Index-based insurance - Wikipedia - Index-based insurance, primarily used in agriculture, links payouts to an index closely correlated with production losses (such as rainfall or yield), triggering payments when the index exceeds a set threshold, thus reducing administrative costs compared to traditional indemnity-based insurance.

Index-based Crop Insurance: Agricultural Parametric Solutions - EOS Data Analytics - Index-based crop insurance uses predefined indices to determine payouts, offering a simpler, faster, and more affordable alternative to traditional insurance, especially beneficial for smallholder farmers in developing countries.

dowidth.com

dowidth.com