Social prescribing insurance focuses on covering holistic health services that promote well-being through community and social support, while life insurance provides a financial safety net to beneficiaries after the insured's death. Both types of insurance play distinct roles in managing health risks and financial security, with social prescribing insurance emphasizing preventive care and life insurance prioritizing legacy protection. Explore the differences and benefits to determine which insurance aligns best with your needs.

Why it is important

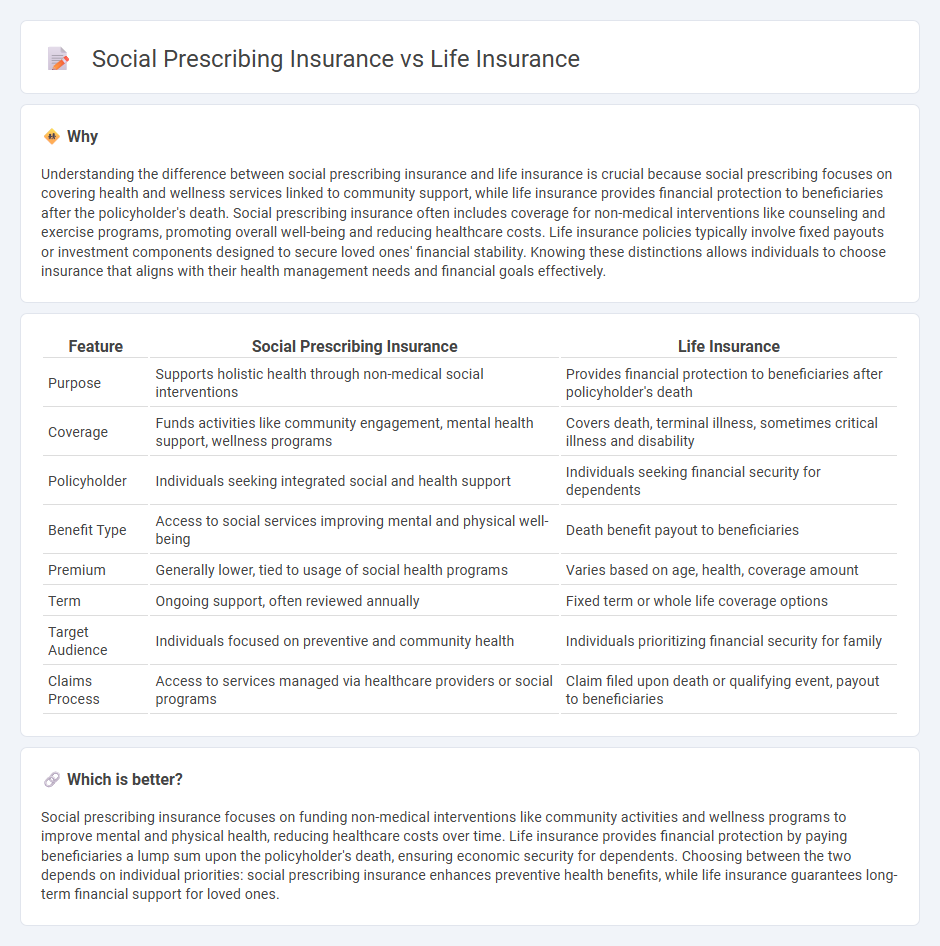

Understanding the difference between social prescribing insurance and life insurance is crucial because social prescribing focuses on covering health and wellness services linked to community support, while life insurance provides financial protection to beneficiaries after the policyholder's death. Social prescribing insurance often includes coverage for non-medical interventions like counseling and exercise programs, promoting overall well-being and reducing healthcare costs. Life insurance policies typically involve fixed payouts or investment components designed to secure loved ones' financial stability. Knowing these distinctions allows individuals to choose insurance that aligns with their health management needs and financial goals effectively.

Comparison Table

| Feature | Social Prescribing Insurance | Life Insurance |

|---|---|---|

| Purpose | Supports holistic health through non-medical social interventions | Provides financial protection to beneficiaries after policyholder's death |

| Coverage | Funds activities like community engagement, mental health support, wellness programs | Covers death, terminal illness, sometimes critical illness and disability |

| Policyholder | Individuals seeking integrated social and health support | Individuals seeking financial security for dependents |

| Benefit Type | Access to social services improving mental and physical well-being | Death benefit payout to beneficiaries |

| Premium | Generally lower, tied to usage of social health programs | Varies based on age, health, coverage amount |

| Term | Ongoing support, often reviewed annually | Fixed term or whole life coverage options |

| Target Audience | Individuals focused on preventive and community health | Individuals prioritizing financial security for family |

| Claims Process | Access to services managed via healthcare providers or social programs | Claim filed upon death or qualifying event, payout to beneficiaries |

Which is better?

Social prescribing insurance focuses on funding non-medical interventions like community activities and wellness programs to improve mental and physical health, reducing healthcare costs over time. Life insurance provides financial protection by paying beneficiaries a lump sum upon the policyholder's death, ensuring economic security for dependents. Choosing between the two depends on individual priorities: social prescribing insurance enhances preventive health benefits, while life insurance guarantees long-term financial support for loved ones.

Connection

Social prescribing insurance and life insurance intersect through their shared focus on holistic well-being and risk management. Social prescribing insurance supports preventative health measures by funding activities that improve mental and physical health, potentially reducing claims on life insurance policies. This integration promotes healthier lifestyles, which can lead to lower mortality risks and more accurate life insurance underwriting.

Key Terms

Beneficiary

Life insurance provides a financial payout to designated beneficiaries upon the policyholder's death, ensuring economic security for dependents or loved ones. Social prescribing insurance, by contrast, focuses on improving the insured's health and well-being through non-medical interventions connected to community services, indirectly benefiting both the individual and their social network. Explore more to understand how these insurance types uniquely support beneficiaries' needs.

Premium

Life insurance premiums are calculated based on factors such as age, health status, lifestyle, and coverage amount, typically requiring regular payments to maintain financial protection for beneficiaries. Social prescribing insurance premiums focus on covering services that support holistic health through non-medical interventions like community activities and mental health support, often resulting in varied premium structures depending on the provider and scope. Explore more to understand how premium differences impact overall coverage benefits and financial planning.

Coverage

Life insurance primarily offers financial protection by providing a payout to beneficiaries upon the policyholder's death, covering expenses such as funeral costs, debts, and income replacement. Social prescribing insurance, on the other hand, supports health and well-being by funding non-medical interventions like community activities, mental health support, and lifestyle programs aimed at preventing illness. Explore how these distinct insurance coverages can complement your overall health and financial security plans.

Source and External Links

Life Insurance | Get Your Quote Today - Allstate - Provides life insurance options tailored to individual needs and budgets, offering various coverage types and benefits.

Life Insurance Policy - Get a Free Quote | Aflac - Offers term life, whole life, and final expense life insurance policies with guaranteed-issue options for select products.

Life Insurance - Get a Free Quote Now - GEICO - Allows users to estimate their life insurance needs and offers different types of policies such as term life, whole life, and universal life insurance.

dowidth.com

dowidth.com