Cyber insurance protects businesses from financial losses caused by data breaches, cyberattacks, and other digital threats. Engineering insurance covers risks related to construction projects, machinery breakdown, and design errors, ensuring protection against physical and operational hazards. Explore further to understand which insurance best suits your specific industry needs.

Why it is important

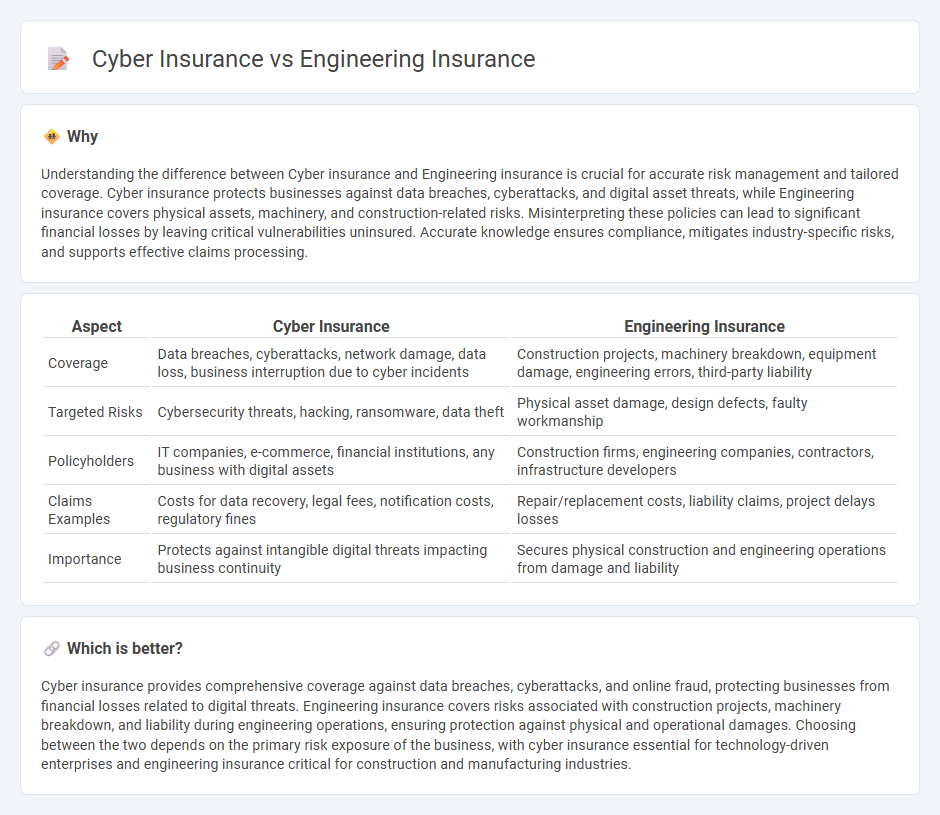

Understanding the difference between Cyber insurance and Engineering insurance is crucial for accurate risk management and tailored coverage. Cyber insurance protects businesses against data breaches, cyberattacks, and digital asset threats, while Engineering insurance covers physical assets, machinery, and construction-related risks. Misinterpreting these policies can lead to significant financial losses by leaving critical vulnerabilities uninsured. Accurate knowledge ensures compliance, mitigates industry-specific risks, and supports effective claims processing.

Comparison Table

| Aspect | Cyber Insurance | Engineering Insurance |

|---|---|---|

| Coverage | Data breaches, cyberattacks, network damage, data loss, business interruption due to cyber incidents | Construction projects, machinery breakdown, equipment damage, engineering errors, third-party liability |

| Targeted Risks | Cybersecurity threats, hacking, ransomware, data theft | Physical asset damage, design defects, faulty workmanship |

| Policyholders | IT companies, e-commerce, financial institutions, any business with digital assets | Construction firms, engineering companies, contractors, infrastructure developers |

| Claims Examples | Costs for data recovery, legal fees, notification costs, regulatory fines | Repair/replacement costs, liability claims, project delays losses |

| Importance | Protects against intangible digital threats impacting business continuity | Secures physical construction and engineering operations from damage and liability |

Which is better?

Cyber insurance provides comprehensive coverage against data breaches, cyberattacks, and online fraud, protecting businesses from financial losses related to digital threats. Engineering insurance covers risks associated with construction projects, machinery breakdown, and liability during engineering operations, ensuring protection against physical and operational damages. Choosing between the two depends on the primary risk exposure of the business, with cyber insurance essential for technology-driven enterprises and engineering insurance critical for construction and manufacturing industries.

Connection

Cyber insurance and engineering insurance intersect in protecting businesses from technology-related risks and operational failures. Cyber insurance covers losses from data breaches, cyberattacks, and digital disruptions, while engineering insurance focuses on physical project risks such as construction defects and equipment failures. Integrating both insurances offers comprehensive risk management for projects reliant on digital infrastructure and complex engineering systems.

Key Terms

**Engineering insurance:**

Engineering insurance protects businesses from risks related to construction, machinery breakdown, and equipment installation, covering physical assets and potential project delays. It includes coverage for contractors' tools, construction machinery, and electronic equipment failures to minimize financial losses. Discover how engineering insurance can safeguard your infrastructure investments and ensure project continuity.

Erection All Risks (EAR)

Engineering insurance for Erection All Risks (EAR) covers physical loss or damage during the construction and installation of plants, machinery, and equipment, ensuring protection against risks such as fire, theft, and natural disasters. Cyber insurance, on the other hand, safeguards against digital threats including data breaches, ransomware, and cyber-attacks that can disrupt engineering projects and operational technology systems. Explore detailed comparisons and risk management strategies to understand how these insurance types complement each other in protecting complex engineering ventures.

Contractors’ All Risks (CAR)

Contractors' All Risks (CAR) insurance primarily covers physical damages and third-party claims related to construction projects, safeguarding assets from risks like fire, theft, and structural defects. In contrast, cyber insurance protects against digital threats including data breaches, ransomware attacks, and business interruptions caused by cyber incidents affecting contractors' IT systems. Explore the key differences and benefits of integrating both policies to fully secure construction businesses.

Source and External Links

Engineering Insurance - This page provides information on customized insurance for engineers and their firms, covering risks such as professional liability and job-related injuries.

Business Insurance for Engineers - Business insurance for engineers offers protection through policies like general liability and professional liability, helping manage risks such as property damage and professional errors.

Engineering Insurance - NEXT Insurance offers tailored business insurance packages for engineers, including general liability, professional liability, and more, to protect against various business risks.

dowidth.com

dowidth.com