Crop microinsurance protects smallholder farmers against losses from adverse weather events, pests, or diseases, ensuring financial stability and crop yield security. Life microinsurance offers low-cost coverage tailored for low-income individuals, providing beneficiaries with crucial support in case of the policyholder's death. Explore the detailed benefits and differences between crop and life microinsurance to make informed decisions.

Why it is important

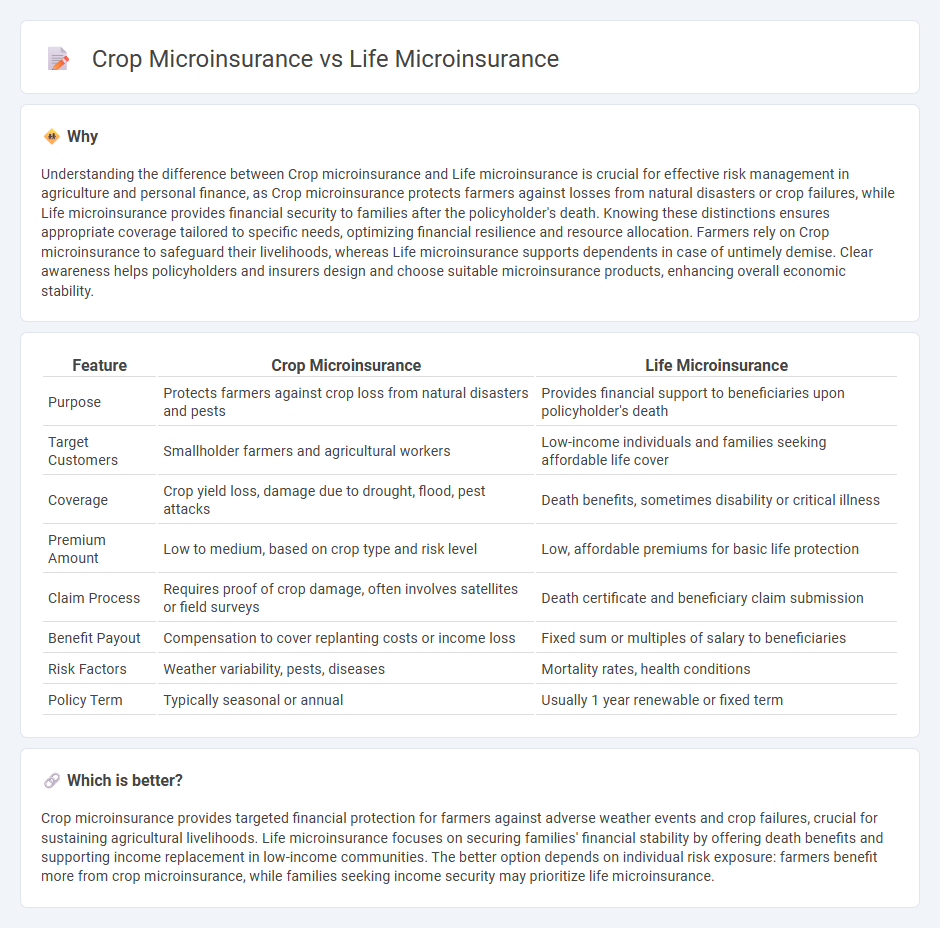

Understanding the difference between Crop microinsurance and Life microinsurance is crucial for effective risk management in agriculture and personal finance, as Crop microinsurance protects farmers against losses from natural disasters or crop failures, while Life microinsurance provides financial security to families after the policyholder's death. Knowing these distinctions ensures appropriate coverage tailored to specific needs, optimizing financial resilience and resource allocation. Farmers rely on Crop microinsurance to safeguard their livelihoods, whereas Life microinsurance supports dependents in case of untimely demise. Clear awareness helps policyholders and insurers design and choose suitable microinsurance products, enhancing overall economic stability.

Comparison Table

| Feature | Crop Microinsurance | Life Microinsurance |

|---|---|---|

| Purpose | Protects farmers against crop loss from natural disasters and pests | Provides financial support to beneficiaries upon policyholder's death |

| Target Customers | Smallholder farmers and agricultural workers | Low-income individuals and families seeking affordable life cover |

| Coverage | Crop yield loss, damage due to drought, flood, pest attacks | Death benefits, sometimes disability or critical illness |

| Premium Amount | Low to medium, based on crop type and risk level | Low, affordable premiums for basic life protection |

| Claim Process | Requires proof of crop damage, often involves satellites or field surveys | Death certificate and beneficiary claim submission |

| Benefit Payout | Compensation to cover replanting costs or income loss | Fixed sum or multiples of salary to beneficiaries |

| Risk Factors | Weather variability, pests, diseases | Mortality rates, health conditions |

| Policy Term | Typically seasonal or annual | Usually 1 year renewable or fixed term |

Which is better?

Crop microinsurance provides targeted financial protection for farmers against adverse weather events and crop failures, crucial for sustaining agricultural livelihoods. Life microinsurance focuses on securing families' financial stability by offering death benefits and supporting income replacement in low-income communities. The better option depends on individual risk exposure: farmers benefit more from crop microinsurance, while families seeking income security may prioritize life microinsurance.

Connection

Crop microinsurance and life microinsurance are interconnected by their focus on providing financial protection to low-income individuals, particularly in vulnerable agricultural communities. Crop microinsurance mitigates risks related to crop failure due to weather events, while life microinsurance secures families against the economic consequences of the policyholder's death. Both products enhance resilience by stabilizing income streams and reducing poverty in rural areas.

Key Terms

Life microinsurance:

Life microinsurance provides low-cost insurance coverage designed to protect low-income individuals against risks such as death, disability, or critical illness, ensuring financial support for families during emergencies. It typically offers tailored benefits like lump-sum payouts or monthly income replacement, crucial for vulnerable populations lacking traditional insurance access. Discover more about how Life microinsurance safeguards livelihoods and strengthens community resilience.

Beneficiary

Life microinsurance primarily targets individual policyholders and their families, providing financial protection against unexpected death or disability, ensuring income replacement and covering funeral expenses. Crop microinsurance is designed for smallholder farmers, offering indemnity or index-based coverage to safeguard against losses due to weather events, pests, or diseases that impact agricultural yield. Explore the key differences in beneficiary profiles and coverage objectives to understand which microinsurance product best meets your needs.

Premium

Life microinsurance premiums are typically calculated based on age, health, and coverage amount, offering affordable protection for low-income individuals against mortality risks. Crop microinsurance premiums vary depending on factors such as crop type, acreage, weather patterns, and yield estimates, aiming to shield farmers from losses due to natural disasters and climate variability. Explore detailed comparisons to understand how premium structures align with specific risk factors in these microinsurance products.

Source and External Links

Profitability and client value along the life microinsurance value... - Life microinsurance offers a strong business case in markets like the Philippines, with potential for profitability for both insurers and distributors.

Life - Microinsurance Innovation Facility - Life microinsurance is the most common type of microinsurance, extending beyond credit-linked products to provide a range of coverage options.

Microinsurance | Insurance | Milliman | Worldwide - Milliman's microinsurance solutions focus on creating accessible life microinsurance products that protect vulnerable populations against significant risks.

dowidth.com

dowidth.com