Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets, providing more accurate risk assessments and faster policy decisions. Behavioral data underwriting focuses on real-time customer behavior patterns, offering personalized risk profiles and improved fraud detection. Explore how these advanced underwriting methods revolutionize the insurance industry and enhance customer experiences.

Why it is important

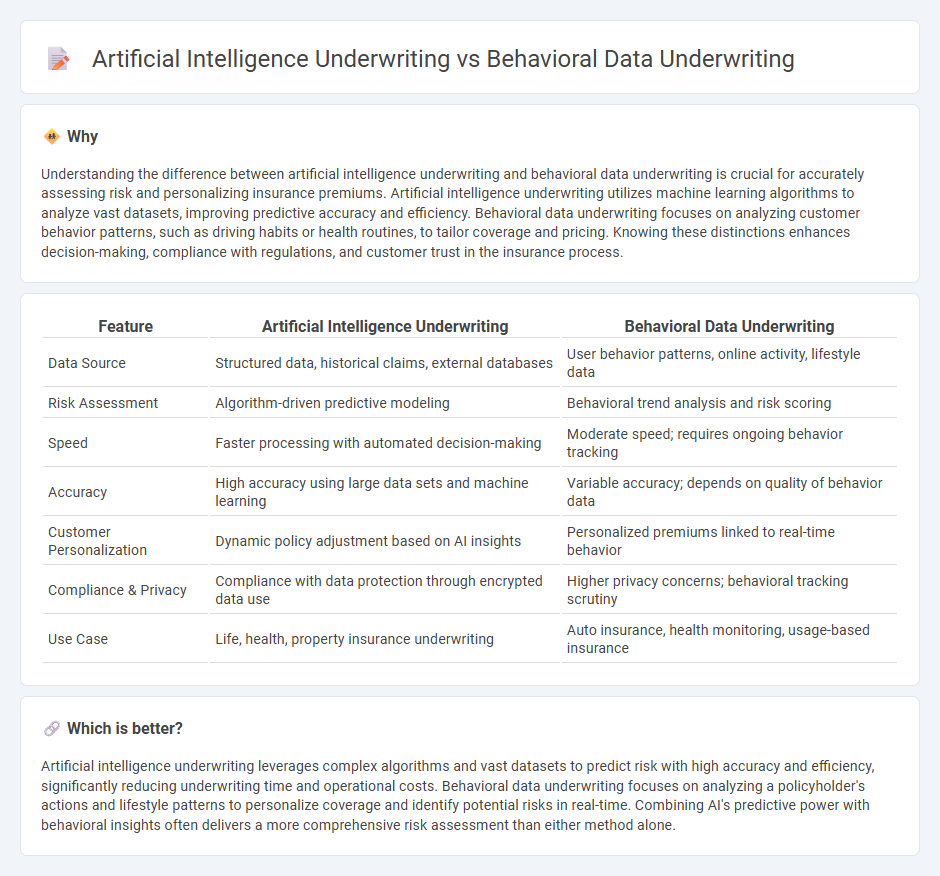

Understanding the difference between artificial intelligence underwriting and behavioral data underwriting is crucial for accurately assessing risk and personalizing insurance premiums. Artificial intelligence underwriting utilizes machine learning algorithms to analyze vast datasets, improving predictive accuracy and efficiency. Behavioral data underwriting focuses on analyzing customer behavior patterns, such as driving habits or health routines, to tailor coverage and pricing. Knowing these distinctions enhances decision-making, compliance with regulations, and customer trust in the insurance process.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Behavioral Data Underwriting |

|---|---|---|

| Data Source | Structured data, historical claims, external databases | User behavior patterns, online activity, lifestyle data |

| Risk Assessment | Algorithm-driven predictive modeling | Behavioral trend analysis and risk scoring |

| Speed | Faster processing with automated decision-making | Moderate speed; requires ongoing behavior tracking |

| Accuracy | High accuracy using large data sets and machine learning | Variable accuracy; depends on quality of behavior data |

| Customer Personalization | Dynamic policy adjustment based on AI insights | Personalized premiums linked to real-time behavior |

| Compliance & Privacy | Compliance with data protection through encrypted data use | Higher privacy concerns; behavioral tracking scrutiny |

| Use Case | Life, health, property insurance underwriting | Auto insurance, health monitoring, usage-based insurance |

Which is better?

Artificial intelligence underwriting leverages complex algorithms and vast datasets to predict risk with high accuracy and efficiency, significantly reducing underwriting time and operational costs. Behavioral data underwriting focuses on analyzing a policyholder's actions and lifestyle patterns to personalize coverage and identify potential risks in real-time. Combining AI's predictive power with behavioral insights often delivers a more comprehensive risk assessment than either method alone.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast amounts of behavioral data, identifying patterns that traditional methods might miss. Behavioral data underwriting enhances risk assessment accuracy by integrating real-time customer behaviors, enabling more personalized insurance pricing. The synergy between AI and behavioral data transforms underwriting efficiency and predicts policyholder risk with greater precision.

Key Terms

**Behavioral Data Underwriting:**

Behavioral data underwriting leverages real-time customer behavior patterns, such as spending habits, social interactions, and digital footprints, to assess risk more dynamically than traditional methods. This approach enhances accuracy by incorporating nuanced human actions and decisions into credit and insurance evaluations. Explore how behavioral data underwriting transforms risk assessment and financial decision-making for deeper insights.

Predictive Analytics

Behavioral data underwriting leverages consumer actions and patterns to enhance risk assessment, providing granular insights into individual behavior that refine predictive analytics models. Artificial intelligence underwriting integrates machine learning algorithms to analyze vast datasets, identifying complex risk patterns with higher accuracy and speed than traditional methods. Explore how predictive analytics transforms underwriting by combining behavioral data and AI for superior risk prediction.

Telematics

Behavioral data underwriting leverages telematics to capture real-time driving patterns such as speed, braking, and mileage, enabling insurers to assess risk more accurately based on actual policyholder behavior. Artificial intelligence underwriting integrates telematics data with machine learning algorithms to automate risk evaluation, predict future claims, and customize premiums with higher precision. Explore how telematics-driven AI transforms insurance underwriting and enhances risk management through actionable behavioral insights.

Source and External Links

Enhancing Insurance Underwriting: Behavioral Patterns and Actuarial Tables - Decisimo - Behavioral data underwriting integrates behavioral pattern recognition with traditional actuarial methods using rule engines to achieve more accurate, personalized risk assessments and insurance pricing, marking a new era in underwriting.

Addressing Homeowners Underwriting with Behavioral Risk Predictions - AAIS - AI-driven behavioral risk predictions in underwriting enable insurers to assess individual policyholder risk more precisely, including litigation propensity, claims frequency, and likelihood of policy cancellation, leading to improved risk selection and customer-centric coverage.

Crossing the Streams: How Behavioral Science Enhances Automated Underwriting - RGA - Behavioral science serves as a third critical data stream alongside underwriting manuals and automated platforms, enhancing information accuracy and consumer experience in underwriting decisions by providing nuanced insights into applicant risk profiles.

dowidth.com

dowidth.com