Climate risk insurance specifically covers losses from natural disasters and weather-related events, while business interruption insurance compensates for income loss due to disruptions in normal operations caused by various events. Both types of coverage play crucial roles in financial risk management but focus on different aspects of protection for businesses. Explore how these insurance solutions can safeguard your enterprise amid increasing uncertainties.

Why it is important

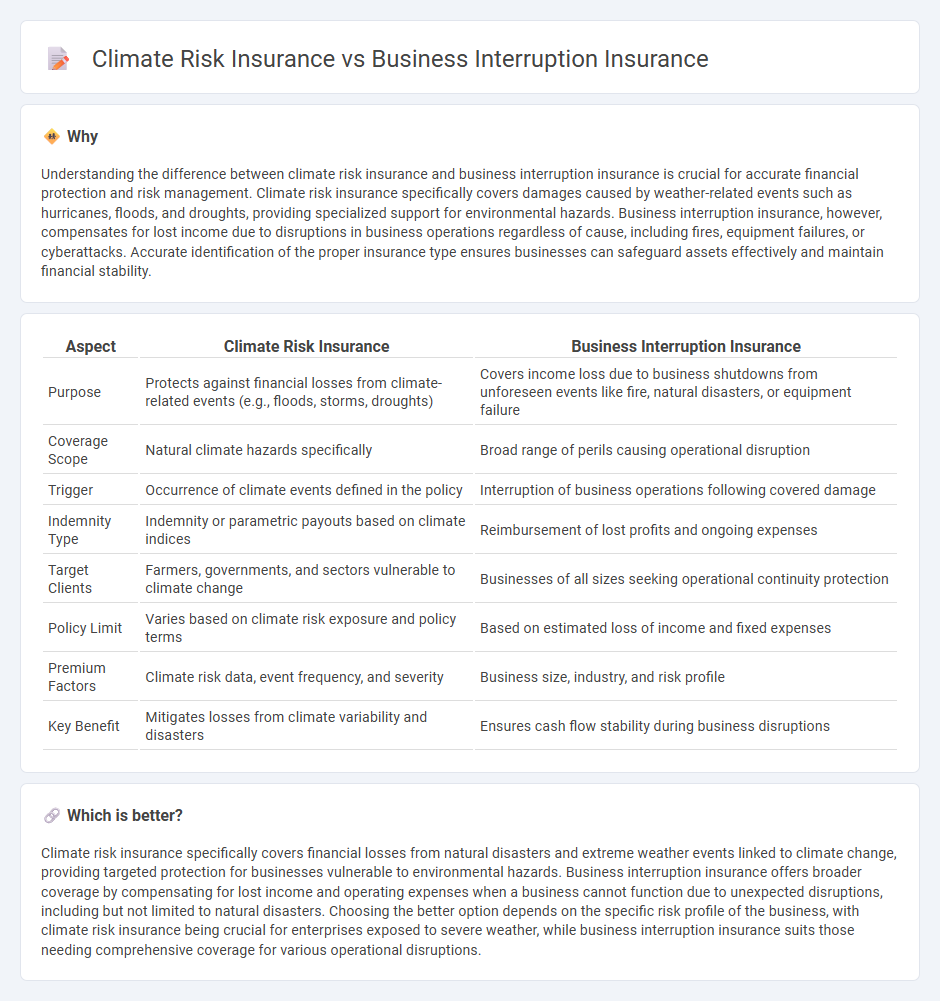

Understanding the difference between climate risk insurance and business interruption insurance is crucial for accurate financial protection and risk management. Climate risk insurance specifically covers damages caused by weather-related events such as hurricanes, floods, and droughts, providing specialized support for environmental hazards. Business interruption insurance, however, compensates for lost income due to disruptions in business operations regardless of cause, including fires, equipment failures, or cyberattacks. Accurate identification of the proper insurance type ensures businesses can safeguard assets effectively and maintain financial stability.

Comparison Table

| Aspect | Climate Risk Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Protects against financial losses from climate-related events (e.g., floods, storms, droughts) | Covers income loss due to business shutdowns from unforeseen events like fire, natural disasters, or equipment failure |

| Coverage Scope | Natural climate hazards specifically | Broad range of perils causing operational disruption |

| Trigger | Occurrence of climate events defined in the policy | Interruption of business operations following covered damage |

| Indemnity Type | Indemnity or parametric payouts based on climate indices | Reimbursement of lost profits and ongoing expenses |

| Target Clients | Farmers, governments, and sectors vulnerable to climate change | Businesses of all sizes seeking operational continuity protection |

| Policy Limit | Varies based on climate risk exposure and policy terms | Based on estimated loss of income and fixed expenses |

| Premium Factors | Climate risk data, event frequency, and severity | Business size, industry, and risk profile |

| Key Benefit | Mitigates losses from climate variability and disasters | Ensures cash flow stability during business disruptions |

Which is better?

Climate risk insurance specifically covers financial losses from natural disasters and extreme weather events linked to climate change, providing targeted protection for businesses vulnerable to environmental hazards. Business interruption insurance offers broader coverage by compensating for lost income and operating expenses when a business cannot function due to unexpected disruptions, including but not limited to natural disasters. Choosing the better option depends on the specific risk profile of the business, with climate risk insurance being crucial for enterprises exposed to severe weather, while business interruption insurance suits those needing comprehensive coverage for various operational disruptions.

Connection

Climate risk insurance protects businesses from financial losses due to extreme weather events such as floods, hurricanes, and droughts, which can disrupt operations and damage assets. Business interruption insurance complements this coverage by reimbursing lost income and ongoing expenses during the downtime caused by these climate-related incidents. Together, these insurances provide comprehensive risk management for businesses facing increasing climate-related threats.

Key Terms

**Business Interruption Insurance:**

Business Interruption Insurance provides critical financial protection by covering lost income and operating expenses when a business is forced to halt operations due to unforeseen events such as fires, natural disasters, or other insured perils. This insurance helps businesses maintain cash flow during recovery periods, ensuring expenses like payroll, rent, and loan payments are met despite revenue disruptions. Explore more about how Business Interruption Insurance safeguards your operations against unexpected closures.

Loss of Income

Business interruption insurance primarily covers Loss of Income resulting from unforeseen events like fire or equipment failure, ensuring operational continuity. Climate risk insurance addresses income loss specifically linked to climate-related disruptions such as floods, storms, or droughts, offering tailored financial protection. Explore how these insurance types can safeguard your revenue against diverse risks by learning more about their benefits and coverage.

Indemnity Period

Business interruption insurance typically covers losses for a specified indemnity period, usually ranging from 12 to 24 months, allowing businesses to recover lost income due to disruptions like fire or theft. Climate risk insurance, on the other hand, often involves flexible indemnity periods tailored to climate-related events such as floods, hurricanes, or droughts, which may cause prolonged or recurring damage. Explore the differences in policy structures and indemnity terms to protect your business effectively against diverse risks.

Source and External Links

Business Interruption Insurance: Coverage, Quotes & Policies - Business interruption insurance helps replace lost income and other expenses when a business is forced to shut down due to a covered peril.

What Is Business Interruption Insurance? - Business interruption insurance covers lost income and extra expenses incurred when a business is affected by a covered peril like theft or fire.

Business Interruption Insurance and Coverage Basics - Business interruption insurance covers operating expenses and lost income for a set period when a business cannot operate normally due to physical damage from a covered peril.

dowidth.com

dowidth.com