Pet insurance platforms focus on providing coverage for veterinary care, accidents, and illnesses affecting household animals, utilizing data on breed-specific health risks and owner preferences. Crop insurance platforms specialize in protecting farmers from losses due to adverse weather, pests, and market fluctuations, leveraging satellite imagery and agronomic data for precise risk assessment. Explore the key differences and benefits of each platform to determine the best insurance solution for your needs.

Why it is important

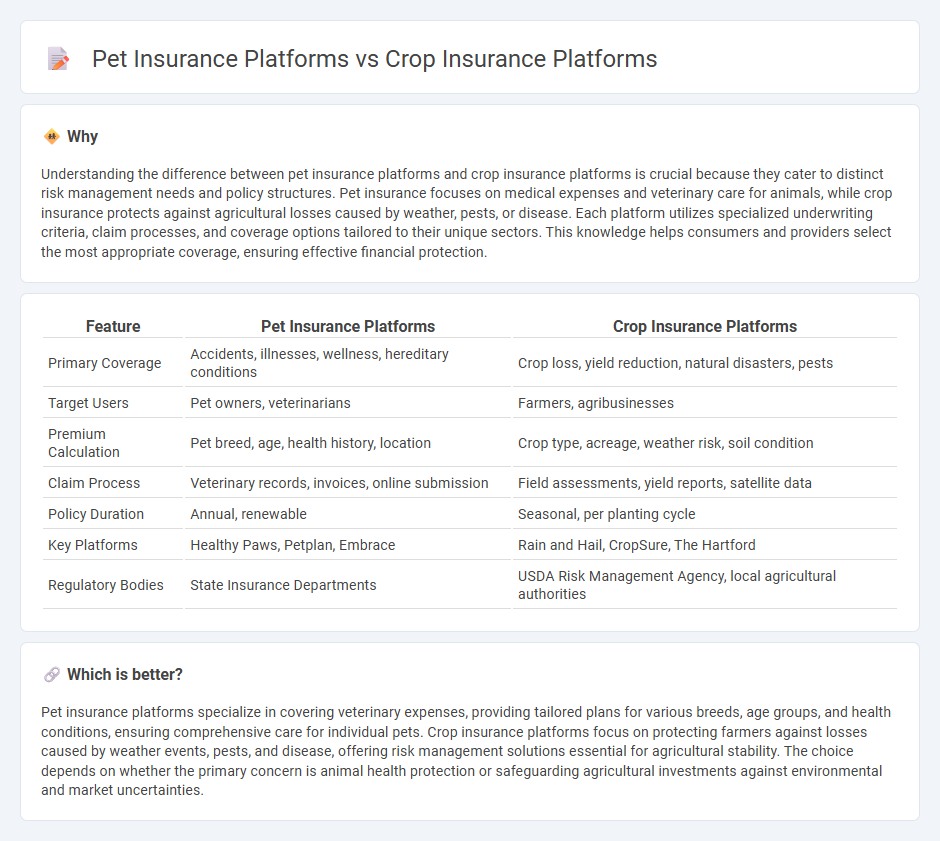

Understanding the difference between pet insurance platforms and crop insurance platforms is crucial because they cater to distinct risk management needs and policy structures. Pet insurance focuses on medical expenses and veterinary care for animals, while crop insurance protects against agricultural losses caused by weather, pests, or disease. Each platform utilizes specialized underwriting criteria, claim processes, and coverage options tailored to their unique sectors. This knowledge helps consumers and providers select the most appropriate coverage, ensuring effective financial protection.

Comparison Table

| Feature | Pet Insurance Platforms | Crop Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, wellness, hereditary conditions | Crop loss, yield reduction, natural disasters, pests |

| Target Users | Pet owners, veterinarians | Farmers, agribusinesses |

| Premium Calculation | Pet breed, age, health history, location | Crop type, acreage, weather risk, soil condition |

| Claim Process | Veterinary records, invoices, online submission | Field assessments, yield reports, satellite data |

| Policy Duration | Annual, renewable | Seasonal, per planting cycle |

| Key Platforms | Healthy Paws, Petplan, Embrace | Rain and Hail, CropSure, The Hartford |

| Regulatory Bodies | State Insurance Departments | USDA Risk Management Agency, local agricultural authorities |

Which is better?

Pet insurance platforms specialize in covering veterinary expenses, providing tailored plans for various breeds, age groups, and health conditions, ensuring comprehensive care for individual pets. Crop insurance platforms focus on protecting farmers against losses caused by weather events, pests, and disease, offering risk management solutions essential for agricultural stability. The choice depends on whether the primary concern is animal health protection or safeguarding agricultural investments against environmental and market uncertainties.

Connection

Pet insurance platforms and crop insurance platforms both utilize data analytics and risk assessment models to optimize policy pricing and coverage tailored to specific needs. These platforms leverage technology such as remote sensing and IoT devices to monitor health indicators or environmental conditions, enhancing real-time claims processing and fraud detection. Integrating artificial intelligence enables customized insurance solutions that improve customer experience and operational efficiency across both sectors.

Key Terms

**Crop Insurance Platforms:**

Crop insurance platforms leverage advanced satellite imagery, weather data analytics, and AI-driven risk assessments to provide tailored coverage for agricultural producers. These platforms minimize financial losses due to crop failures caused by pests, drought, or extreme weather, offering real-time claim processing and payout automation. Explore how cutting-edge crop insurance technology is transforming farm risk management and enhancing agricultural resilience.

Yield Coverage

Crop insurance platforms provide yield coverage tailored to agricultural producers, protecting against losses due to weather events, pests, or diseases and ensuring income stability. Pet insurance platforms primarily cover veterinary expenses, focusing on health and accident costs rather than income replacement or yield concerns. Explore how these insurance models differ fundamentally in risk coverage and client benefits.

Weather Data Integration

Crop insurance platforms leverage advanced weather data integration to assess risk, predict yield outcomes, and automate claim processes, optimizing farmer payouts through real-time weather metrics like rainfall, temperature, and drought indices. In contrast, pet insurance platforms rarely require direct weather data input, as their risk factors predominantly concern breed, age, and health history rather than environmental variables. Explore the evolving role of data integration in enhancing insurance accuracy and customer experience.

Source and External Links

Cropguard - Offers AI-powered crop insurance solutions to modernize crop risk management for farmers and insurance agencies.

AgriSompo - Provides federally-sponsored crop insurance through a nationwide network of agents, offering traditional and innovative agricultural risk management solutions.

Blockchain Climate Risk Crop Insurance - Utilizes blockchain technology to create accessible and affordable crop insurance for smallholder farmers in Africa.

dowidth.com

dowidth.com