Behavioral policy pricing leverages customer data and real-time behavior insights to tailor insurance premiums, enhancing risk assessment accuracy beyond traditional models that rely heavily on aggregated historical data and broad demographic factors. This approach integrates telematics, usage patterns, and lifestyle metrics to dynamically adjust rates, fostering personalized insurance experiences and incentivizing safer behaviors. Discover how behavioral policy pricing is revolutionizing the insurance industry by clicking here for an in-depth exploration.

Why it is important

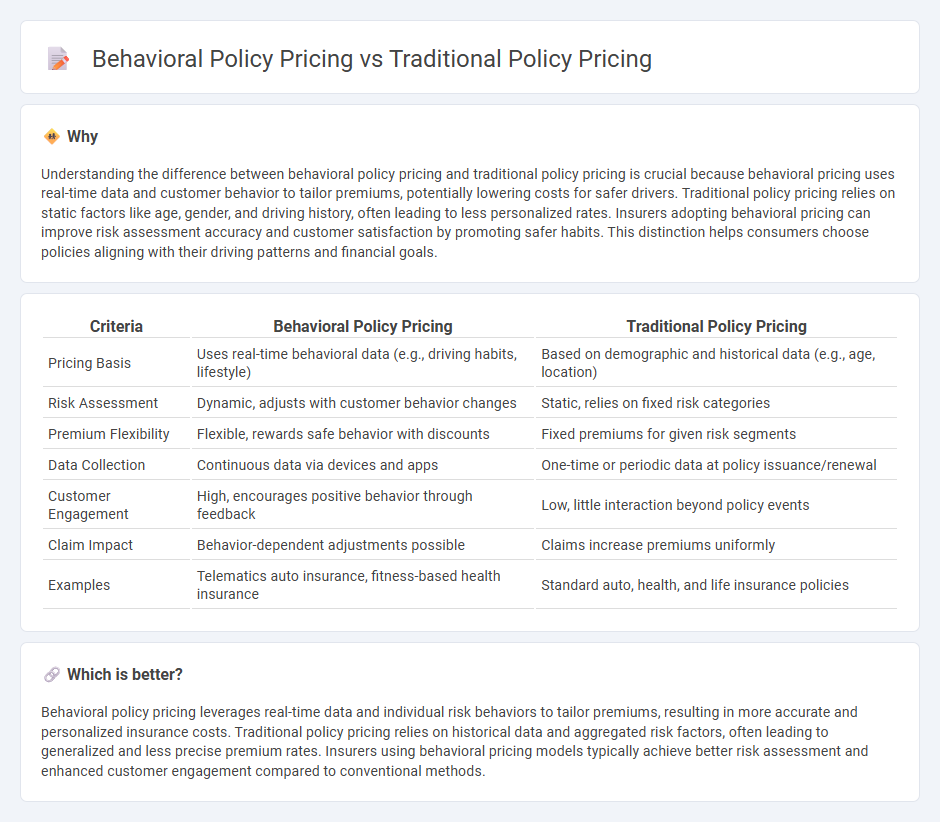

Understanding the difference between behavioral policy pricing and traditional policy pricing is crucial because behavioral pricing uses real-time data and customer behavior to tailor premiums, potentially lowering costs for safer drivers. Traditional policy pricing relies on static factors like age, gender, and driving history, often leading to less personalized rates. Insurers adopting behavioral pricing can improve risk assessment accuracy and customer satisfaction by promoting safer habits. This distinction helps consumers choose policies aligning with their driving patterns and financial goals.

Comparison Table

| Criteria | Behavioral Policy Pricing | Traditional Policy Pricing |

|---|---|---|

| Pricing Basis | Uses real-time behavioral data (e.g., driving habits, lifestyle) | Based on demographic and historical data (e.g., age, location) |

| Risk Assessment | Dynamic, adjusts with customer behavior changes | Static, relies on fixed risk categories |

| Premium Flexibility | Flexible, rewards safe behavior with discounts | Fixed premiums for given risk segments |

| Data Collection | Continuous data via devices and apps | One-time or periodic data at policy issuance/renewal |

| Customer Engagement | High, encourages positive behavior through feedback | Low, little interaction beyond policy events |

| Claim Impact | Behavior-dependent adjustments possible | Claims increase premiums uniformly |

| Examples | Telematics auto insurance, fitness-based health insurance | Standard auto, health, and life insurance policies |

Which is better?

Behavioral policy pricing leverages real-time data and individual risk behaviors to tailor premiums, resulting in more accurate and personalized insurance costs. Traditional policy pricing relies on historical data and aggregated risk factors, often leading to generalized and less precise premium rates. Insurers using behavioral pricing models typically achieve better risk assessment and enhanced customer engagement compared to conventional methods.

Connection

Behavioral policy pricing and traditional policy pricing intersect through the fundamental goal of risk assessment in the insurance industry. Behavioral pricing incorporates customer behavior data, such as driving habits or health choices, enhancing traditional models that rely on demographic and historical claims data. Integrating behavioral insights with conventional underwriting improves pricing accuracy and personalizes insurance premiums, ultimately driving more competitive and fair market offerings.

Key Terms

Underwriting

Traditional policy pricing relies on historical data, actuarial tables, and generalized risk categories to determine premiums, often resulting in uniform rates that may not fully capture individual risk nuances. Behavioral policy pricing incorporates real-time behavioral data, such as driving habits or lifestyle choices, enabling underwriters to tailor premiums more precisely to individual risk profiles. Explore the evolving landscape of underwriting by learning how behavioral analytics is reshaping insurance pricing strategies.

Risk Assessment

Traditional policy pricing relies on historical data and broad risk categories to assess premiums, often resulting in generalized risk profiles. Behavioral policy pricing incorporates real-time data and individual behavior patterns, leading to more personalized and accurate risk evaluations. Explore how behavioral insights can revolutionize risk assessment in insurance pricing.

Personalization

Traditional policy pricing relies on broad risk categories and historical data averages, often leading to generic premium rates that may not reflect individual behavior. Behavioral policy pricing utilizes real-time data analytics and personalized risk assessments based on customer actions, preferences, and lifestyle, resulting in more accurate and tailored insurance premiums. Discover how integrating behavioral insights can transform and personalize your insurance pricing strategy effectively.

Source and External Links

PBM Pricing Models: Pass Thru vs. Traditional - Traditional policy pricing, also known as spread pricing, involves a Pharmacy Benefit Manager (PBM) charging a plan sponsor more than the negotiated pharmacy reimbursement rate and keeping the difference as profit, often with limited transparency on actual costs.

Understanding Traditional vs. Hybrid Long-Term Care Policies - Traditional long-term care insurance policies require regular, ongoing premiums that may increase over time, offer highly customizable benefits focused solely on long-term care expenses, but lack premium guarantees.

How Much Does Long-Term Care Insurance Cost and Is It Worth It? - Traditional long-term care insurance pricing varies based on factors such as policy type, age, coverage amount, and duration, typically involving ongoing premium payments without the hybrid policy's guaranteed premium features.

dowidth.com

dowidth.com