Social prescribing insurance covers costs related to non-medical interventions that improve overall well-being, such as community activities and support services, while accident insurance provides financial protection against injuries from unforeseen events like car crashes or workplace accidents. Social prescribing insurance emphasizes preventive care and mental health benefits, whereas accident insurance focuses on immediate medical expenses and income replacement after incidents. Explore how these insurance types cater to different needs and enhance comprehensive coverage.

Why it is important

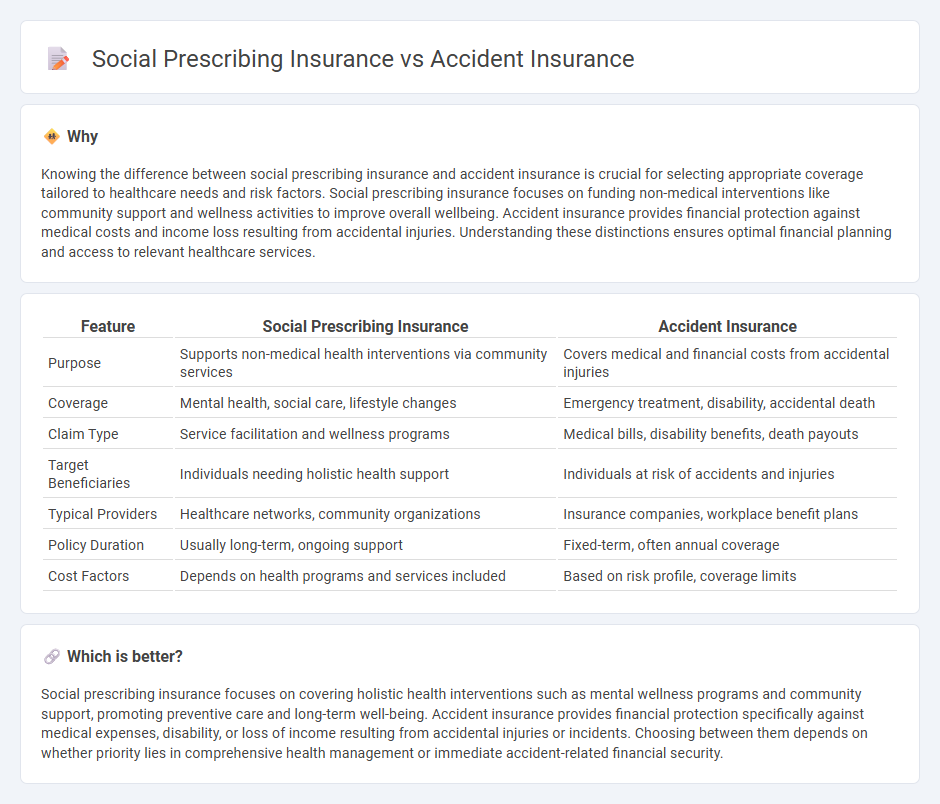

Knowing the difference between social prescribing insurance and accident insurance is crucial for selecting appropriate coverage tailored to healthcare needs and risk factors. Social prescribing insurance focuses on funding non-medical interventions like community support and wellness activities to improve overall wellbeing. Accident insurance provides financial protection against medical costs and income loss resulting from accidental injuries. Understanding these distinctions ensures optimal financial planning and access to relevant healthcare services.

Comparison Table

| Feature | Social Prescribing Insurance | Accident Insurance |

|---|---|---|

| Purpose | Supports non-medical health interventions via community services | Covers medical and financial costs from accidental injuries |

| Coverage | Mental health, social care, lifestyle changes | Emergency treatment, disability, accidental death |

| Claim Type | Service facilitation and wellness programs | Medical bills, disability benefits, death payouts |

| Target Beneficiaries | Individuals needing holistic health support | Individuals at risk of accidents and injuries |

| Typical Providers | Healthcare networks, community organizations | Insurance companies, workplace benefit plans |

| Policy Duration | Usually long-term, ongoing support | Fixed-term, often annual coverage |

| Cost Factors | Depends on health programs and services included | Based on risk profile, coverage limits |

Which is better?

Social prescribing insurance focuses on covering holistic health interventions such as mental wellness programs and community support, promoting preventive care and long-term well-being. Accident insurance provides financial protection specifically against medical expenses, disability, or loss of income resulting from accidental injuries or incidents. Choosing between them depends on whether priority lies in comprehensive health management or immediate accident-related financial security.

Connection

Social prescribing insurance and accident insurance intersect by addressing holistic health and financial protection needs. Social prescribing insurance supports preventive care and mental well-being, reducing the likelihood and severity of accidents. Accident insurance provides coverage for injuries, complementing social prescribing programs that aim to improve overall health and reduce emergency claims.

Key Terms

Accident Insurance:

Accident insurance provides financial coverage for medical expenses, lost wages, and disability resulting from unexpected injuries, ensuring rapid economic relief. Unlike social prescribing insurance, which focuses on holistic, non-medical interventions for health improvement, accident insurance emphasizes immediate, tangible benefits after physical trauma. Explore the key benefits and coverage details of accident insurance to safeguard your financial health effectively.

Personal Injury

Accident insurance provides financial compensation for personal injuries resulting from unforeseen events, covering medical expenses, lost wages, and rehabilitation costs. Social prescribing insurance emphasizes holistic support by funding non-medical interventions like community activities and counseling to enhance recovery and prevent long-term disability. Explore the benefits and differences between these two insurance types to make informed decisions about personal injury coverage.

Lump Sum Benefit

Accident insurance provides a lump sum benefit paid directly to policyholders upon occurrence of an accident resulting in injury or disability, offering immediate financial relief. Social prescribing insurance, while newer, focuses on funding non-clinical health interventions and may provide lump sum payments to cover prescribed social support services, enhancing overall well-being. Explore the differences and benefits of each insurance type to determine which best suits your health and financial needs.

Source and External Links

Understanding Accident Insurance - Accident insurance provides cash benefits for injuries from accidents, covering costs like hospital treatment, diagnostic tests, and rehabilitation, supplementing your health insurance to help with out-of-pocket expenses.

Accident insurance: What It Is, Coverage, and Is It Worth It - Accident insurance pays fixed cash benefits directly to you for covered injuries such as burns, broken bones, or emergency room visits, helping with both medical and non-medical expenses during recovery.

Accident insurance | Supplemental - Accident insurance offers cash benefits to help cover expenses like ambulance services, physical therapy, lost wages, and high deductibles after an accidental injury, with the payout usable as you see fit.

dowidth.com

dowidth.com