Peer-to-peer insurance leverages a community-based model where policyholders pool funds to cover claims, promoting transparency and reducing administrative costs compared to traditional insurance, which relies on centralized companies assuming risk and collecting premiums. This innovative approach fosters trust and potential cost savings by minimizing profit-driven expenses commonly seen in traditional insurance structures. Discover how peer-to-peer insurance could reshape risk management and offer personalized coverage options.

Why it is important

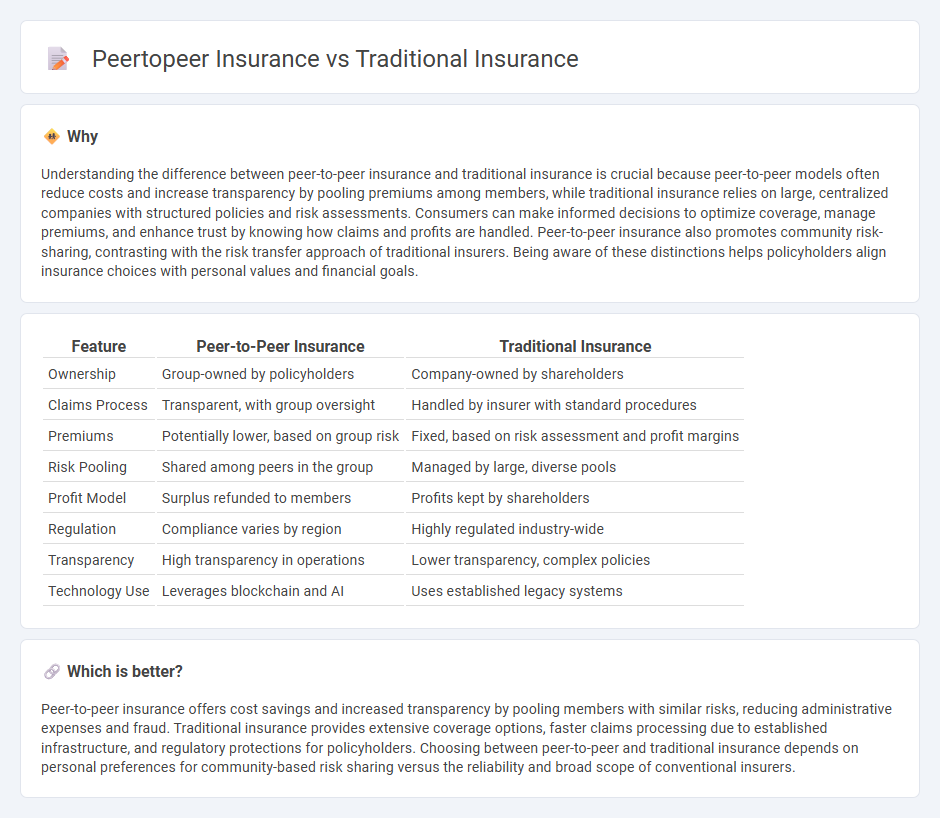

Understanding the difference between peer-to-peer insurance and traditional insurance is crucial because peer-to-peer models often reduce costs and increase transparency by pooling premiums among members, while traditional insurance relies on large, centralized companies with structured policies and risk assessments. Consumers can make informed decisions to optimize coverage, manage premiums, and enhance trust by knowing how claims and profits are handled. Peer-to-peer insurance also promotes community risk-sharing, contrasting with the risk transfer approach of traditional insurers. Being aware of these distinctions helps policyholders align insurance choices with personal values and financial goals.

Comparison Table

| Feature | Peer-to-Peer Insurance | Traditional Insurance |

|---|---|---|

| Ownership | Group-owned by policyholders | Company-owned by shareholders |

| Claims Process | Transparent, with group oversight | Handled by insurer with standard procedures |

| Premiums | Potentially lower, based on group risk | Fixed, based on risk assessment and profit margins |

| Risk Pooling | Shared among peers in the group | Managed by large, diverse pools |

| Profit Model | Surplus refunded to members | Profits kept by shareholders |

| Regulation | Compliance varies by region | Highly regulated industry-wide |

| Transparency | High transparency in operations | Lower transparency, complex policies |

| Technology Use | Leverages blockchain and AI | Uses established legacy systems |

Which is better?

Peer-to-peer insurance offers cost savings and increased transparency by pooling members with similar risks, reducing administrative expenses and fraud. Traditional insurance provides extensive coverage options, faster claims processing due to established infrastructure, and regulatory protections for policyholders. Choosing between peer-to-peer and traditional insurance depends on personal preferences for community-based risk sharing versus the reliability and broad scope of conventional insurers.

Connection

Peer-to-peer insurance and traditional insurance connect through shared risk management principles, where both pool premiums from participants to cover claims. Peer-to-peer models utilize digital platforms to directly link insured members, reducing administrative costs typical in traditional insurance companies. This integration fosters innovation by combining community-driven trust with established underwriting and regulatory practices.

Key Terms

Risk Pooling

Traditional insurance relies on large, centralized risk pools managed by established companies to spread financial risk across a broad subscriber base. Peer-to-peer insurance creates smaller, community-based risk pools where members collectively share potential losses, enhancing transparency and reducing administrative costs. Explore the differences in risk pooling dynamics to understand which insurance model suits your needs best.

Underwriting

Traditional insurance underwriting relies on actuarial data, risk pools, and historical claims to set premiums and coverage terms, ensuring financial stability for insurers. Peer-to-peer insurance underwriting emphasizes community risk sharing and collective decision-making, often leveraging member data and behavior to create more personalized and transparent policies. Explore the detailed dynamics and benefits of each model to understand their impact on policyholders and the industry.

Claims Management

Traditional insurance relies on centralized claims management processes with dedicated adjusters and standardized procedures, often resulting in longer claim settlement times and higher administrative costs. Peer-to-peer insurance utilizes decentralized, community-based frameworks that enable faster claims verification through direct member collaboration and reduced overhead. Explore the evolving dynamics of claims management in insurance to understand the benefits and challenges of each model.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional insurance plans, especially in life insurance, are proven financial instruments offering life coverage, fixed income, tax benefits, and can be either pure life protection or a mix of insurance with investment, such as term insurance, endowment plans, and retirement plans.

Traditional Indemnity Insurance Plans - Virginia Health Information - Traditional indemnity insurance plans reimburse patients for medical expenses based on usual, customary, and reasonable fees, offering flexibility in provider choice and often coming as fee-for-service plans with a variety of coverage options.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Traditional insurance involves paying premiums for comprehensive coverage including deductibles and co-pays, which can lead to high out-of-pocket costs; however, it is often chosen for its catastrophic coverage and broad service access.

dowidth.com

dowidth.com