Weather index insurance offers financial protection based on predefined weather parameters, such as rainfall or temperature, making it ideal for agricultural and climate-sensitive sectors. Health insurance provides coverage for medical expenses, including hospital stays, treatments, and preventive care, safeguarding individuals against high healthcare costs. Explore the key differences and benefits of weather index insurance versus health insurance to choose the coverage that suits your needs best.

Why it is important

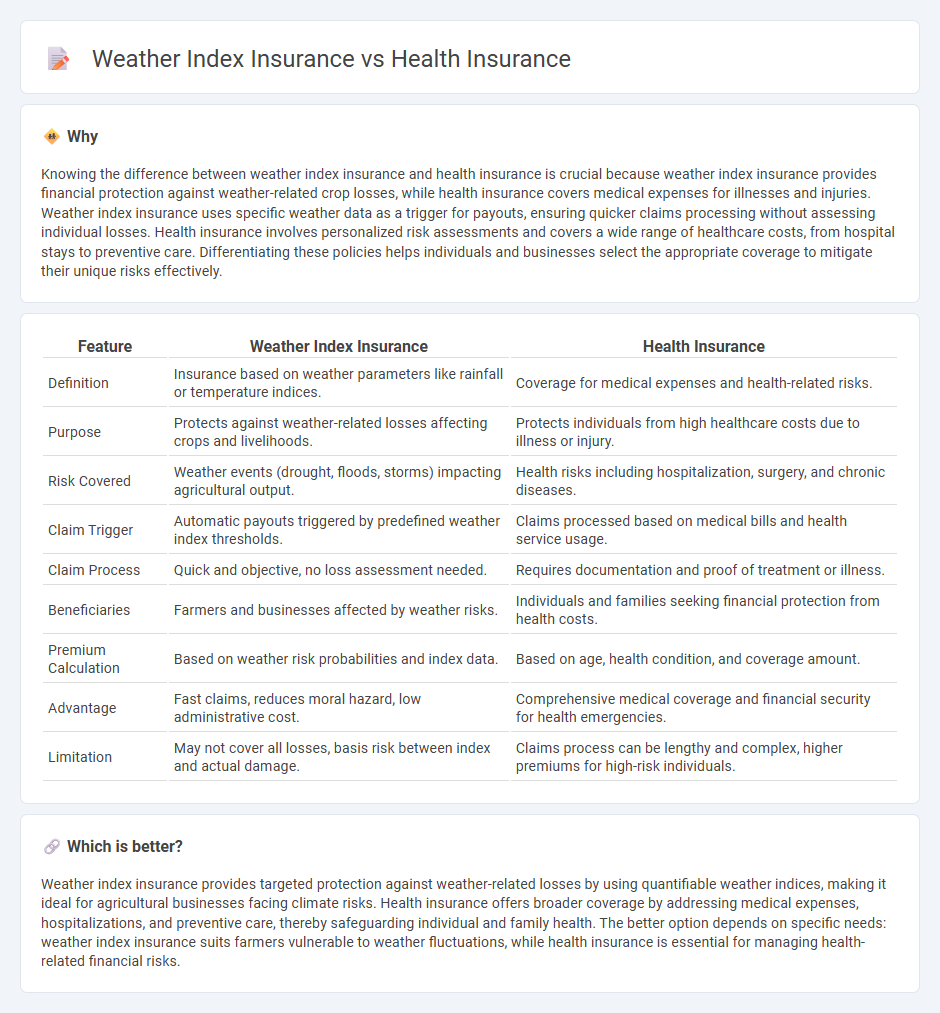

Knowing the difference between weather index insurance and health insurance is crucial because weather index insurance provides financial protection against weather-related crop losses, while health insurance covers medical expenses for illnesses and injuries. Weather index insurance uses specific weather data as a trigger for payouts, ensuring quicker claims processing without assessing individual losses. Health insurance involves personalized risk assessments and covers a wide range of healthcare costs, from hospital stays to preventive care. Differentiating these policies helps individuals and businesses select the appropriate coverage to mitigate their unique risks effectively.

Comparison Table

| Feature | Weather Index Insurance | Health Insurance |

|---|---|---|

| Definition | Insurance based on weather parameters like rainfall or temperature indices. | Coverage for medical expenses and health-related risks. |

| Purpose | Protects against weather-related losses affecting crops and livelihoods. | Protects individuals from high healthcare costs due to illness or injury. |

| Risk Covered | Weather events (drought, floods, storms) impacting agricultural output. | Health risks including hospitalization, surgery, and chronic diseases. |

| Claim Trigger | Automatic payouts triggered by predefined weather index thresholds. | Claims processed based on medical bills and health service usage. |

| Claim Process | Quick and objective, no loss assessment needed. | Requires documentation and proof of treatment or illness. |

| Beneficiaries | Farmers and businesses affected by weather risks. | Individuals and families seeking financial protection from health costs. |

| Premium Calculation | Based on weather risk probabilities and index data. | Based on age, health condition, and coverage amount. |

| Advantage | Fast claims, reduces moral hazard, low administrative cost. | Comprehensive medical coverage and financial security for health emergencies. |

| Limitation | May not cover all losses, basis risk between index and actual damage. | Claims process can be lengthy and complex, higher premiums for high-risk individuals. |

Which is better?

Weather index insurance provides targeted protection against weather-related losses by using quantifiable weather indices, making it ideal for agricultural businesses facing climate risks. Health insurance offers broader coverage by addressing medical expenses, hospitalizations, and preventive care, thereby safeguarding individual and family health. The better option depends on specific needs: weather index insurance suits farmers vulnerable to weather fluctuations, while health insurance is essential for managing health-related financial risks.

Connection

Weather index insurance and health insurance are connected through their focus on risk management and financial protection against unforeseen events. Weather index insurance provides coverage based on weather data and indices to mitigate losses in agriculture and livelihoods caused by adverse weather conditions, indirectly impacting public health by ensuring food security and reducing economic stress. Health insurance complements this by covering medical expenses arising from illnesses or injuries, creating a comprehensive safety net that addresses both environmental and health-related vulnerabilities.

Key Terms

**Health insurance:**

Health insurance provides financial protection against medical expenses by covering hospital stays, treatments, and medications, ensuring individuals receive necessary healthcare without facing significant out-of-pocket costs. It often includes preventive services, chronic disease management, and access to a network of healthcare providers, enhancing overall health security. Discover how health insurance plans can be tailored to meet diverse medical needs and budgets.

Premium

Health insurance premiums are typically based on individual risk factors such as age, medical history, and lifestyle, resulting in personalized payment amounts. Weather index insurance premiums depend on regional weather data like rainfall or temperature indices, offering a more standardized and data-driven pricing model with lower adverse selection risk. Explore in-depth comparisons to understand which insurance premium structure best suits your needs.

Deductible

Health insurance typically includes a deductible, which is the amount policyholders pay out-of-pocket before coverage begins, often ranging from $500 to $3,000 annually, depending on the plan. In contrast, weather index insurance has no deductible since payouts are triggered by predefined weather parameters like rainfall or temperature indices rather than actual losses, offering swift compensation without loss assessment. Explore further to understand how deductible structures impact cost-efficiency and coverage effectiveness in both insurance types.

Source and External Links

Get Medical Insurance in New Hampshire - NH Healthy Families offers affordable individual and family health plans, including marketplace options like Ambetter and NH Medicaid, with eligibility based on age, income, family size, and health needs.

Health insurance | USAGov - USAGov provides information on major health insurance programs including Medicaid, Medicare, the ACA Health Insurance Marketplace, and COBRA, along with guidance on how to apply for each.

New Hampshire Health Insurance Plans - Anthem offers both on-exchange (with potential subsidies) and off-exchange health insurance plans in New Hampshire, covering essential health benefits and helping you understand costs like deductibles, copays, and coinsurance.

dowidth.com

dowidth.com