Decoupled insurance separates the underwriting and distribution processes, allowing specialized providers to focus on specific tasks within the insurance value chain, enhancing flexibility and efficiency. Traditional insurance integrates underwriting, policy issuance, and claims management within a single company, maintaining centralized control over all processes. Explore the advantages and challenges of each approach to determine which model best fits your insurance needs.

Why it is important

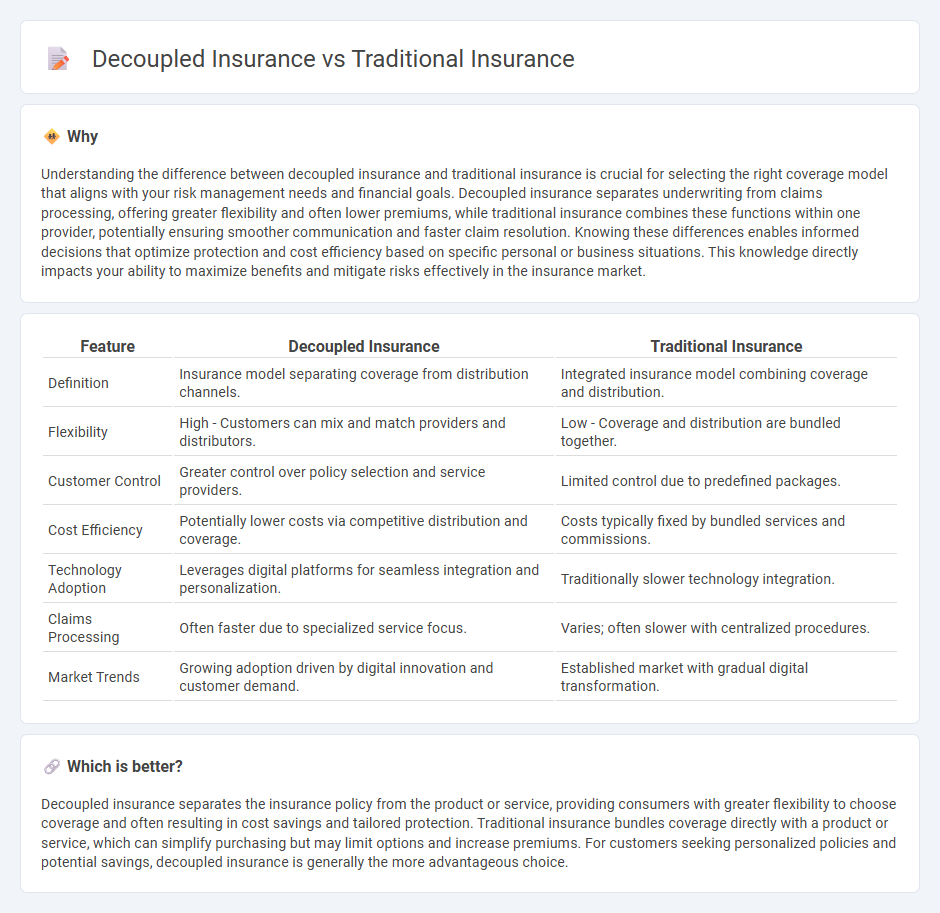

Understanding the difference between decoupled insurance and traditional insurance is crucial for selecting the right coverage model that aligns with your risk management needs and financial goals. Decoupled insurance separates underwriting from claims processing, offering greater flexibility and often lower premiums, while traditional insurance combines these functions within one provider, potentially ensuring smoother communication and faster claim resolution. Knowing these differences enables informed decisions that optimize protection and cost efficiency based on specific personal or business situations. This knowledge directly impacts your ability to maximize benefits and mitigate risks effectively in the insurance market.

Comparison Table

| Feature | Decoupled Insurance | Traditional Insurance |

|---|---|---|

| Definition | Insurance model separating coverage from distribution channels. | Integrated insurance model combining coverage and distribution. |

| Flexibility | High - Customers can mix and match providers and distributors. | Low - Coverage and distribution are bundled together. |

| Customer Control | Greater control over policy selection and service providers. | Limited control due to predefined packages. |

| Cost Efficiency | Potentially lower costs via competitive distribution and coverage. | Costs typically fixed by bundled services and commissions. |

| Technology Adoption | Leverages digital platforms for seamless integration and personalization. | Traditionally slower technology integration. |

| Claims Processing | Often faster due to specialized service focus. | Varies; often slower with centralized procedures. |

| Market Trends | Growing adoption driven by digital innovation and customer demand. | Established market with gradual digital transformation. |

Which is better?

Decoupled insurance separates the insurance policy from the product or service, providing consumers with greater flexibility to choose coverage and often resulting in cost savings and tailored protection. Traditional insurance bundles coverage directly with a product or service, which can simplify purchasing but may limit options and increase premiums. For customers seeking personalized policies and potential savings, decoupled insurance is generally the more advantageous choice.

Connection

Decoupled insurance separates the underwriting, distribution, and claims management processes, often leveraging technology platforms for enhanced efficiency and customer experience. Traditional insurance integrates these functions within a single company, relying on established agents and underwriting protocols. Both models share risk assessment principles and regulatory compliance but differ in operational structure and technological adoption.

Key Terms

Risk Pooling

Traditional insurance relies on risk pooling to spread potential losses among a large group, ensuring financial protection for policyholders through collective premiums. Decoupled insurance separates risk assessment from risk pooling, allowing for more personalized coverage and pricing based on individual risk profiles. Explore how decoupled insurance transforms risk management beyond conventional pooling strategies.

Underwriting

Traditional insurance underwriting involves a centralized process where insurers assess risk based on predefined criteria, relying heavily on historical data and manual evaluation. In contrast, decoupled insurance leverages technology and data analytics to separate underwriting from policy issuance, enabling more flexible, real-time risk assessment and personalized coverage options. Explore the advantages of innovative underwriting approaches to enhance insurance efficiency and customer experience.

Embedded Insurance

Traditional insurance relies on standalone policies that consumers purchase separately, often involving complex underwriting and claims processes. Decoupled insurance integrates coverage directly into products or services, simplifying customer experience and enabling real-time risk management. Explore how embedded insurance is transforming risk protection by seamlessly combining coverage with everyday purchases.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional life insurance plans provide long-standing financial instruments like term insurance, Endowment Plans, and Retirement Plans, offering benefits such as life coverage and fixed incomes.

Traditional Indemnity Insurance Plans - Virginia Health Information - Traditional indemnity health insurance plans reimburse patients based on usual, customary, and reasonable fees, allowing choice of healthcare providers without restrictions.

What is the difference between traditional health insurance and healthcare sharing ministries - Traditional health insurance involves contractual agreements between individuals or employers and insurance companies, where premiums are paid in exchange for specified healthcare coverage.

dowidth.com

dowidth.com