Pet health insurance provides coverage for veterinary expenses, ensuring timely medical care for your pets. Disability insurance offers income protection by replacing lost wages if you become unable to work due to illness or injury. Explore how these distinct insurance types safeguard your finances and wellbeing.

Why it is important

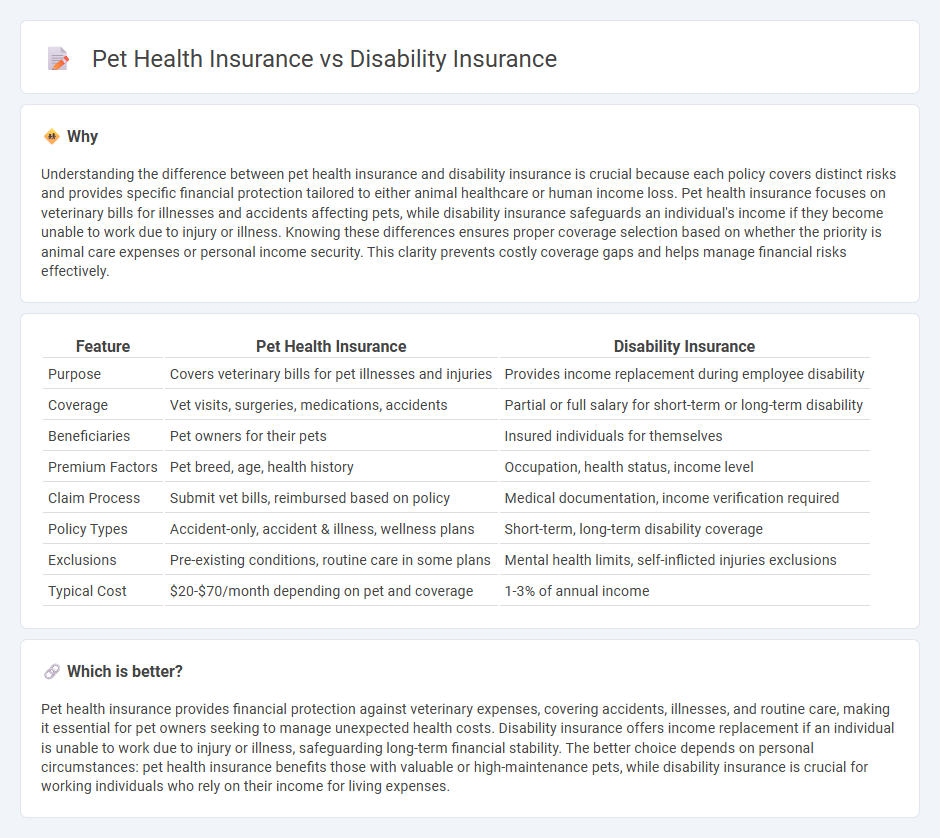

Understanding the difference between pet health insurance and disability insurance is crucial because each policy covers distinct risks and provides specific financial protection tailored to either animal healthcare or human income loss. Pet health insurance focuses on veterinary bills for illnesses and accidents affecting pets, while disability insurance safeguards an individual's income if they become unable to work due to injury or illness. Knowing these differences ensures proper coverage selection based on whether the priority is animal care expenses or personal income security. This clarity prevents costly coverage gaps and helps manage financial risks effectively.

Comparison Table

| Feature | Pet Health Insurance | Disability Insurance |

|---|---|---|

| Purpose | Covers veterinary bills for pet illnesses and injuries | Provides income replacement during employee disability |

| Coverage | Vet visits, surgeries, medications, accidents | Partial or full salary for short-term or long-term disability |

| Beneficiaries | Pet owners for their pets | Insured individuals for themselves |

| Premium Factors | Pet breed, age, health history | Occupation, health status, income level |

| Claim Process | Submit vet bills, reimbursed based on policy | Medical documentation, income verification required |

| Policy Types | Accident-only, accident & illness, wellness plans | Short-term, long-term disability coverage |

| Exclusions | Pre-existing conditions, routine care in some plans | Mental health limits, self-inflicted injuries exclusions |

| Typical Cost | $20-$70/month depending on pet and coverage | 1-3% of annual income |

Which is better?

Pet health insurance provides financial protection against veterinary expenses, covering accidents, illnesses, and routine care, making it essential for pet owners seeking to manage unexpected health costs. Disability insurance offers income replacement if an individual is unable to work due to injury or illness, safeguarding long-term financial stability. The better choice depends on personal circumstances: pet health insurance benefits those with valuable or high-maintenance pets, while disability insurance is crucial for working individuals who rely on their income for living expenses.

Connection

Pet health insurance and disability insurance both provide financial protection against unexpected health-related expenses by covering medical treatments and care. Each policy minimizes out-of-pocket costs, ensuring access to necessary services whether for pets or individuals unable to work due to disability. These insurances emphasize risk management and peace of mind by mitigating the economic impact of health emergencies.

Key Terms

**Disability Insurance:**

Disability insurance provides financial protection by replacing a portion of your income if an illness or injury prevents you from working, ensuring stability during periods of disability. It covers short-term and long-term disabilities and is crucial for maintaining lifestyle and meeting essential expenses. Explore the benefits and options of disability insurance to secure your financial future.

Elimination Period

Disability insurance's elimination period is the waiting duration before benefits begin, typically ranging from 30 to 90 days, whereas pet health insurance elimination periods often vary by condition, averaging 14 days for illnesses and no waiting for accidents. Understanding these waiting times is crucial for optimizing coverage and managing out-of-pocket expenses effectively. Explore detailed comparisons and policies to choose the best insurance tailored to your needs.

Benefit Period

Disability insurance offers a benefit period that typically ranges from a few years to lifetime coverage, depending on the policy, providing financial support when an individual cannot work due to illness or injury. Pet health insurance generally covers veterinary expenses during the policy term but does not have a benefit period, as claims are paid per incident or condition without long-term income replacement. Explore more details to understand which insurance aligns best with your financial protection needs.

Source and External Links

Disability insurance - Disability insurance is a type of insurance that protects a worker's earned income if a disability prevents them from performing their job, covering paid sick leave, short-term, and long-term disability benefits.

What is Social Security Disability Insurance? - Social Security Disability Insurance (SSDI) pays monthly benefits to workers disabled by illness or impairment expected to last at least a year or result in death, with benefits based on past earnings.

SSDI and SSI benefits for people with disabilities | USAGov - SSDI provides disability benefits linked to work history and Social Security taxes paid, while SSI offers income support without work requirements; some individuals may qualify for both concurrently.

dowidth.com

dowidth.com