Pet insurance provides coverage for veterinary expenses arising from accidents, illnesses, and routine care, safeguarding pet owners against unexpected financial burdens. Flood insurance protects property owners from damages caused by flooding, often excluded from standard homeowners' policies, making it essential in flood-prone areas. Explore further to understand which insurance type best suits your needs.

Why it is important

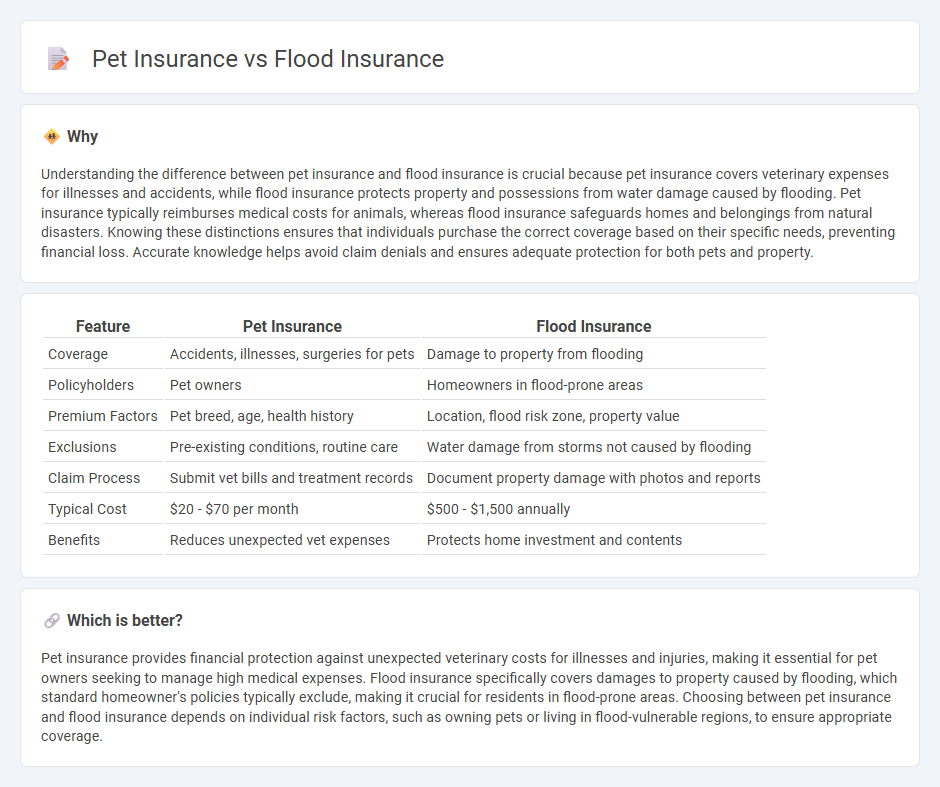

Understanding the difference between pet insurance and flood insurance is crucial because pet insurance covers veterinary expenses for illnesses and accidents, while flood insurance protects property and possessions from water damage caused by flooding. Pet insurance typically reimburses medical costs for animals, whereas flood insurance safeguards homes and belongings from natural disasters. Knowing these distinctions ensures that individuals purchase the correct coverage based on their specific needs, preventing financial loss. Accurate knowledge helps avoid claim denials and ensures adequate protection for both pets and property.

Comparison Table

| Feature | Pet Insurance | Flood Insurance |

|---|---|---|

| Coverage | Accidents, illnesses, surgeries for pets | Damage to property from flooding |

| Policyholders | Pet owners | Homeowners in flood-prone areas |

| Premium Factors | Pet breed, age, health history | Location, flood risk zone, property value |

| Exclusions | Pre-existing conditions, routine care | Water damage from storms not caused by flooding |

| Claim Process | Submit vet bills and treatment records | Document property damage with photos and reports |

| Typical Cost | $20 - $70 per month | $500 - $1,500 annually |

| Benefits | Reduces unexpected vet expenses | Protects home investment and contents |

Which is better?

Pet insurance provides financial protection against unexpected veterinary costs for illnesses and injuries, making it essential for pet owners seeking to manage high medical expenses. Flood insurance specifically covers damages to property caused by flooding, which standard homeowner's policies typically exclude, making it crucial for residents in flood-prone areas. Choosing between pet insurance and flood insurance depends on individual risk factors, such as owning pets or living in flood-vulnerable regions, to ensure appropriate coverage.

Connection

Pet insurance and flood insurance both provide financial protection against unexpected events, mitigating potential out-of-pocket expenses for pet owners and homeowners. Flood insurance specifically covers property damage caused by natural water-related disasters, while pet insurance addresses veterinary costs arising from accidents or illnesses. Integrating both types of coverage ensures comprehensive risk management for families facing diverse vulnerabilities.

Key Terms

Coverage

Flood insurance specifically covers damage to property and belongings caused by flooding, including rising water from heavy rains, river overflow, or storm surges. Pet insurance, in contrast, provides coverage for veterinary expenses related to illness, accidents, or routine care for pets, often including surgeries, medications, and preventive treatments. Explore detailed comparisons to understand which policy best fits your risk management needs.

Premium

Flood insurance premiums are determined by factors such as property location, elevation, and flood zone risk, often resulting in higher costs for homes in high-risk areas. Pet insurance premiums vary based on pet breed, age, health history, and coverage options, typically offering more customizable and affordable plans compared to flood insurance. Explore detailed comparisons to understand how premiums impact coverage and savings for both insurance types.

Exclusions

Flood insurance typically excludes damage caused by other types of water-related events such as sewer backups, while pet insurance often excludes pre-existing conditions and cosmetic procedures. Understanding specific policy exclusions is crucial to avoid unexpected costs when filing claims. Explore detailed coverage differences to choose the best protection for your needs.

Source and External Links

Flood Insurance - The National Flood Insurance Program (NFIP), managed by FEMA, offers flood insurance to property owners, renters, and businesses in participating communities, covering both buildings and contents, with policies typically taking effect after a 30-day waiting period and available through over 47 insurance companies or directly from the NFIP.

Flood Insurance Quotes - Flood insurance through the NFIP covers up to $250,000 for your home, is often required in high-risk areas or for government-backed mortgages, and provides protection even when federal disaster assistance is not available, with policies usually becoming effective after a 30-day waiting period.

Flood Insurance | Insurance Department - Flood insurance can be purchased either through the NFIP or private insurers, with coverage options including the structure of your home and personal belongings, and switching from private to NFIP coverage may result in higher premiums or loss of access to certain FEMA grant programs.

dowidth.com

dowidth.com