Behavioral policy pricing leverages individual customer data and actions to tailor insurance premiums, enhancing risk assessment accuracy. Index-based insurance offers coverage tied to predefined indices, such as weather or crop yields, minimizing claim disputes through objective triggers. Discover how these innovative approaches transform risk management and optimize policyholder benefits.

Why it is important

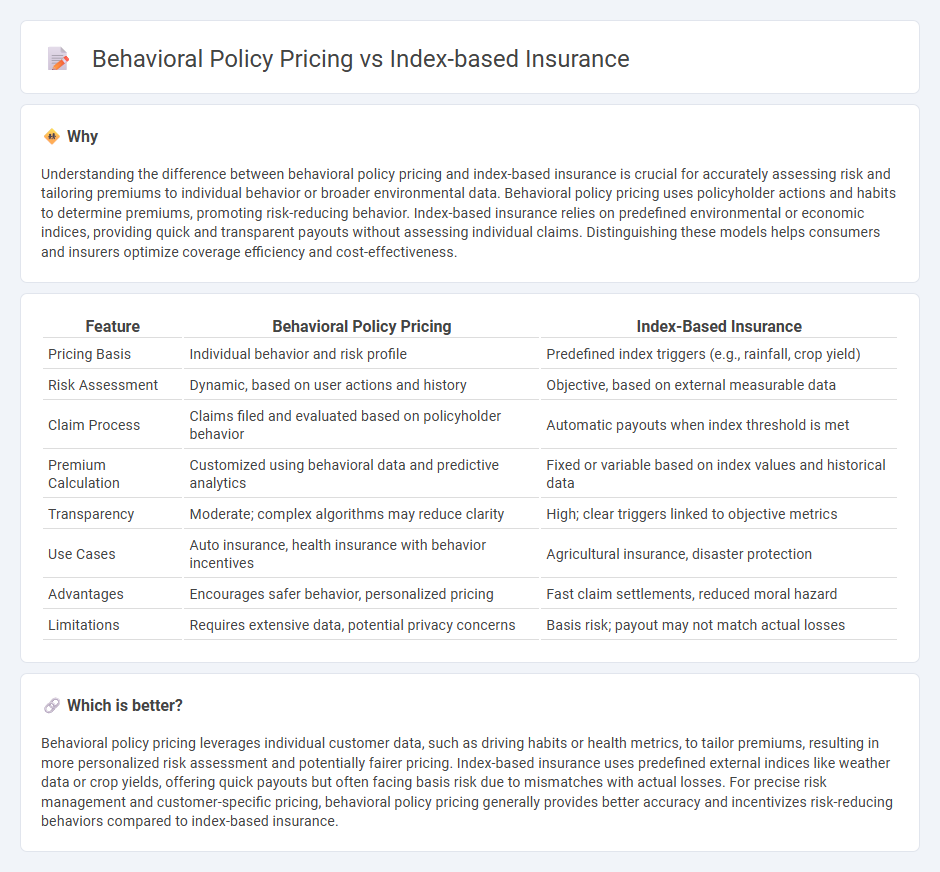

Understanding the difference between behavioral policy pricing and index-based insurance is crucial for accurately assessing risk and tailoring premiums to individual behavior or broader environmental data. Behavioral policy pricing uses policyholder actions and habits to determine premiums, promoting risk-reducing behavior. Index-based insurance relies on predefined environmental or economic indices, providing quick and transparent payouts without assessing individual claims. Distinguishing these models helps consumers and insurers optimize coverage efficiency and cost-effectiveness.

Comparison Table

| Feature | Behavioral Policy Pricing | Index-Based Insurance |

|---|---|---|

| Pricing Basis | Individual behavior and risk profile | Predefined index triggers (e.g., rainfall, crop yield) |

| Risk Assessment | Dynamic, based on user actions and history | Objective, based on external measurable data |

| Claim Process | Claims filed and evaluated based on policyholder behavior | Automatic payouts when index threshold is met |

| Premium Calculation | Customized using behavioral data and predictive analytics | Fixed or variable based on index values and historical data |

| Transparency | Moderate; complex algorithms may reduce clarity | High; clear triggers linked to objective metrics |

| Use Cases | Auto insurance, health insurance with behavior incentives | Agricultural insurance, disaster protection |

| Advantages | Encourages safer behavior, personalized pricing | Fast claim settlements, reduced moral hazard |

| Limitations | Requires extensive data, potential privacy concerns | Basis risk; payout may not match actual losses |

Which is better?

Behavioral policy pricing leverages individual customer data, such as driving habits or health metrics, to tailor premiums, resulting in more personalized risk assessment and potentially fairer pricing. Index-based insurance uses predefined external indices like weather data or crop yields, offering quick payouts but often facing basis risk due to mismatches with actual losses. For precise risk management and customer-specific pricing, behavioral policy pricing generally provides better accuracy and incentivizes risk-reducing behaviors compared to index-based insurance.

Connection

Behavioral policy pricing leverages data on individual actions and risk profiles to tailor premiums, enhancing accuracy in risk assessment. Index-based insurance calculates payouts using pre-defined indices like weather or crop yields, minimizing claims processing time and moral hazard. Both approaches utilize data-driven models to optimize risk management and promote fair pricing in the insurance industry.

Key Terms

**Index-based insurance:**

Index-based insurance provides coverage linked to a specific index such as weather data or crop yields, reducing the need for individual loss assessments and enabling faster claim settlements. This approach minimizes administrative costs and moral hazard risks by triggering payouts automatically when index thresholds are met. Explore further to understand how index-based insurance optimizes risk management and enhances protection for underserved sectors.

Parametric triggers

Index-based insurance uses predefined parametric triggers such as rainfall levels or temperature thresholds to automate claim payouts, ensuring rapid and transparent compensation with minimal loss adjustment expenses. Behavioral policy pricing incorporates customer actions or risk management behaviors detected through IoT devices and telematics, enabling more personalized premiums and incentivizing risk-reducing behaviors. Explore how parametric triggers revolutionize insurance accuracy and efficiency by learning more about their applications and benefits.

Basis risk

Index-based insurance reduces traditional claims processing costs but exposes policyholders to basis risk, where payouts may not perfectly match individual losses. Behavioral policy pricing leverages detailed behavioral data to minimize basis risk by tailoring premiums more closely to actual risk profiles, enhancing fairness and efficiency. Explore how these approaches impact risk management and customer experience in insurance markets.

Source and External Links

What is index insurance? - Index-based insurance pays out benefits based on a predetermined index such as rainfall or temperature, enabling quicker and more objective claims settlement mainly for losses due to weather and catastrophic events, and is especially beneficial for agricultural risk management in developing countries.

Index-based insurance - Index-based insurance uses a measurable index like rainfall or crop yield to trigger payouts, eliminating costly individual claims assessments and making it viable for smallholders by covering widespread risks impacting agricultural livelihoods.

Index-Based Insurance: Types, Benefits, And Solutions - This insurance type improves affordability and accessibility for farmers by simplifying claims, reducing overhead, encouraging strategic farm management, and facilitating easier credit access by lenders due to parametric coverage based on weather or satellite data.

dowidth.com

dowidth.com