Insurance as a service offers a flexible, technology-driven approach that streamlines policy management through digital platforms, contrasting with traditional insurance's reliance on manual processes and fixed coverage packages. This model provides tailored policies with real-time analytics and instant claims processing, enhancing customer experience and operational efficiency. Explore how insurance as a service is transforming risk management and coverage options.

Why it is important

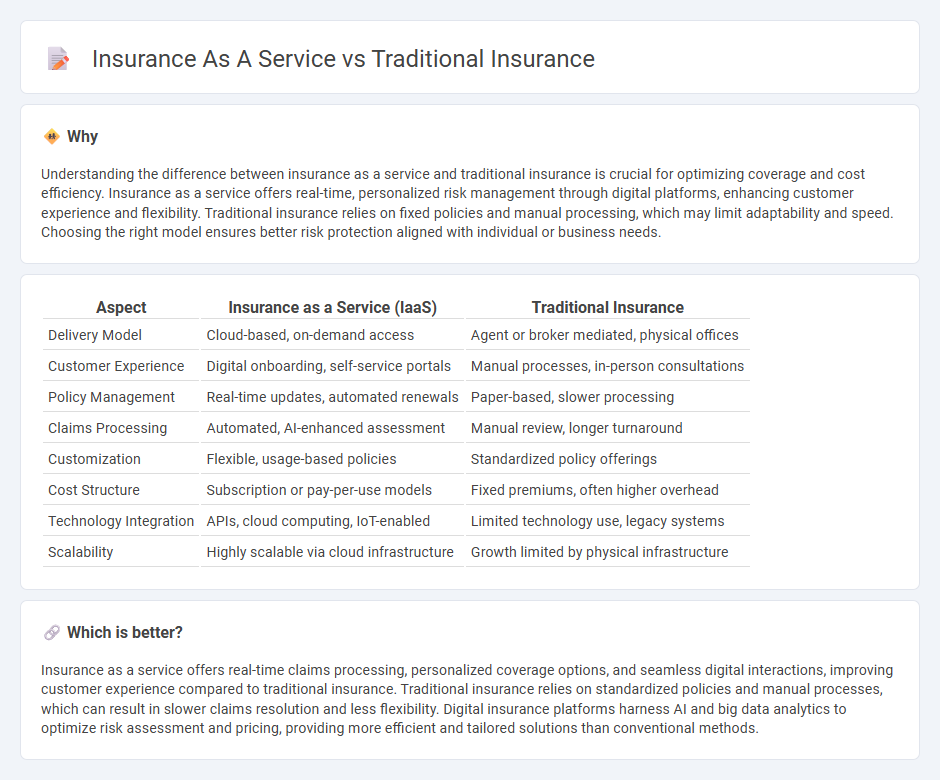

Understanding the difference between insurance as a service and traditional insurance is crucial for optimizing coverage and cost efficiency. Insurance as a service offers real-time, personalized risk management through digital platforms, enhancing customer experience and flexibility. Traditional insurance relies on fixed policies and manual processing, which may limit adaptability and speed. Choosing the right model ensures better risk protection aligned with individual or business needs.

Comparison Table

| Aspect | Insurance as a Service (IaaS) | Traditional Insurance |

|---|---|---|

| Delivery Model | Cloud-based, on-demand access | Agent or broker mediated, physical offices |

| Customer Experience | Digital onboarding, self-service portals | Manual processes, in-person consultations |

| Policy Management | Real-time updates, automated renewals | Paper-based, slower processing |

| Claims Processing | Automated, AI-enhanced assessment | Manual review, longer turnaround |

| Customization | Flexible, usage-based policies | Standardized policy offerings |

| Cost Structure | Subscription or pay-per-use models | Fixed premiums, often higher overhead |

| Technology Integration | APIs, cloud computing, IoT-enabled | Limited technology use, legacy systems |

| Scalability | Highly scalable via cloud infrastructure | Growth limited by physical infrastructure |

Which is better?

Insurance as a service offers real-time claims processing, personalized coverage options, and seamless digital interactions, improving customer experience compared to traditional insurance. Traditional insurance relies on standardized policies and manual processes, which can result in slower claims resolution and less flexibility. Digital insurance platforms harness AI and big data analytics to optimize risk assessment and pricing, providing more efficient and tailored solutions than conventional methods.

Connection

Insurance as a service leverages digital platforms to streamline policy management, claims processing, and customer engagement, enhancing efficiency compared to traditional insurance. Traditional insurance relies on established actuarial models and face-to-face interactions, forming the foundational risk assessment and coverage structures that insurance as a service builds upon. Both models share core objectives of risk mitigation and financial protection, with insurance as a service evolving to meet modern consumer demands through technology integration.

Key Terms

Underwriting

Traditional insurance underwriting relies heavily on manual risk assessment and historical data analysis, often leading to slower policy approvals and limited customization. Insurance as a Service (IaaS) leverages advanced AI algorithms and real-time data integration to deliver dynamic, precise underwriting that enhances risk prediction and expedites decision-making processes. Explore how transitioning to Insurance as a Service can revolutionize underwriting efficiency and accuracy.

Risk Pooling

Traditional insurance relies on risk pooling by collecting premiums from a large group to cover individual losses, creating a shared financial safety net. Insurance as a Service (IaaS) enhances this model with real-time data analytics and flexible coverage options, optimizing risk assessment and premium allocation dynamically. Explore how IaaS transforms risk pooling for more efficient and personalized insurance solutions.

Digital Platforms

Traditional insurance relies on manual processes and legacy systems, leading to slower policy management and claims processing. Insurance as a Service (IaaS) leverages cloud-based digital platforms to offer scalable, real-time solutions, enabling personalized customer experiences and rapid product innovation. Explore how digital transformation in insurance platforms enhances efficiency and customer engagement.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional life insurance plans include term insurance, endowment plans, and retirement plans, offering benefits like life coverage and fixed incomes.

Traditional Indemnity Insurance Plans - Virginia Health Information - Traditional health insurance plans reimburse patients based on usual, customary, and reasonable fees, allowing freedom in choosing healthcare providers.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Traditional insurance plans involve monthly premiums and cover a portion of medical costs, often with deductibles and co-pays, offering comprehensive coverage but with potential high out-of-pocket costs.

dowidth.com

dowidth.com