Micro-mobility insurance covers electric scooters, bikes, and other small vehicles used for short-distance travel, focusing on liability, theft, and damage specific to urban environments. Motorcycle insurance provides broader protection tailored to high-speed vehicles, including comprehensive coverage for accidents, theft, liability, and personal injury. Explore the key differences in coverage options and cost factors to find the ideal insurance for your needs.

Why it is important

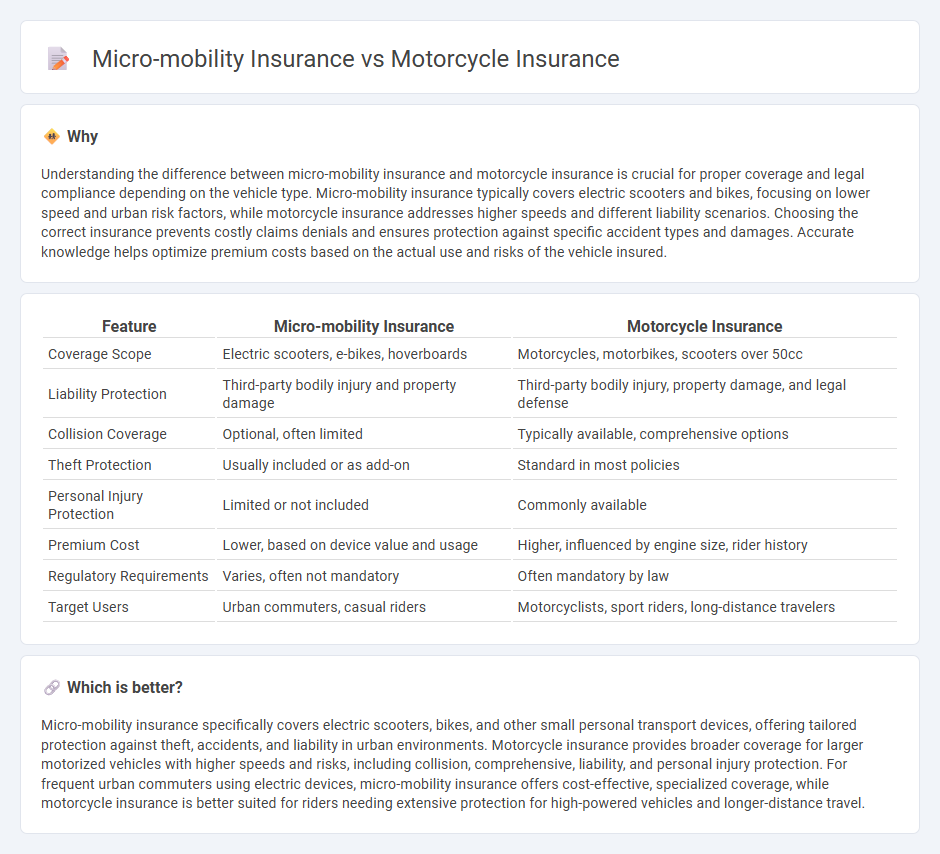

Understanding the difference between micro-mobility insurance and motorcycle insurance is crucial for proper coverage and legal compliance depending on the vehicle type. Micro-mobility insurance typically covers electric scooters and bikes, focusing on lower speed and urban risk factors, while motorcycle insurance addresses higher speeds and different liability scenarios. Choosing the correct insurance prevents costly claims denials and ensures protection against specific accident types and damages. Accurate knowledge helps optimize premium costs based on the actual use and risks of the vehicle insured.

Comparison Table

| Feature | Micro-mobility Insurance | Motorcycle Insurance |

|---|---|---|

| Coverage Scope | Electric scooters, e-bikes, hoverboards | Motorcycles, motorbikes, scooters over 50cc |

| Liability Protection | Third-party bodily injury and property damage | Third-party bodily injury, property damage, and legal defense |

| Collision Coverage | Optional, often limited | Typically available, comprehensive options |

| Theft Protection | Usually included or as add-on | Standard in most policies |

| Personal Injury Protection | Limited or not included | Commonly available |

| Premium Cost | Lower, based on device value and usage | Higher, influenced by engine size, rider history |

| Regulatory Requirements | Varies, often not mandatory | Often mandatory by law |

| Target Users | Urban commuters, casual riders | Motorcyclists, sport riders, long-distance travelers |

Which is better?

Micro-mobility insurance specifically covers electric scooters, bikes, and other small personal transport devices, offering tailored protection against theft, accidents, and liability in urban environments. Motorcycle insurance provides broader coverage for larger motorized vehicles with higher speeds and risks, including collision, comprehensive, liability, and personal injury protection. For frequent urban commuters using electric devices, micro-mobility insurance offers cost-effective, specialized coverage, while motorcycle insurance is better suited for riders needing extensive protection for high-powered vehicles and longer-distance travel.

Connection

Micro-mobility insurance and motorcycle insurance both provide financial protection against accidents, theft, and liability for two-wheeled vehicles under distinct usage scenarios. Both insurance types assess risk factors such as rider experience, vehicle type, and usage frequency, offering tailored coverage options for daily commuters and recreational riders. Integration of telematics and usage-based policies is increasingly common, enhancing risk assessment accuracy and personalized premium pricing for micro-mobility and motorcycle users alike.

Key Terms

Coverage Scope

Motorcycle insurance typically covers liability, collision, comprehensive damage, theft, and medical expenses for traditional two-wheeled vehicles exceeding 50cc engine capacity. Micro-mobility insurance addresses coverage for electric scooters, e-bikes, and mopeds, focusing on personal injury protection, third-party liability, and often includes specialized policies for shared vehicles. Explore detailed comparisons to understand which insurance best suits your mobility needs and risks.

Vehicle Type

Motorcycle insurance primarily covers traditional two-wheeled motorbikes with engine capacities ranging from 50cc to over 1000cc, offering protection against theft, accidents, and liability. Micro-mobility insurance, on the other hand, targets smaller electric-powered vehicles such as e-scooters, e-bikes, and hoverboards, which have lower speeds and different usage patterns. Explore the distinctions in coverage and benefits to choose the insurance that best fits your vehicle type.

Liability Limits

Motorcycle insurance typically offers higher liability limits due to the increased risk and potential damage compared to micro-mobility insurance, which usually provides more modest coverage tailored for electric scooters, bikes, and other small vehicles. Liability limits in motorcycle insurance often range from $300,000 to $500,000 or more, reflecting the severity of accidents and third-party claims, whereas micro-mobility insurance may cap liability at around $100,000 to $250,000, sufficient for urban environments with lower speeds. Explore comprehensive insurance options to find the best coverage suited for your specific vehicle and riding conditions.

Source and External Links

Motorcycle Insurance: Get a Quote Today! - GEICO offers affordable motorcycle insurance rates with coverage options that include liability, collision, and comprehensive policies.

Motorcycle Insurance Quotes - Liberty Mutual provides customized motorcycle insurance quotes with discounts and coverage options like liability and collision.

Motorcycle Insurance | Get a Quote - Travelers offers motorcycle insurance through their partner Dairyland, featuring competitive rates and quality coverage for various types of bikes.

dowidth.com

dowidth.com