Weather index insurance offers financial protection by triggering payouts based on measurable weather parameters such as rainfall or temperature, minimizing the need for individual loss assessments. Livestock insurance, on the other hand, provides coverage against risks like disease, death, or theft of animals, focusing on tangible asset protection. Explore the distinct benefits and applications of each insurance type to better safeguard agricultural investments.

Why it is important

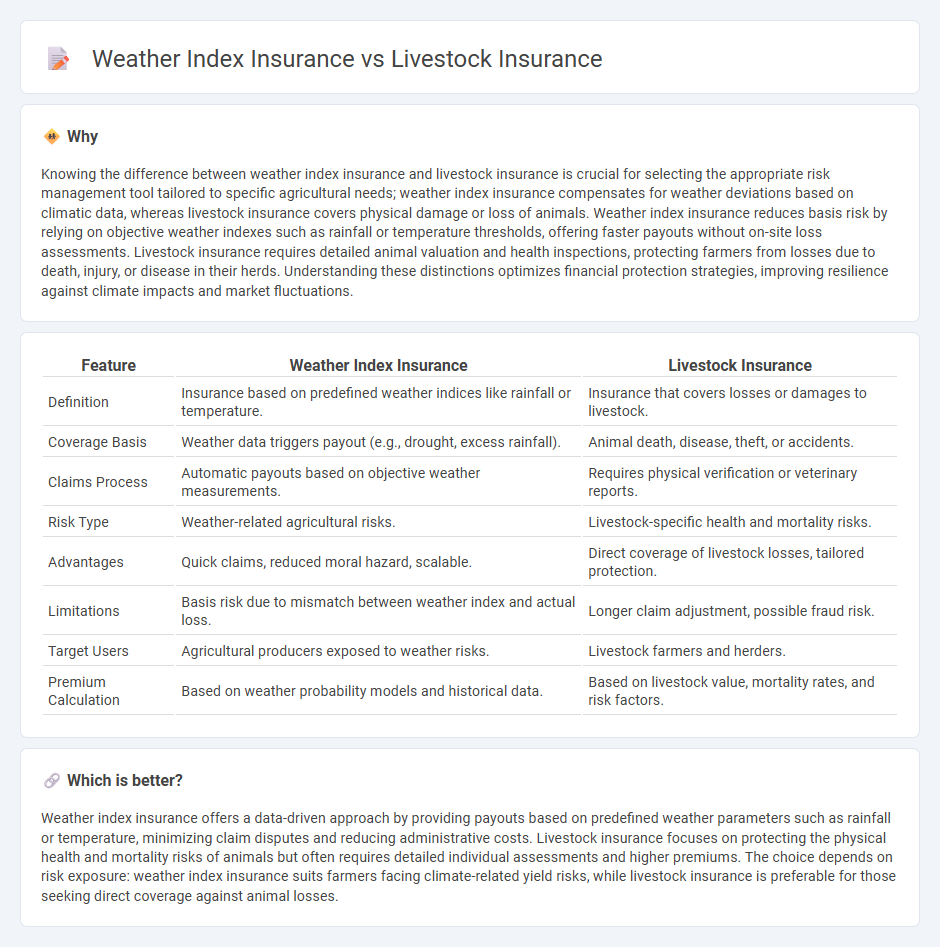

Knowing the difference between weather index insurance and livestock insurance is crucial for selecting the appropriate risk management tool tailored to specific agricultural needs; weather index insurance compensates for weather deviations based on climatic data, whereas livestock insurance covers physical damage or loss of animals. Weather index insurance reduces basis risk by relying on objective weather indexes such as rainfall or temperature thresholds, offering faster payouts without on-site loss assessments. Livestock insurance requires detailed animal valuation and health inspections, protecting farmers from losses due to death, injury, or disease in their herds. Understanding these distinctions optimizes financial protection strategies, improving resilience against climate impacts and market fluctuations.

Comparison Table

| Feature | Weather Index Insurance | Livestock Insurance |

|---|---|---|

| Definition | Insurance based on predefined weather indices like rainfall or temperature. | Insurance that covers losses or damages to livestock. |

| Coverage Basis | Weather data triggers payout (e.g., drought, excess rainfall). | Animal death, disease, theft, or accidents. |

| Claims Process | Automatic payouts based on objective weather measurements. | Requires physical verification or veterinary reports. |

| Risk Type | Weather-related agricultural risks. | Livestock-specific health and mortality risks. |

| Advantages | Quick claims, reduced moral hazard, scalable. | Direct coverage of livestock losses, tailored protection. |

| Limitations | Basis risk due to mismatch between weather index and actual loss. | Longer claim adjustment, possible fraud risk. |

| Target Users | Agricultural producers exposed to weather risks. | Livestock farmers and herders. |

| Premium Calculation | Based on weather probability models and historical data. | Based on livestock value, mortality rates, and risk factors. |

Which is better?

Weather index insurance offers a data-driven approach by providing payouts based on predefined weather parameters such as rainfall or temperature, minimizing claim disputes and reducing administrative costs. Livestock insurance focuses on protecting the physical health and mortality risks of animals but often requires detailed individual assessments and higher premiums. The choice depends on risk exposure: weather index insurance suits farmers facing climate-related yield risks, while livestock insurance is preferable for those seeking direct coverage against animal losses.

Connection

Weather index insurance and livestock insurance are connected through their shared goal of mitigating risks related to environmental factors impacting agricultural productivity. Weather index insurance uses specific weather parameters, such as rainfall levels or temperature, as indicators to trigger compensation, which directly benefits livestock farmers facing losses due to adverse weather conditions like drought or flooding. This integration allows for more accurate, timely financial support, enhancing the resilience of livestock operations against climate variability.

Key Terms

Insurable Asset vs. Index Parameter

Livestock insurance directly protects the insurable asset, such as cattle or sheep, by compensating losses due to mortality, theft, or disease, ensuring financial security for farmers. Weather index insurance, on the other hand, relies on predetermined index parameters like rainfall levels or temperature thresholds rather than actual asset damage, providing payouts based on weather deviations that affect productivity. Explore the detailed differences and benefits of both insurance types to determine the best risk management strategy for your agricultural needs.

Individual Loss Assessment vs. Trigger Event

Livestock insurance relies on individual loss assessment, providing payouts based on the verified loss of each insured animal, ensuring precise compensation for farmers. Weather index insurance, by contrast, uses predefined weather parameters such as rainfall or temperature thresholds as triggers, enabling faster, objective payouts without the need for field loss verification. Explore more to understand which insurance type best suits your risk management strategy.

Moral Hazard vs. Basis Risk

Livestock insurance mitigates moral hazard by directly covering animal losses, incentivizing proper care and management, whereas weather index insurance minimizes moral hazard by relying on objective weather parameters but faces higher basis risk due to imperfect correlation with actual losses. Basis risk in weather index insurance arises when insured weather events do not align precisely with livestock damage, potentially leading to under- or over-compensation. Explore further to understand how these insurance mechanisms balance risk and incentives in agricultural finance.

Source and External Links

Livestock Insurance for Comprehensive Protection - Livestock insurance covers accidents, theft, and natural disasters but typically excludes disease and old age.

Livestock Insurance - Nationwide - Nationwide offers livestock insurance that covers fire, lightning, floods, and accidents, with additional protection against unfounded animal cruelty lawsuits.

Livestock Insurance | Farm Bureau Financial Services - Farm Bureau provides specialized insurance options like Livestock Gross Margin and Livestock Risk Protection to protect against price fluctuations and revenue loss.

dowidth.com

dowidth.com