Pay-as-you-drive insurance charges premiums based on actual miles driven, offering cost savings for low-mileage drivers by aligning costs directly with usage. On-demand car insurance provides flexible coverage activated only when driving, ideal for occasional or shared vehicle users seeking control over when insurance is active. Explore the benefits and pricing models of these innovative insurance options to determine which suits your driving habits best.

Why it is important

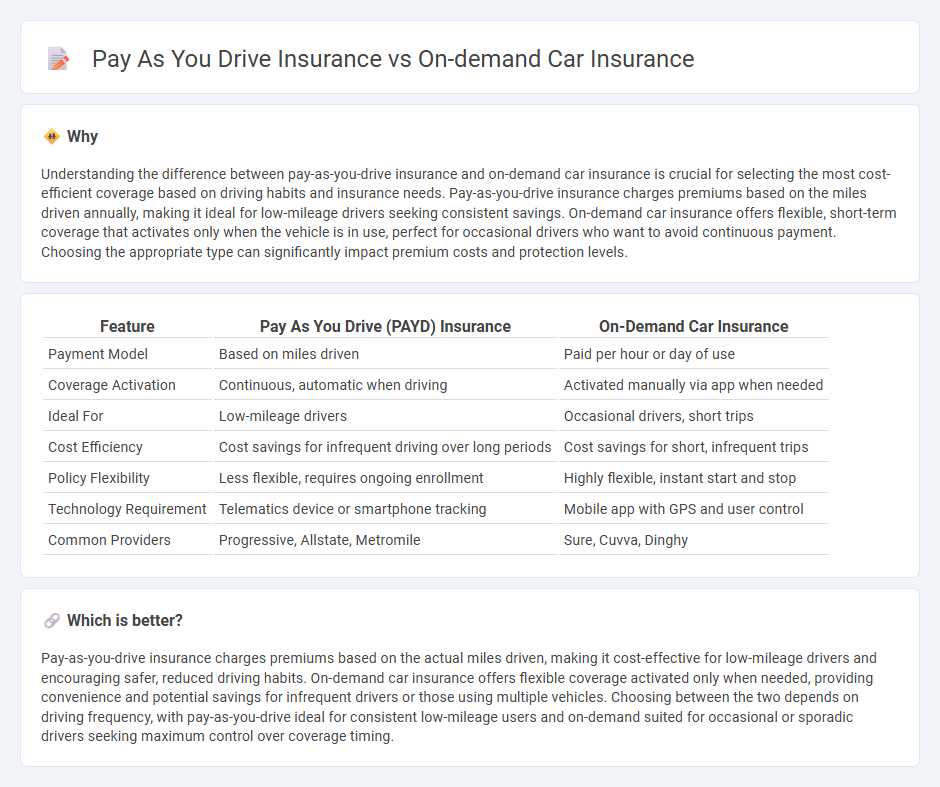

Understanding the difference between pay-as-you-drive insurance and on-demand car insurance is crucial for selecting the most cost-efficient coverage based on driving habits and insurance needs. Pay-as-you-drive insurance charges premiums based on the miles driven annually, making it ideal for low-mileage drivers seeking consistent savings. On-demand car insurance offers flexible, short-term coverage that activates only when the vehicle is in use, perfect for occasional drivers who want to avoid continuous payment. Choosing the appropriate type can significantly impact premium costs and protection levels.

Comparison Table

| Feature | Pay As You Drive (PAYD) Insurance | On-Demand Car Insurance |

|---|---|---|

| Payment Model | Based on miles driven | Paid per hour or day of use |

| Coverage Activation | Continuous, automatic when driving | Activated manually via app when needed |

| Ideal For | Low-mileage drivers | Occasional drivers, short trips |

| Cost Efficiency | Cost savings for infrequent driving over long periods | Cost savings for short, infrequent trips |

| Policy Flexibility | Less flexible, requires ongoing enrollment | Highly flexible, instant start and stop |

| Technology Requirement | Telematics device or smartphone tracking | Mobile app with GPS and user control |

| Common Providers | Progressive, Allstate, Metromile | Sure, Cuvva, Dinghy |

Which is better?

Pay-as-you-drive insurance charges premiums based on the actual miles driven, making it cost-effective for low-mileage drivers and encouraging safer, reduced driving habits. On-demand car insurance offers flexible coverage activated only when needed, providing convenience and potential savings for infrequent drivers or those using multiple vehicles. Choosing between the two depends on driving frequency, with pay-as-you-drive ideal for consistent low-mileage users and on-demand suited for occasional or sporadic drivers seeking maximum control over coverage timing.

Connection

Pay-as-you-drive insurance and on-demand car insurance both offer flexible, usage-based coverage models that charge premiums based on actual driving behavior or time. These innovative insurance types leverage telematics technology and mobile apps to monitor mileage, driving patterns, and duration, enabling personalized pricing and immediate activation or deactivation. By aligning costs with real-world vehicle usage, they provide cost-effective, tailored insurance solutions for infrequent or diverse drivers.

Key Terms

Coverage flexibility

On-demand car insurance offers greater coverage flexibility by allowing drivers to activate and customize policies for specific time periods, such as hourly or daily usage, ideal for occasional drivers. Pay-as-you-drive insurance bases premiums on actual mileage driven, providing cost efficiency for low-mileage users but less adaptability in terms of timing and coverage customization. Explore how these insurance options can be tailored to fit your driving habits and savings goals.

Usage-based premium

On-demand car insurance charges premiums based on short-term usage, offering flexibility for infrequent drivers by allowing coverage only when the vehicle is in use. Pay-as-you-drive insurance calculates premiums according to actual mileage, providing cost savings for low-mileage drivers by linking rates directly to distance driven. Explore the differences between these usage-based premium models to determine the best fit for your driving habits.

Policy duration

On-demand car insurance offers flexible coverage activated only when needed, typically for short durations such as hours or days, whereas pay-as-you-drive insurance calculates premiums based on actual distance driven over longer policy periods, often monthly or annually. This results in potentially lower costs with pay-as-you-drive models for infrequent drivers who want continuous coverage, while on-demand insurance suits sporadic, immediate needs without long-term commitment. Explore more to determine which policy duration aligns best with your driving habits and financial goals.

Source and External Links

What Is On-Demand Insurance? - This model allows policyholders to turn coverage on and off, paying only when the policy is active, often used for filling gaps in traditional insurance or providing temporary coverage.

How to Get Auto Insurance for On-Demand Companies - This guide focuses on the challenges of obtaining auto insurance for on-demand companies, emphasizing the need for thorough driver and vehicle screening.

Pay-Per-Mile Car Insurance - Although not traditional on-demand insurance, this type of insurance charges based on the number of miles driven, offering potential savings for low-mileage drivers.

dowidth.com

dowidth.com