Flood risk modeling utilizes hydrological data, geographic information systems, and climate patterns to predict potential flood scenarios and their financial impact. Reinsurance modeling focuses on aggregating risks from multiple insurance portfolios to assess overall exposure and optimize risk transfer strategies. Explore how these distinct approaches combine to enhance insurance resilience against catastrophic losses.

Why it is important

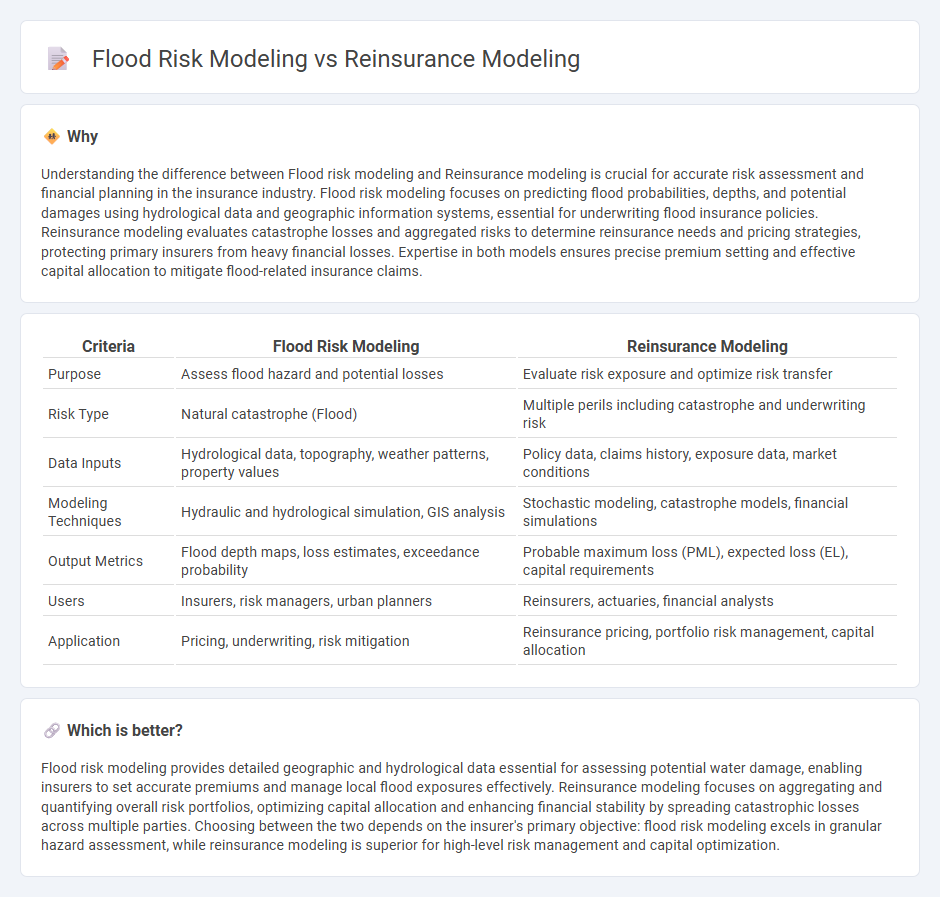

Understanding the difference between Flood risk modeling and Reinsurance modeling is crucial for accurate risk assessment and financial planning in the insurance industry. Flood risk modeling focuses on predicting flood probabilities, depths, and potential damages using hydrological data and geographic information systems, essential for underwriting flood insurance policies. Reinsurance modeling evaluates catastrophe losses and aggregated risks to determine reinsurance needs and pricing strategies, protecting primary insurers from heavy financial losses. Expertise in both models ensures precise premium setting and effective capital allocation to mitigate flood-related insurance claims.

Comparison Table

| Criteria | Flood Risk Modeling | Reinsurance Modeling |

|---|---|---|

| Purpose | Assess flood hazard and potential losses | Evaluate risk exposure and optimize risk transfer |

| Risk Type | Natural catastrophe (Flood) | Multiple perils including catastrophe and underwriting risk |

| Data Inputs | Hydrological data, topography, weather patterns, property values | Policy data, claims history, exposure data, market conditions |

| Modeling Techniques | Hydraulic and hydrological simulation, GIS analysis | Stochastic modeling, catastrophe models, financial simulations |

| Output Metrics | Flood depth maps, loss estimates, exceedance probability | Probable maximum loss (PML), expected loss (EL), capital requirements |

| Users | Insurers, risk managers, urban planners | Reinsurers, actuaries, financial analysts |

| Application | Pricing, underwriting, risk mitigation | Reinsurance pricing, portfolio risk management, capital allocation |

Which is better?

Flood risk modeling provides detailed geographic and hydrological data essential for assessing potential water damage, enabling insurers to set accurate premiums and manage local flood exposures effectively. Reinsurance modeling focuses on aggregating and quantifying overall risk portfolios, optimizing capital allocation and enhancing financial stability by spreading catastrophic losses across multiple parties. Choosing between the two depends on the insurer's primary objective: flood risk modeling excels in granular hazard assessment, while reinsurance modeling is superior for high-level risk management and capital optimization.

Connection

Flood risk modeling quantifies potential losses from flood events by analyzing hydrological data, geographical factors, and historical flood patterns, forming the basis for accurate risk assessment. Reinsurance modeling utilizes these flood risk estimates to structure risk transfer mechanisms, diversify exposure, and price reinsurance contracts effectively. The integration of flood risk modeling into reinsurance frameworks enhances insurers' capacity to manage catastrophic risks and stabilizes financial performance against flood-related claims.

Key Terms

**Reinsurance modeling:**

Reinsurance modeling utilizes advanced statistical techniques and catastrophe models to quantify potential losses for insurers, incorporating variables such as hazard frequency, exposure data, and vulnerability functions. This approach enables risk transfer optimization and capital allocation efficiency in the reinsurance sector by accurately predicting large-scale, low-probability events. Discover more about how cutting-edge reinsurance modeling shapes risk management and financial stability in the insurance industry.

Catastrophe Exposure

Reinsurance modeling focuses on assessing aggregate catastrophe exposure across diversified portfolios using probabilistic models to estimate potential losses from events like hurricanes, earthquakes, and floods. Flood risk modeling specifically evaluates the hazard, vulnerability, and exposure at localized or regional scales, integrating hydrological data and climate change projections to quantify flood-related financial impact. Explore in-depth methodologies and case studies to better understand how both models mitigate financial risks in disaster-prone areas.

Treaty Structure

Reinsurance modeling primarily focuses on optimizing treaty structures to balance risk transfer and capital efficiency, often using probabilistic loss distributions and premium calculations to design treaties such as quota share or excess of loss. Flood risk modeling emphasizes hazard assessment, vulnerability, and exposure data to quantify potential flood losses, which directly inform treaty terms, limits, and attachment points in reinsurance contracts. Explore more on how detailed flood risk models enhance treaty structuring for precise risk management and financial protection.

Source and External Links

Modeling Reinsurance Treaties - IBM - This page provides guidance on modeling reinsurance treaties using a Business Data Model, which helps structure agreements between insurers and reinsurers.

Reinsurance Credit Risk Modelling - This paper discusses a stochastic approach to modeling reinsurance credit risk, focusing on default rates and dependency structures in a DFA environment.

Lessons from the Kansas Reinsurance Modeling Project - This report outlines a retrospective reinsurance model where the primary insurer covers claims up to an attachment point, with the reinsurer paying a percentage of claims above that threshold.

dowidth.com

dowidth.com