An insurance sandbox offers a controlled environment where companies can test innovative products, services, or business models under regulatory supervision without full compliance obligations. Pilot programs allow insurers to implement new initiatives on a small scale in real market conditions to evaluate performance and customer response before broader rollout. Explore the differences between insurance sandboxes and pilot programs to optimize your innovation strategy.

Why it is important

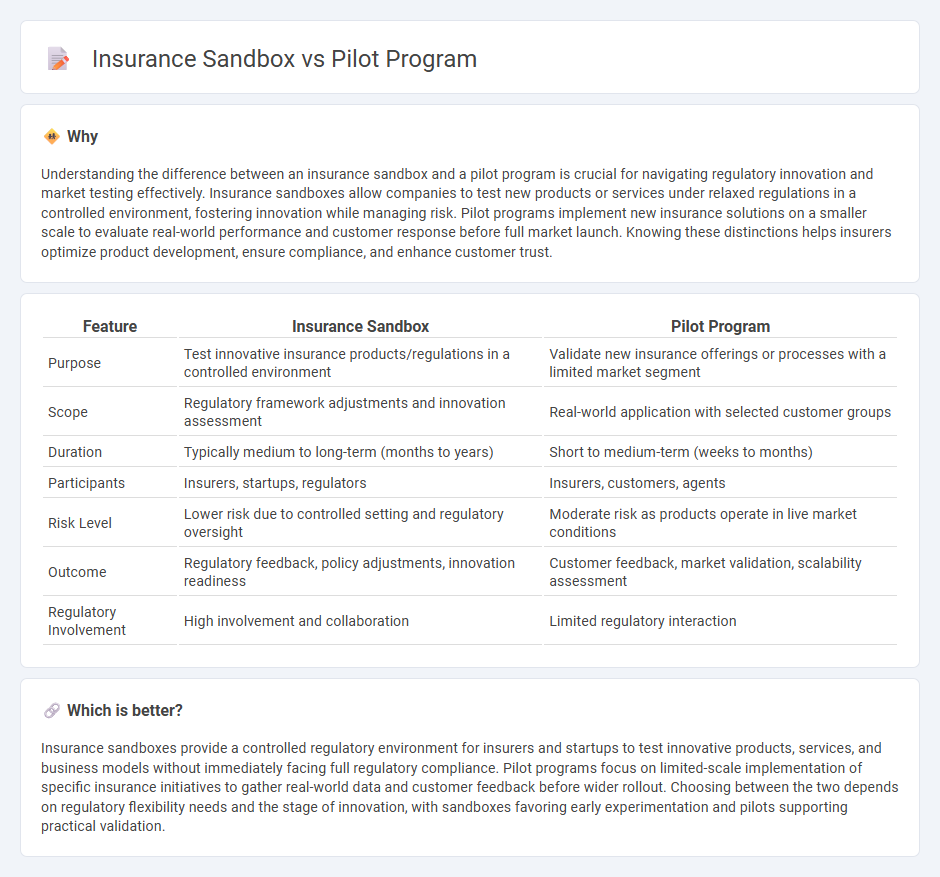

Understanding the difference between an insurance sandbox and a pilot program is crucial for navigating regulatory innovation and market testing effectively. Insurance sandboxes allow companies to test new products or services under relaxed regulations in a controlled environment, fostering innovation while managing risk. Pilot programs implement new insurance solutions on a smaller scale to evaluate real-world performance and customer response before full market launch. Knowing these distinctions helps insurers optimize product development, ensure compliance, and enhance customer trust.

Comparison Table

| Feature | Insurance Sandbox | Pilot Program |

|---|---|---|

| Purpose | Test innovative insurance products/regulations in a controlled environment | Validate new insurance offerings or processes with a limited market segment |

| Scope | Regulatory framework adjustments and innovation assessment | Real-world application with selected customer groups |

| Duration | Typically medium to long-term (months to years) | Short to medium-term (weeks to months) |

| Participants | Insurers, startups, regulators | Insurers, customers, agents |

| Risk Level | Lower risk due to controlled setting and regulatory oversight | Moderate risk as products operate in live market conditions |

| Outcome | Regulatory feedback, policy adjustments, innovation readiness | Customer feedback, market validation, scalability assessment |

| Regulatory Involvement | High involvement and collaboration | Limited regulatory interaction |

Which is better?

Insurance sandboxes provide a controlled regulatory environment for insurers and startups to test innovative products, services, and business models without immediately facing full regulatory compliance. Pilot programs focus on limited-scale implementation of specific insurance initiatives to gather real-world data and customer feedback before wider rollout. Choosing between the two depends on regulatory flexibility needs and the stage of innovation, with sandboxes favoring early experimentation and pilots supporting practical validation.

Connection

Insurance sandboxes provide a controlled regulatory environment where insurers can test innovative products and services under real market conditions with relaxed compliance requirements. Pilot programs within these sandboxes enable companies to validate new insurance models, assess risk, and gather customer feedback before full-scale launch. This connection accelerates innovation by balancing experimentation with regulatory oversight in the insurance industry.

Key Terms

Controlled Environment

A pilot program tests innovative insurance solutions on a limited scale to assess feasibility and gather real-world user feedback, offering a controlled environment with defined parameters and participant criteria. Insurance sandboxes provide regulatory frameworks allowing insurers and startups to experiment with new products and technologies under regulatory supervision, ensuring compliance while managing risks in a controlled setting. Explore the distinctions between these approaches to understand how controlled environments drive innovation and risk management in insurance.

Regulatory Oversight

Pilot programs allow regulatory authorities to evaluate new insurance products or services on a limited scale, ensuring compliance with existing regulations while fostering innovation. Insurance sandboxes provide a controlled environment where insurers can test novel business models and technologies under relaxed regulatory requirements, enabling iterative feedback and risk management. Explore the differences in regulatory oversight to understand how each approach accelerates insurance innovation.

Innovation Testing

Pilot programs and insurance sandboxes serve as critical platforms for innovation testing within the insurance sector, enabling companies to trial new products, services, and technologies under controlled conditions. Pilot programs typically focus on real-world consumer engagement and market validation, while insurance sandboxes offer regulatory flexibility to explore compliance boundaries and risk management strategies. Explore how these frameworks accelerate insurance innovation and transform industry standards.

Source and External Links

What is a pilot program (pilot study)? | Definition from TechTarget - A pilot program is a small-scale, short-term experiment that organizations use to test and learn how a large-scale project might work in practice, helping minimize risks and optimize resource allocation before full implementation.

PLAN Pilot | New York State Education Department - The PLAN Pilot is a networked school initiative studying how to shift instructional practices and improve school culture through performance-based learning and assessment.

Propel Pilot Career Path Program | Delta Air Lines - Propel is a defined pilot career path program by Delta offering mentorship, streamlined hiring, and support for aspiring pilots through collegiate and other tailored routes.

dowidth.com

dowidth.com