Short term rental insurance provides coverage specifically designed for property owners renting out their homes or rooms for brief periods, protecting against property damage, liability claims, and lost rental income. Renters insurance, on the other hand, safeguards tenants by covering personal belongings, liability, and additional living expenses during the lease term. Explore the key differences and benefits of each policy to find the best protection for your rental needs.

Why it is important

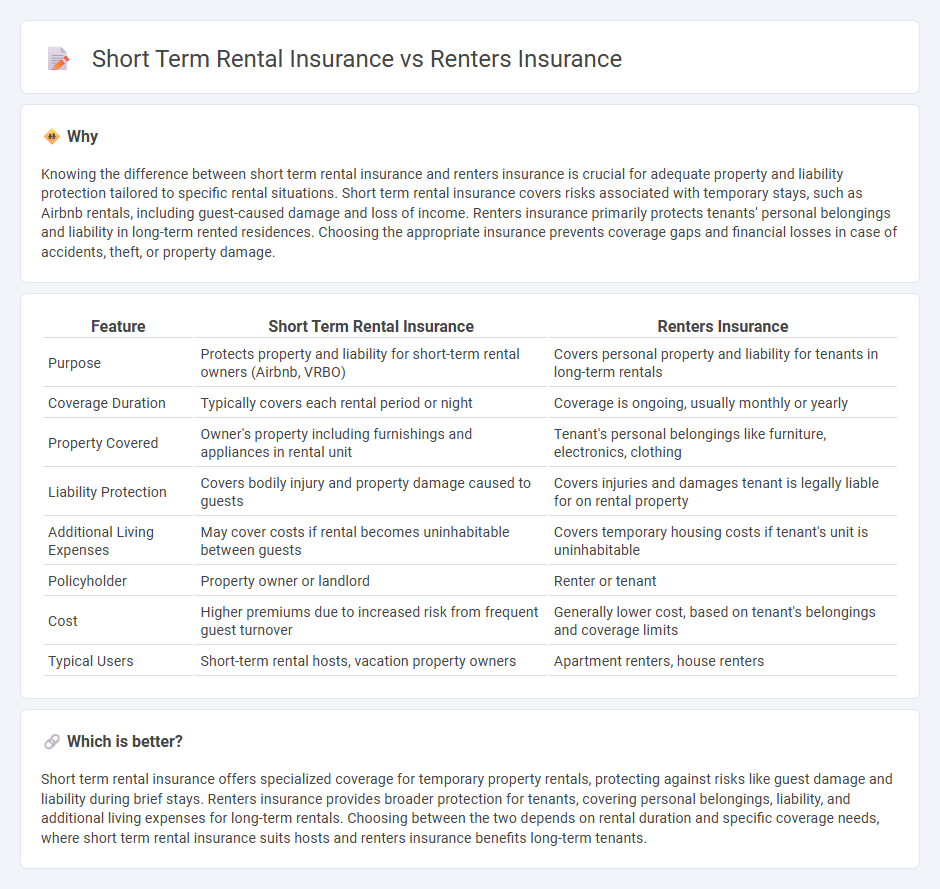

Knowing the difference between short term rental insurance and renters insurance is crucial for adequate property and liability protection tailored to specific rental situations. Short term rental insurance covers risks associated with temporary stays, such as Airbnb rentals, including guest-caused damage and loss of income. Renters insurance primarily protects tenants' personal belongings and liability in long-term rented residences. Choosing the appropriate insurance prevents coverage gaps and financial losses in case of accidents, theft, or property damage.

Comparison Table

| Feature | Short Term Rental Insurance | Renters Insurance |

|---|---|---|

| Purpose | Protects property and liability for short-term rental owners (Airbnb, VRBO) | Covers personal property and liability for tenants in long-term rentals |

| Coverage Duration | Typically covers each rental period or night | Coverage is ongoing, usually monthly or yearly |

| Property Covered | Owner's property including furnishings and appliances in rental unit | Tenant's personal belongings like furniture, electronics, clothing |

| Liability Protection | Covers bodily injury and property damage caused to guests | Covers injuries and damages tenant is legally liable for on rental property |

| Additional Living Expenses | May cover costs if rental becomes uninhabitable between guests | Covers temporary housing costs if tenant's unit is uninhabitable |

| Policyholder | Property owner or landlord | Renter or tenant |

| Cost | Higher premiums due to increased risk from frequent guest turnover | Generally lower cost, based on tenant's belongings and coverage limits |

| Typical Users | Short-term rental hosts, vacation property owners | Apartment renters, house renters |

Which is better?

Short term rental insurance offers specialized coverage for temporary property rentals, protecting against risks like guest damage and liability during brief stays. Renters insurance provides broader protection for tenants, covering personal belongings, liability, and additional living expenses for long-term rentals. Choosing between the two depends on rental duration and specific coverage needs, where short term rental insurance suits hosts and renters insurance benefits long-term tenants.

Connection

Short term rental insurance and renters insurance both provide financial protection for tenants, but short term rental insurance specifically covers temporary rental situations such as vacation homes, while renters insurance offers broader coverage for long-term residential leases. Both policies typically include liability protection, personal property coverage, and loss of use benefits, ensuring renters are safeguarded against damages, theft, or accidents. Understanding the overlap helps tenants select insurance that fits the duration and nature of their lease, optimizing risk management for both short-term stays and extended rentals.

Key Terms

Personal Property Coverage

Personal property coverage in renters insurance typically protects tenants' belongings from risks such as theft, fire, or water damage within their primary residence. In contrast, short term rental insurance often extends protection to personal property left in the rental unit between guest stays, including coverage for damage caused by renters themselves. Understanding the distinctions in personal property coverage can help renters and property owners select the best insurance solution; explore detailed comparisons for informed decisions.

Liability Protection

Renters insurance primarily offers liability protection for damages or injuries occurring within your personal rental unit, covering incidents such as slip-and-fall accidents or property damage caused by the insured tenant. Short term rental insurance provides expanded liability coverage designed for property owners who rent their homes or units on platforms like Airbnb, addressing unique risks including guest injuries, property damage, and potential lawsuits arising from frequent occupant turnover. Explore comprehensive options to ensure your specific liability exposures are adequately covered.

Loss of Income (Business Interruption)

Loss of income coverage in renters insurance typically excludes business interruption claims, leaving short term rental owners at financial risk during property downtime. Short term rental insurance often includes specific business interruption protection to compensate for lost rental income due to covered damages or unforeseen events. Discover how tailored insurance policies safeguard your rental income and secure your investment against interruptions.

Source and External Links

GEICO Renters Insurance - Renters insurance protects tenants' possessions and liability, covering losses from fire, theft, water damage, and more, at an affordable rate.

State Farm Renters Insurance - Offers personalized renters insurance covering belongings like electronics and furniture, with options to bundle with auto insurance for savings and easy online claims.

Allstate Renters Insurance - Provides renters insurance starting at $5/month, covering personal property, liability, guest medical, and additional living expenses.

dowidth.com

dowidth.com