Usage-based insurance leverages telematics to track driving behavior, offering personalized premiums based on actual risk, while on-demand insurance provides flexible, short-term coverage activated only when needed. Both models utilize technology to enhance cost efficiency and convenience for policyholders. Discover how these innovative insurance solutions can transform your coverage experience.

Why it is important

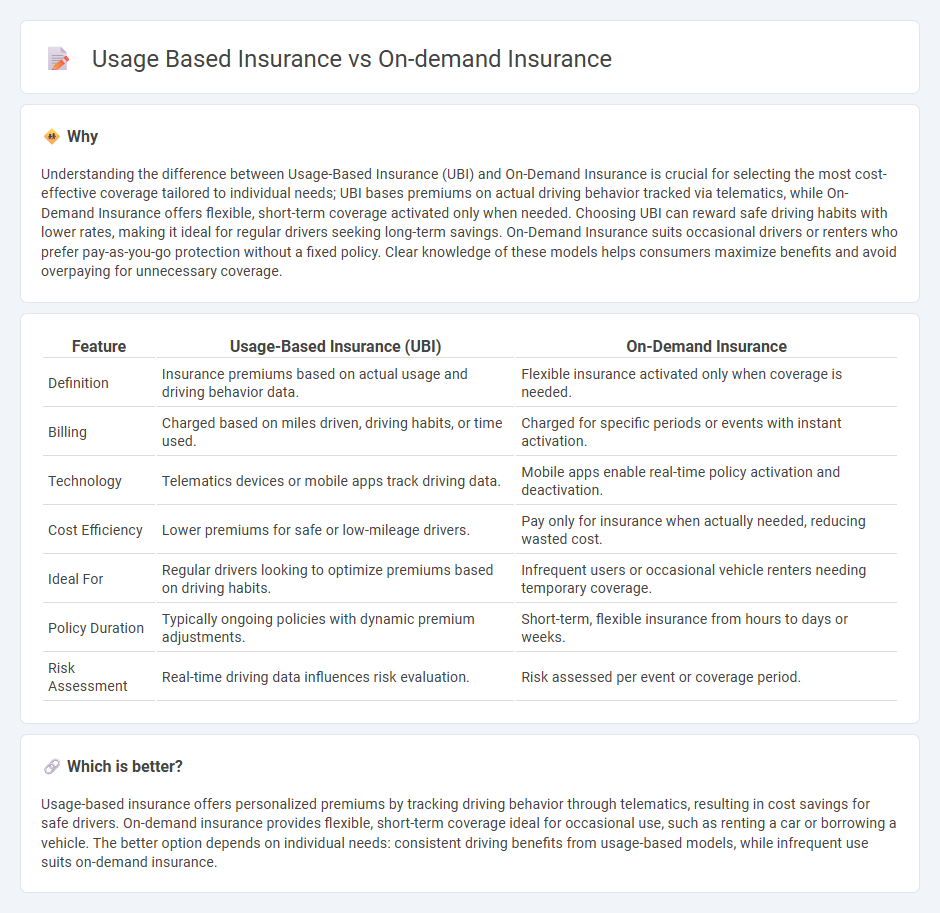

Understanding the difference between Usage-Based Insurance (UBI) and On-Demand Insurance is crucial for selecting the most cost-effective coverage tailored to individual needs; UBI bases premiums on actual driving behavior tracked via telematics, while On-Demand Insurance offers flexible, short-term coverage activated only when needed. Choosing UBI can reward safe driving habits with lower rates, making it ideal for regular drivers seeking long-term savings. On-Demand Insurance suits occasional drivers or renters who prefer pay-as-you-go protection without a fixed policy. Clear knowledge of these models helps consumers maximize benefits and avoid overpaying for unnecessary coverage.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | On-Demand Insurance |

|---|---|---|

| Definition | Insurance premiums based on actual usage and driving behavior data. | Flexible insurance activated only when coverage is needed. |

| Billing | Charged based on miles driven, driving habits, or time used. | Charged for specific periods or events with instant activation. |

| Technology | Telematics devices or mobile apps track driving data. | Mobile apps enable real-time policy activation and deactivation. |

| Cost Efficiency | Lower premiums for safe or low-mileage drivers. | Pay only for insurance when actually needed, reducing wasted cost. |

| Ideal For | Regular drivers looking to optimize premiums based on driving habits. | Infrequent users or occasional vehicle renters needing temporary coverage. |

| Policy Duration | Typically ongoing policies with dynamic premium adjustments. | Short-term, flexible insurance from hours to days or weeks. |

| Risk Assessment | Real-time driving data influences risk evaluation. | Risk assessed per event or coverage period. |

Which is better?

Usage-based insurance offers personalized premiums by tracking driving behavior through telematics, resulting in cost savings for safe drivers. On-demand insurance provides flexible, short-term coverage ideal for occasional use, such as renting a car or borrowing a vehicle. The better option depends on individual needs: consistent driving benefits from usage-based models, while infrequent use suits on-demand insurance.

Connection

Usage-based insurance (UBI) and on-demand insurance both rely on real-time data to tailor coverage and premiums to individual behavior and needs. UBI uses telematics to monitor driving habits and adjust rates accordingly, while on-demand insurance allows consumers to activate coverage only when needed through digital platforms. Both models leverage technology to provide flexible, cost-efficient insurance solutions that enhance customer control and personalization.

Key Terms

Premium Calculation

On-demand insurance calculates premiums based on coverage duration and specific events, offering flexible, short-term protection tailored to immediate needs. Usage-based insurance determines premiums through real-time data such as mileage, driving behavior, or frequency of use, enabling personalized pricing that rewards safe, low-mileage drivers. Explore how these premium calculation methods impact cost efficiency and policy customization to choose the best fit for your insurance needs.

Coverage Period

On-demand insurance offers flexible coverage tailored to specific time frames, activating only when the insured needs protection, whereas usage-based insurance relies on real-time data to adjust premiums based on actual usage patterns over a continuous policy period. This dynamic approach allows on-demand insurance to be ideal for temporary needs like short trips, while usage-based insurance benefits long-term policyholders seeking customized pricing based on driving behavior or mileage. Explore more about how coverage periods influence insurance effectiveness to choose the best plan for your needs.

Policy Activation

On-demand insurance allows users to activate coverage only when needed, providing flexibility and cost savings by paying solely for the policy duration. Usage-based insurance activates policies based on real-time data such as driving behavior or mileage, enabling personalized premiums and continuous risk assessment. Discover how these activation methods transform insurance accessibility and affordability.

Source and External Links

The Ins and Outs of On-Demand Insurance - On-demand insurance allows consumers to purchase coverage as needed through digital platforms, offering flexibility and personalized insurance options.

On-Demand Insurance Market Size & Share Report, 2030 - The global on-demand insurance market is expected to expand significantly, driven by its flexibility and transparency, with North America accounting for a substantial share.

What Is On-Demand Insurance? - On-demand insurance provides policyholders with the flexibility to turn coverage on and off, paying only for active periods, and is typically managed via smartphones or digital devices.

dowidth.com

dowidth.com