Microinsurance offers affordable, low-premium coverage designed for low-income individuals, focusing on specific risks like health, crop failure, or accidents. Life insurance provides financial security to beneficiaries by paying a lump sum or annuity upon the policyholder's death, often with higher coverage amounts and long-term benefits. Explore the differences and benefits to determine the best fit for your protection needs.

Why it is important

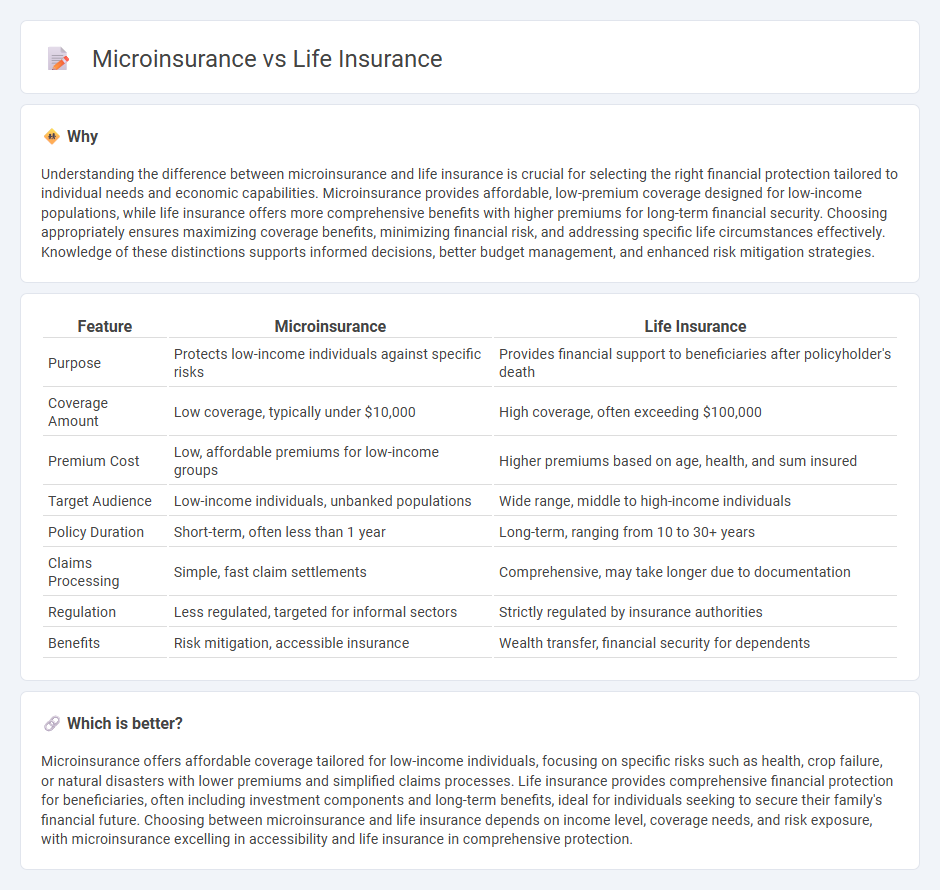

Understanding the difference between microinsurance and life insurance is crucial for selecting the right financial protection tailored to individual needs and economic capabilities. Microinsurance provides affordable, low-premium coverage designed for low-income populations, while life insurance offers more comprehensive benefits with higher premiums for long-term financial security. Choosing appropriately ensures maximizing coverage benefits, minimizing financial risk, and addressing specific life circumstances effectively. Knowledge of these distinctions supports informed decisions, better budget management, and enhanced risk mitigation strategies.

Comparison Table

| Feature | Microinsurance | Life Insurance |

|---|---|---|

| Purpose | Protects low-income individuals against specific risks | Provides financial support to beneficiaries after policyholder's death |

| Coverage Amount | Low coverage, typically under $10,000 | High coverage, often exceeding $100,000 |

| Premium Cost | Low, affordable premiums for low-income groups | Higher premiums based on age, health, and sum insured |

| Target Audience | Low-income individuals, unbanked populations | Wide range, middle to high-income individuals |

| Policy Duration | Short-term, often less than 1 year | Long-term, ranging from 10 to 30+ years |

| Claims Processing | Simple, fast claim settlements | Comprehensive, may take longer due to documentation |

| Regulation | Less regulated, targeted for informal sectors | Strictly regulated by insurance authorities |

| Benefits | Risk mitigation, accessible insurance | Wealth transfer, financial security for dependents |

Which is better?

Microinsurance offers affordable coverage tailored for low-income individuals, focusing on specific risks such as health, crop failure, or natural disasters with lower premiums and simplified claims processes. Life insurance provides comprehensive financial protection for beneficiaries, often including investment components and long-term benefits, ideal for individuals seeking to secure their family's financial future. Choosing between microinsurance and life insurance depends on income level, coverage needs, and risk exposure, with microinsurance excelling in accessibility and life insurance in comprehensive protection.

Connection

Microinsurance and life insurance are interconnected through their shared goal of providing financial protection against life's uncertainties, with microinsurance specifically designed to offer affordable coverage to low-income populations. Both types of insurance mitigate financial risks associated with death or disability, ensuring economic stability for beneficiaries. Microinsurance often serves as an entry point to more comprehensive life insurance products, expanding accessibility and promoting broader insurance inclusion.

Key Terms

Coverage Amount

Life insurance typically offers higher coverage amounts, often ranging from tens of thousands to several million dollars, designed to provide significant financial security for beneficiaries. Microinsurance provides smaller coverage amounts, usually between $100 and $10,000, tailored to low-income individuals and families needing affordable protection against specific risks. Explore more to understand which coverage amount aligns best with your financial goals and needs.

Premium

Life insurance premiums generally require higher payments reflecting broader coverage and longer-term benefits, making them suitable for individuals seeking extensive financial protection. Microinsurance premiums are significantly lower, designed to be affordable for low-income populations while covering specific risks such as health, agriculture, or funeral expenses. Explore more about how premium structures impact coverage suitability and accessibility in different insurance models.

Beneficiary

Life insurance policies typically designate a primary beneficiary who receives the full benefit upon the policyholder's death, often providing substantial financial security to dependents. Microinsurance, designed for low-income individuals, usually offers simpler beneficiary designations with more flexible, community-based payout options to ensure swift support. Explore detailed comparisons to understand which beneficiary structure suits your family's needs best.

Source and External Links

Life Insurance | Get Your Quote Today - Allstate - Life insurance protects your loved ones by covering funeral expenses, replacing lost income, paying debts, funding education, and leaving inheritance with options including term and various permanent policies like whole, universal, and variable life insurance.

Life Insurance Policy - Get a Free Quote | Aflac - Aflac offers term, whole, and final expense life insurance policies that provide financial security to beneficiaries with options for guaranteed-issue coverage and no medical questions for select products.

Life Insurance - Get a Free Quote Now - GEICO - Life insurance policies include term (coverage for a set period), whole life (lifetime coverage with benefits), and universal life (flexible lifetime coverage with cash value); you can quickly estimate needed coverage and affordability.

dowidth.com

dowidth.com