Pet insurance covers veterinary expenses related to illness, accidents, and routine care for pets, ensuring financial protection for pet owners against unexpected health costs. Liability insurance protects individuals or businesses from legal and financial responsibilities arising from accidents, injuries, or damages to third parties. Explore the differences in coverage, benefits, and costs between pet insurance and liability insurance to determine the best fit for your needs.

Why it is important

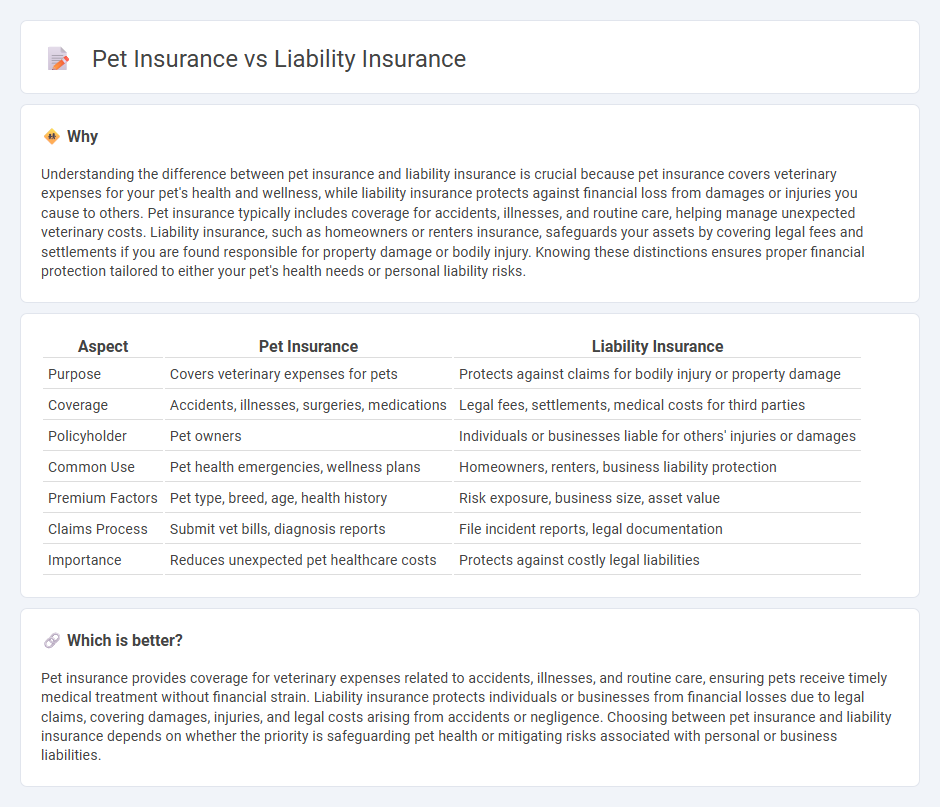

Understanding the difference between pet insurance and liability insurance is crucial because pet insurance covers veterinary expenses for your pet's health and wellness, while liability insurance protects against financial loss from damages or injuries you cause to others. Pet insurance typically includes coverage for accidents, illnesses, and routine care, helping manage unexpected veterinary costs. Liability insurance, such as homeowners or renters insurance, safeguards your assets by covering legal fees and settlements if you are found responsible for property damage or bodily injury. Knowing these distinctions ensures proper financial protection tailored to either your pet's health needs or personal liability risks.

Comparison Table

| Aspect | Pet Insurance | Liability Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Protects against claims for bodily injury or property damage |

| Coverage | Accidents, illnesses, surgeries, medications | Legal fees, settlements, medical costs for third parties |

| Policyholder | Pet owners | Individuals or businesses liable for others' injuries or damages |

| Common Use | Pet health emergencies, wellness plans | Homeowners, renters, business liability protection |

| Premium Factors | Pet type, breed, age, health history | Risk exposure, business size, asset value |

| Claims Process | Submit vet bills, diagnosis reports | File incident reports, legal documentation |

| Importance | Reduces unexpected pet healthcare costs | Protects against costly legal liabilities |

Which is better?

Pet insurance provides coverage for veterinary expenses related to accidents, illnesses, and routine care, ensuring pets receive timely medical treatment without financial strain. Liability insurance protects individuals or businesses from financial losses due to legal claims, covering damages, injuries, and legal costs arising from accidents or negligence. Choosing between pet insurance and liability insurance depends on whether the priority is safeguarding pet health or mitigating risks associated with personal or business liabilities.

Connection

Pet insurance and liability insurance are connected through their role in managing financial risks associated with pet ownership. Pet insurance covers veterinary expenses for illnesses and injuries, while liability insurance protects against claims if a pet causes injury or property damage to others. Together, these policies provide comprehensive protection that mitigates both medical costs for pets and legal liabilities for owners.

Key Terms

Liability insurance:

Liability insurance provides essential financial protection against claims of property damage or bodily injury caused by you or your property, covering legal fees and settlements up to policy limits. It is crucial for homeowners, renters, and business owners to safeguard assets and mitigate risk exposure effectively. Explore detailed insights on liability insurance policies and benefits to ensure comprehensive coverage tailored to your needs.

Negligence

Liability insurance covers financial losses arising from negligence that causes injury or damage to others, protecting policyholders from lawsuits and claims. Pet insurance focuses on reimbursing veterinary expenses related to the pet's health, but typically excludes coverage for damages caused by the pet's negligence or harm to third parties. Explore the differences further to determine which insurance best suits your risk management needs.

Third-party coverage

Liability insurance primarily protects against claims resulting from injury or damage to third parties, covering legal costs and compensation payments. Pet insurance generally covers veterinary expenses for your own pet's health issues, with limited or no third-party liability coverage unless specified. Explore our detailed comparison to understand which insurance best safeguards you and your pet in third-party incidents.

Source and External Links

Liability Insurance - General Coverage for Your Business - This webpage provides information on how general liability insurance protects businesses from claims resulting from normal business operations.

Liability Car Insurance - This page explains how liability insurance in the context of car insurance helps cover medical and legal fees if you are held responsible for someone else's injury or property damage.

General Liability Insurance: Get a Free Quote - This webpage offers details on general liability insurance, which covers businesses for claims involving bodily injury, property damage, or personal and advertising injuries.

dowidth.com

dowidth.com