Flood insurance integration focuses on protecting property owners from water damage caused by natural disasters, encompassing coverage for structural and content losses due to flooding. Liability insurance integration, on the other hand, addresses legal responsibilities by covering claims related to bodily injury or property damage caused to third parties. Explore deeper insights into how these insurance types function and interconnect within comprehensive risk management strategies.

Why it is important

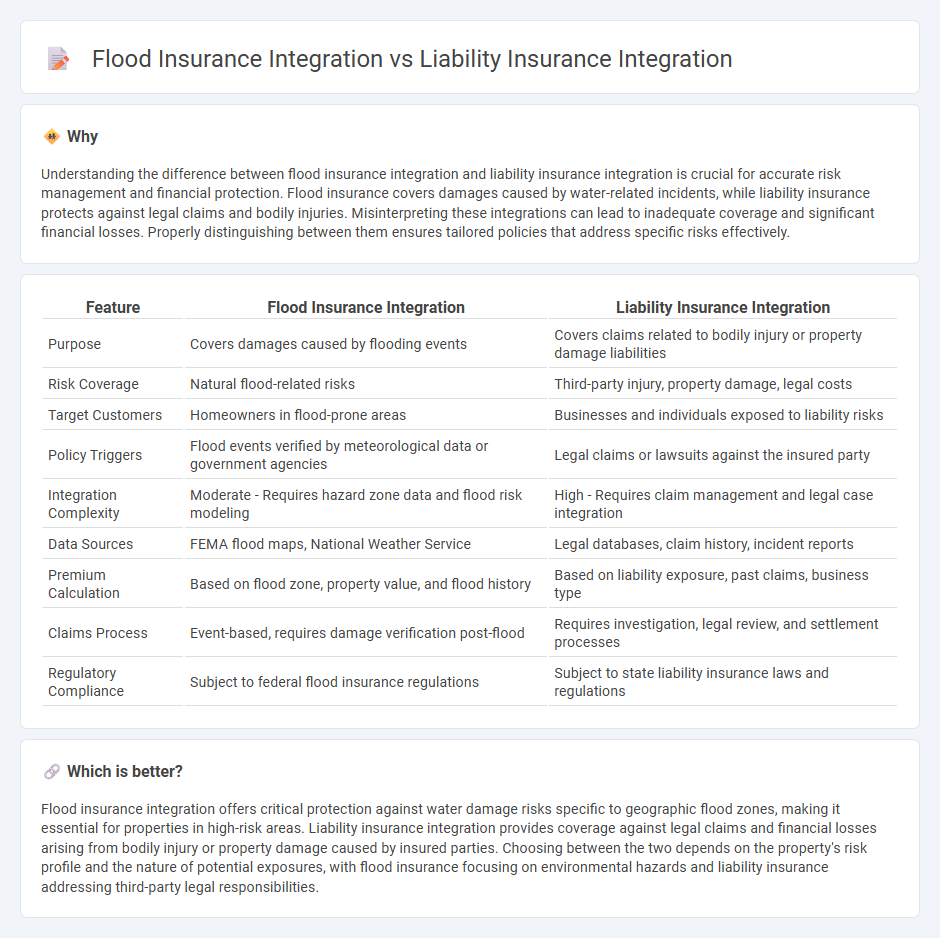

Understanding the difference between flood insurance integration and liability insurance integration is crucial for accurate risk management and financial protection. Flood insurance covers damages caused by water-related incidents, while liability insurance protects against legal claims and bodily injuries. Misinterpreting these integrations can lead to inadequate coverage and significant financial losses. Properly distinguishing between them ensures tailored policies that address specific risks effectively.

Comparison Table

| Feature | Flood Insurance Integration | Liability Insurance Integration |

|---|---|---|

| Purpose | Covers damages caused by flooding events | Covers claims related to bodily injury or property damage liabilities |

| Risk Coverage | Natural flood-related risks | Third-party injury, property damage, legal costs |

| Target Customers | Homeowners in flood-prone areas | Businesses and individuals exposed to liability risks |

| Policy Triggers | Flood events verified by meteorological data or government agencies | Legal claims or lawsuits against the insured party |

| Integration Complexity | Moderate - Requires hazard zone data and flood risk modeling | High - Requires claim management and legal case integration |

| Data Sources | FEMA flood maps, National Weather Service | Legal databases, claim history, incident reports |

| Premium Calculation | Based on flood zone, property value, and flood history | Based on liability exposure, past claims, business type |

| Claims Process | Event-based, requires damage verification post-flood | Requires investigation, legal review, and settlement processes |

| Regulatory Compliance | Subject to federal flood insurance regulations | Subject to state liability insurance laws and regulations |

Which is better?

Flood insurance integration offers critical protection against water damage risks specific to geographic flood zones, making it essential for properties in high-risk areas. Liability insurance integration provides coverage against legal claims and financial losses arising from bodily injury or property damage caused by insured parties. Choosing between the two depends on the property's risk profile and the nature of potential exposures, with flood insurance focusing on environmental hazards and liability insurance addressing third-party legal responsibilities.

Connection

Flood insurance integration and liability insurance integration are connected through their shared goal of comprehensive risk management for property and asset protection. Both types of insurance work together to cover a wide range of potential damages, including natural disasters like floods and legal responsibilities arising from accidents or negligence. Effective integration ensures seamless claims processing, reducing gaps in coverage and enhancing financial security for individuals and businesses.

Key Terms

Coverage Scope

Liability insurance integration primarily covers legal responsibilities arising from bodily injury or property damage caused to third parties, while flood insurance integration specifically protects against damages due to flooding events, typically excluded from standard policies. The coverage scope of liability insurance involves third-party claims and legal defense costs, whereas flood insurance addresses physical property damage and associated losses from flooding. Explore further to understand how nuanced coverage scopes impact insurance integration strategies.

Risk Assessment

Liability insurance integration emphasizes evaluating legal and financial risks linked to third-party claims, focusing on assessing potential damages from bodily injury or property damage liabilities. Flood insurance integration centers on hydrological and meteorological data analysis to predict flood zones and estimated property loss, prioritizing environmental risk factors. Explore further to understand how tailored risk assessment models optimize each insurance type's integration for comprehensive protection.

Policy Exclusions

Liability insurance integration primarily addresses coverage gaps related to legal responsibilities and damages resulting from negligence or accidents, with policy exclusions often including intentional acts, contractual liabilities, and certain types of property damage. Flood insurance integration focuses on safeguarding against water damage from flooding events, with exclusions typically encompassing sewer backups, gradual water damage, and damages occurring outside designated flood zones. Explore the specific policy exclusion nuances to optimize your insurance integration strategy.

Source and External Links

Integrated Management Liability - Harvard's integrated management liability insurance program combines various coverages, including errors & omissions (E&O), into a single policy to protect the university from multiple liability exposures efficiently and at a lower cost.

Control System Integrator Insurance Quotes - Insureon - System integration insurance covers liability risks such as legal fees, medical bills, and property damage, including general liability and errors and omissions insurance for professional services related to system integration.

Structuring Professional Liability Insurance for Integrated Project Delivery - Professional liability insurance is critical for integrated project delivery (IPD) projects to manage risks from design errors or omissions that could cause significant delays and cost overruns, aligning insurance coverage with IPD goals of collaboration and coordination.

dowidth.com

dowidth.com