Digital health insurance leverages advanced technology to offer personalized plans, seamless claims processing, and 24/7 virtual care access, contrasting with traditional health insurance's reliance on in-person support and paper-based processes. The integration of AI and data analytics in digital plans enhances risk assessment and customer experience, while traditional insurance often faces challenges with efficiency and transparency. Explore how digital health insurance is transforming coverage options and patient engagement in the healthcare industry.

Why it is important

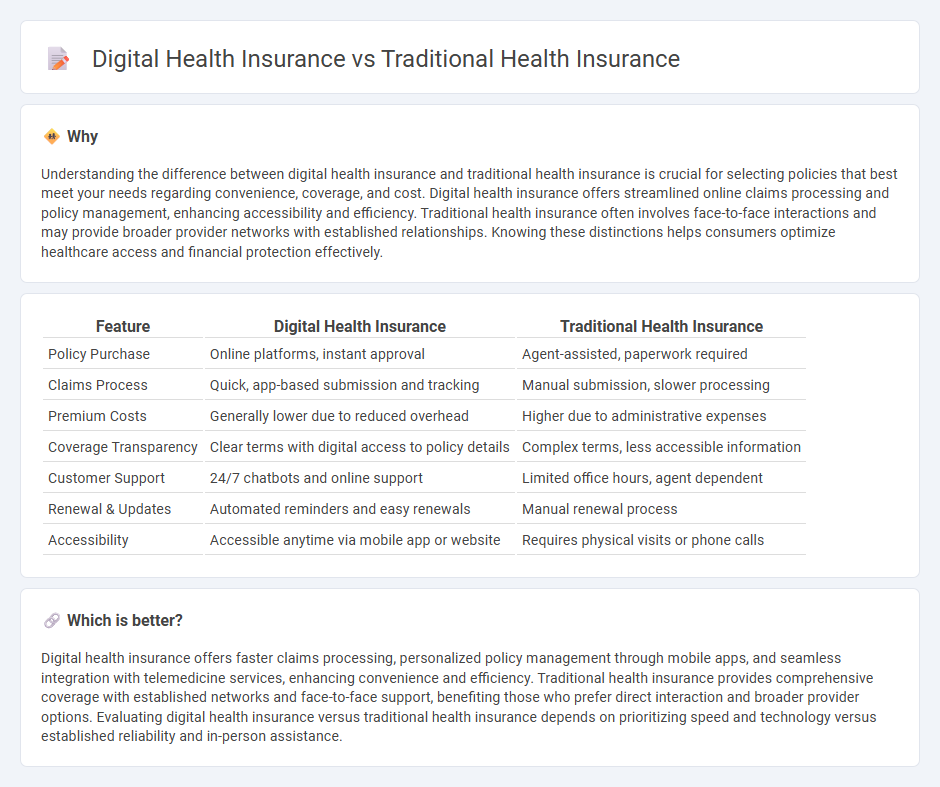

Understanding the difference between digital health insurance and traditional health insurance is crucial for selecting policies that best meet your needs regarding convenience, coverage, and cost. Digital health insurance offers streamlined online claims processing and policy management, enhancing accessibility and efficiency. Traditional health insurance often involves face-to-face interactions and may provide broader provider networks with established relationships. Knowing these distinctions helps consumers optimize healthcare access and financial protection effectively.

Comparison Table

| Feature | Digital Health Insurance | Traditional Health Insurance |

|---|---|---|

| Policy Purchase | Online platforms, instant approval | Agent-assisted, paperwork required |

| Claims Process | Quick, app-based submission and tracking | Manual submission, slower processing |

| Premium Costs | Generally lower due to reduced overhead | Higher due to administrative expenses |

| Coverage Transparency | Clear terms with digital access to policy details | Complex terms, less accessible information |

| Customer Support | 24/7 chatbots and online support | Limited office hours, agent dependent |

| Renewal & Updates | Automated reminders and easy renewals | Manual renewal process |

| Accessibility | Accessible anytime via mobile app or website | Requires physical visits or phone calls |

Which is better?

Digital health insurance offers faster claims processing, personalized policy management through mobile apps, and seamless integration with telemedicine services, enhancing convenience and efficiency. Traditional health insurance provides comprehensive coverage with established networks and face-to-face support, benefiting those who prefer direct interaction and broader provider options. Evaluating digital health insurance versus traditional health insurance depends on prioritizing speed and technology versus established reliability and in-person assistance.

Connection

Digital health insurance integrates advanced technology to streamline claims processing, policy management, and customer service, enhancing the traditional health insurance framework. Both forms rely on risk assessment, premium collection, and coverage provisions, with digital platforms enabling real-time data analytics and personalized insurance plans. This convergence improves efficiency, reduces administrative costs, and offers consumers easier access to comprehensive health coverage solutions.

Key Terms

Paper-based Claims

Traditional health insurance relies heavily on paper-based claims, requiring manual form submissions, physical document storage, and longer processing times, often leading to delayed reimbursements and higher administrative costs. Digital health insurance streamlines claims through electronic submissions, automated verification, and faster claim settlements, reducing errors and enhancing policyholder convenience. Explore how shifting from paper to digital claims can transform your insurance experience.

Telemedicine

Traditional health insurance often requires in-person visits and may have limited coverage for telemedicine services, whereas digital health insurance typically integrates telehealth options, offering instant access to healthcare professionals via smartphones or computers. Digital plans enhance convenience and reduce costs by allowing virtual consultations, prescriptions, and follow-ups without geographic or time constraints. Explore how digital health insurance can transform your healthcare experience with seamless telemedicine access.

Mobile App Integration

Traditional health insurance often relies on paperwork and in-person processes, limiting real-time access to policy details and claims. Digital health insurance leverages mobile app integration to provide instant access, seamless claims submission, and personalized health management tools. Explore how mobile apps are transforming insurance experiences and improving healthcare outcomes.

Source and External Links

What is the difference between traditional health insurance and healthcare sharing ministries? - This webpage explains the differences between traditional health insurance, which involves a contractual agreement with an insurance company, and healthcare sharing ministries, which are faith-based organizations where members share medical expenses.

Traditional vs Managed Care - This webpage discusses traditional health insurance, which allows individuals to select their healthcare providers without restrictions, compared to managed care, which may restrict provider choice but often costs less.

Traditional Indemnity Insurance Plans - This webpage describes traditional indemnity insurance plans, which reimburse patients for medical expenses based on usual, customary, and reasonable fees without restrictions on provider choice.

dowidth.com

dowidth.com