Invisible insurance seamlessly integrates coverage into everyday purchases and services, offering protection without disrupting the customer experience. Digital insurance utilizes advanced technology platforms to provide quick policy access, personalized plans, and streamlined claims processing. Explore the future of insurance by understanding the benefits and differences between invisible and digital insurance solutions.

Why it is important

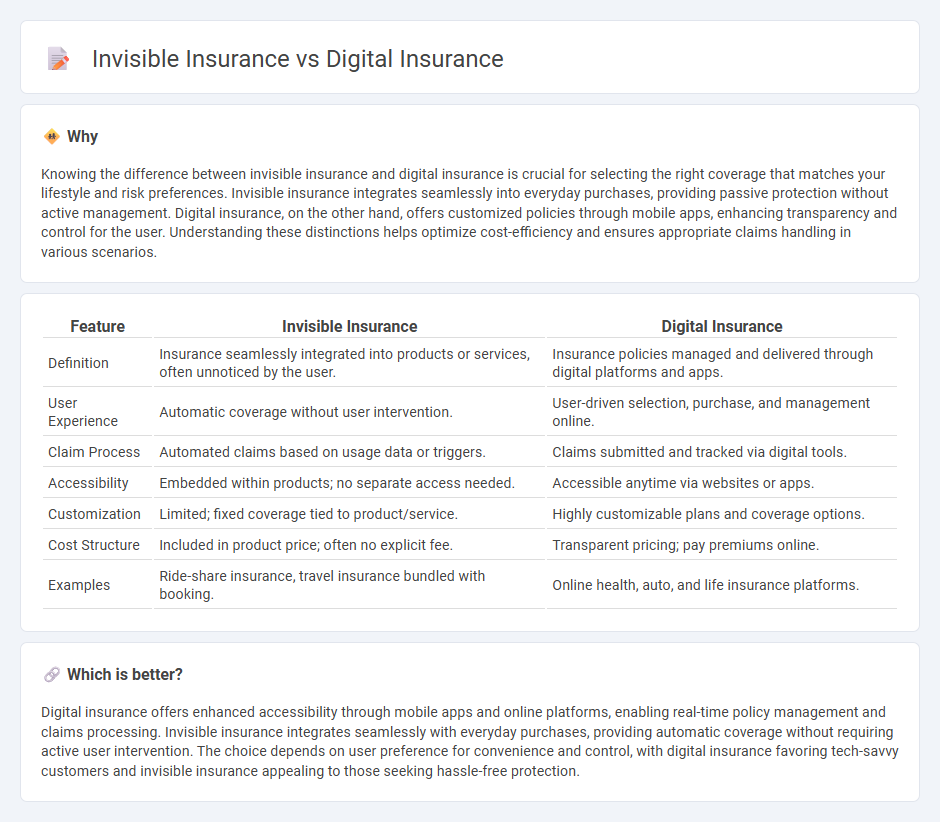

Knowing the difference between invisible insurance and digital insurance is crucial for selecting the right coverage that matches your lifestyle and risk preferences. Invisible insurance integrates seamlessly into everyday purchases, providing passive protection without active management. Digital insurance, on the other hand, offers customized policies through mobile apps, enhancing transparency and control for the user. Understanding these distinctions helps optimize cost-efficiency and ensures appropriate claims handling in various scenarios.

Comparison Table

| Feature | Invisible Insurance | Digital Insurance |

|---|---|---|

| Definition | Insurance seamlessly integrated into products or services, often unnoticed by the user. | Insurance policies managed and delivered through digital platforms and apps. |

| User Experience | Automatic coverage without user intervention. | User-driven selection, purchase, and management online. |

| Claim Process | Automated claims based on usage data or triggers. | Claims submitted and tracked via digital tools. |

| Accessibility | Embedded within products; no separate access needed. | Accessible anytime via websites or apps. |

| Customization | Limited; fixed coverage tied to product/service. | Highly customizable plans and coverage options. |

| Cost Structure | Included in product price; often no explicit fee. | Transparent pricing; pay premiums online. |

| Examples | Ride-share insurance, travel insurance bundled with booking. | Online health, auto, and life insurance platforms. |

Which is better?

Digital insurance offers enhanced accessibility through mobile apps and online platforms, enabling real-time policy management and claims processing. Invisible insurance integrates seamlessly with everyday purchases, providing automatic coverage without requiring active user intervention. The choice depends on user preference for convenience and control, with digital insurance favoring tech-savvy customers and invisible insurance appealing to those seeking hassle-free protection.

Connection

Invisible insurance integrates seamlessly into everyday digital transactions, offering automatic coverage without explicit user actions, while digital insurance leverages technology platforms for streamlined policy management and claims processing. Both concepts rely heavily on advanced data analytics, APIs, and IoT devices to deliver personalized, real-time insurance solutions. This synergy enhances customer experience by providing unobtrusive protection alongside efficient, tech-driven service delivery.

Key Terms

Digital Platforms

Digital insurance leverages advanced digital platforms to offer seamless policy management, real-time claims processing, and personalized customer experiences through AI and big data analytics. Invisible insurance integrates coverage into everyday digital services and transactions, providing users with automatic, context-aware protection without explicit purchase or interaction. Explore the evolving landscape of digital and invisible insurance platforms to understand their impact on customer engagement and risk management.

Embedded Coverage

Embedded coverage revolutionizes digital insurance by seamlessly integrating protection within everyday services, enhancing customer convenience and reducing friction in claims processing. Unlike traditional digital insurance platforms requiring separate apps or portals, invisible insurance operates subtly in the background, ensuring continuous risk management without consumer intervention. Discover how embedded coverage transforms risk mitigation and customer experience in modern insurance landscapes.

API Integration

Digital insurance leverages API integration to streamline policy management, claims processing, and customer interactions, enhancing efficiency and user experience through real-time data exchange. Invisible insurance embeds coverage seamlessly into everyday transactions via APIs, providing a frictionless, automatic protection layer without direct consumer intervention. Discover how API-driven innovations transform insurance delivery by exploring the key differences and benefits of digital versus invisible insurance models.

Source and External Links

What is Digital Insurance? - Tibco - Digital insurance is a technology-driven insurance model focusing on customer-first service with omni-channel presence, automating pricing, risk, and claims through connected software platforms, offering speed, agility, and personalized user experience.

Digital insurance in 2018 - McKinsey - Digital insurance integrates AI and analytics to digitize claims from notification to settlement, improving customer experiences with automated, real-time claims handling and prevention services.

A Guide to Digital Insurance - Hitachi Solutions - Digital insurance encompasses technology-first business models for selling and managing policies with a focus on instant, personalized customer service, faster market delivery, and capabilities like AI-driven fraud detection.

dowidth.com

dowidth.com