An insurance sandbox is a regulatory framework that allows insurers and startups to test innovative products, services, or business models in a real market environment with relaxed compliance requirements. In contrast, a controlled environment is a restricted setting where insurers can develop and trial solutions internally, minimizing market risk and exposure. Explore the key differences and benefits of insurance sandboxes versus controlled environments to optimize your innovation strategy.

Why it is important

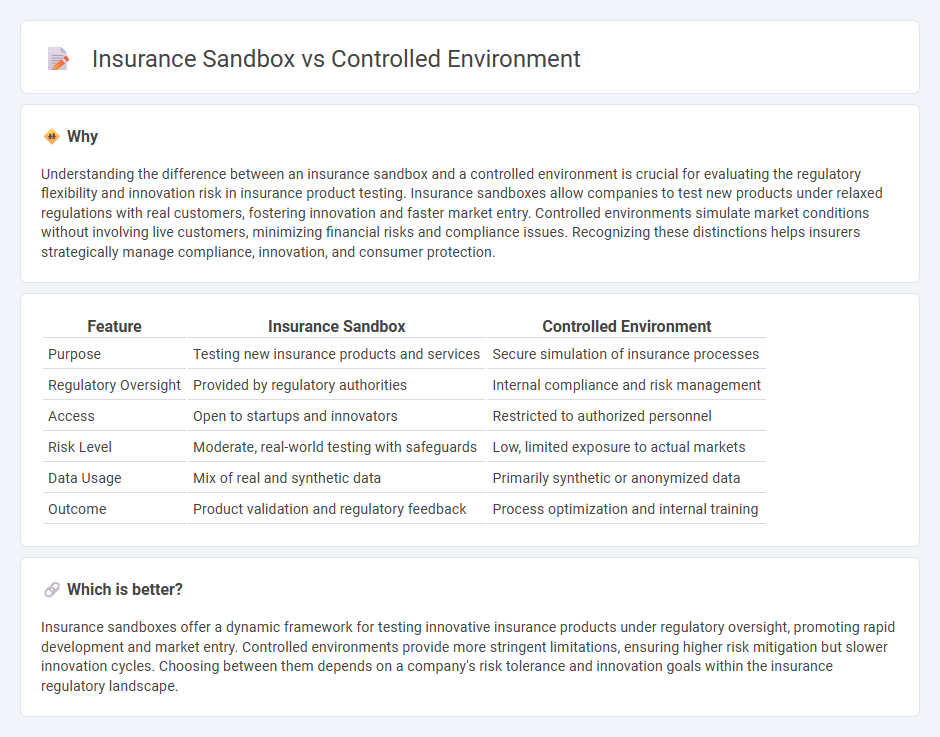

Understanding the difference between an insurance sandbox and a controlled environment is crucial for evaluating the regulatory flexibility and innovation risk in insurance product testing. Insurance sandboxes allow companies to test new products under relaxed regulations with real customers, fostering innovation and faster market entry. Controlled environments simulate market conditions without involving live customers, minimizing financial risks and compliance issues. Recognizing these distinctions helps insurers strategically manage compliance, innovation, and consumer protection.

Comparison Table

| Feature | Insurance Sandbox | Controlled Environment |

|---|---|---|

| Purpose | Testing new insurance products and services | Secure simulation of insurance processes |

| Regulatory Oversight | Provided by regulatory authorities | Internal compliance and risk management |

| Access | Open to startups and innovators | Restricted to authorized personnel |

| Risk Level | Moderate, real-world testing with safeguards | Low, limited exposure to actual markets |

| Data Usage | Mix of real and synthetic data | Primarily synthetic or anonymized data |

| Outcome | Product validation and regulatory feedback | Process optimization and internal training |

Which is better?

Insurance sandboxes offer a dynamic framework for testing innovative insurance products under regulatory oversight, promoting rapid development and market entry. Controlled environments provide more stringent limitations, ensuring higher risk mitigation but slower innovation cycles. Choosing between them depends on a company's risk tolerance and innovation goals within the insurance regulatory landscape.

Connection

Insurance sandboxes provide a controlled environment where insurers, regulators, and innovators can test new products, technologies, and business models under real-world conditions without full regulatory compliance. This controlled setting allows for experimentation with reduced risk, fostering innovation while ensuring consumer protection and regulatory oversight. The connection lies in the sandbox's role as a structured, monitored space designed specifically to balance innovation acceleration with regulatory safety in the insurance industry.

Key Terms

Regulatory Oversight

Controlled environments provide regulators with direct oversight by creating predefined conditions where financial services can operate under strict monitoring to ensure compliance with existing laws. Insurance sandboxes offer a more flexible, experimental framework allowing insurers to test innovative products and business models with regulatory support but limited real-world exposure. Explore how these two approaches balance innovation and risk management in regulatory environments.

Innovation Testing

Controlled environments provide regulated spaces where companies can test innovative products under strict oversight, ensuring compliance and risk mitigation. Insurance sandboxes offer tailored frameworks that promote rapid experimentation with new insurance models, accelerating digital transformation while safeguarding consumer interests. Explore how these innovation testing approaches shape the future of insurance by enabling safe market entry and fostering disruptive technologies.

Risk Containment

Controlled environments provide a regulated setting where financial technology firms can test innovations with strict oversight to minimize operational and compliance risks, ensuring real-world impact is contained. Insurance sandboxes offer a specialized framework for insurers to trial new products and services under relaxed regulatory requirements while managing underwriting, claims, and fraud risks within predefined boundaries. Explore how these approaches optimize risk containment and drive innovation in the insurance industry.

Source and External Links

What Is A Controlled Environment? - An enclosed area where specific parameters like temperature, pressure, light, and airflow are regulated to meet the needs of research or production, without necessarily adhering to strict particle contamination standards.

Controlled Environment - A deliberately isolated space where environmental factors such as temperature, humidity, light, air composition, and pressure are meticulously maintained within set limits to achieve a desired outcome, separate from external conditions.

What is a Controlled Environment? Understanding the Basics - An enclosed space where conditions like air temperature, humidity, particle levels, and light are managed, covering a broad range of settings beyond just cleanrooms, which have stricter particle control requirements.

dowidth.com

dowidth.com