Gig worker insurance offers tailored coverage that addresses the unique risks and income variability faced by freelancers and independent contractors. Public health insurance typically provides broader, government-funded access to healthcare services but may lack the flexibility or specific protections needed for gig economy workers. Explore the key differences and find the best insurance solution for your gig work lifestyle.

Why it is important

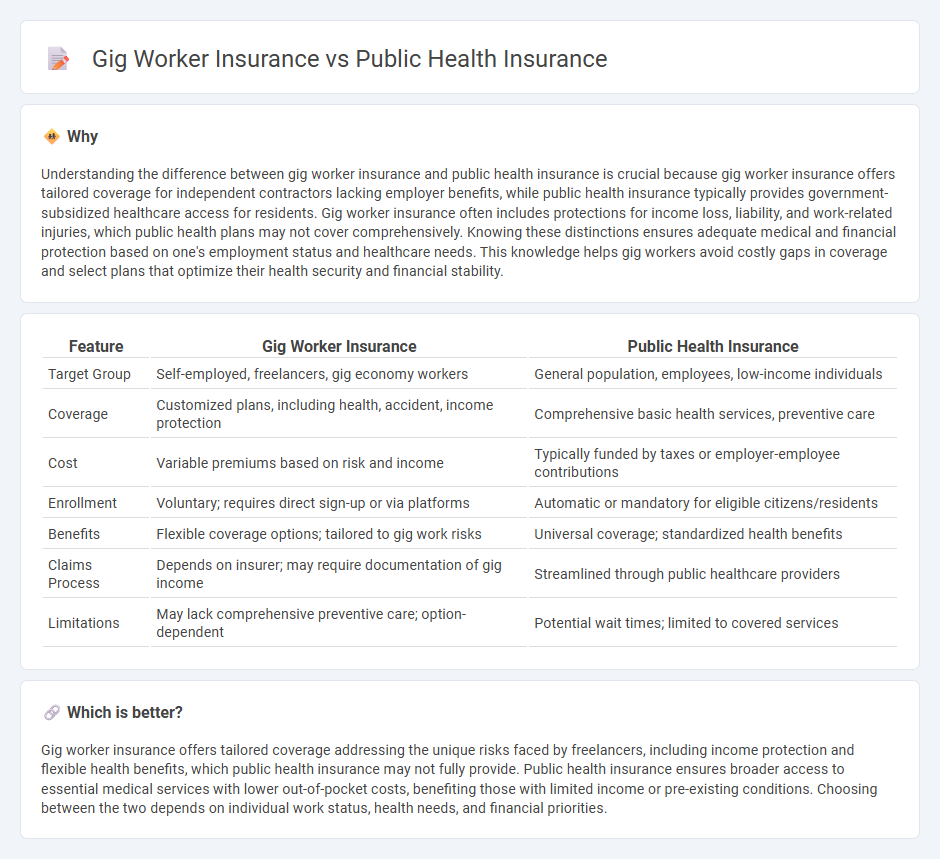

Understanding the difference between gig worker insurance and public health insurance is crucial because gig worker insurance offers tailored coverage for independent contractors lacking employer benefits, while public health insurance typically provides government-subsidized healthcare access for residents. Gig worker insurance often includes protections for income loss, liability, and work-related injuries, which public health plans may not cover comprehensively. Knowing these distinctions ensures adequate medical and financial protection based on one's employment status and healthcare needs. This knowledge helps gig workers avoid costly gaps in coverage and select plans that optimize their health security and financial stability.

Comparison Table

| Feature | Gig Worker Insurance | Public Health Insurance |

|---|---|---|

| Target Group | Self-employed, freelancers, gig economy workers | General population, employees, low-income individuals |

| Coverage | Customized plans, including health, accident, income protection | Comprehensive basic health services, preventive care |

| Cost | Variable premiums based on risk and income | Typically funded by taxes or employer-employee contributions |

| Enrollment | Voluntary; requires direct sign-up or via platforms | Automatic or mandatory for eligible citizens/residents |

| Benefits | Flexible coverage options; tailored to gig work risks | Universal coverage; standardized health benefits |

| Claims Process | Depends on insurer; may require documentation of gig income | Streamlined through public healthcare providers |

| Limitations | May lack comprehensive preventive care; option-dependent | Potential wait times; limited to covered services |

Which is better?

Gig worker insurance offers tailored coverage addressing the unique risks faced by freelancers, including income protection and flexible health benefits, which public health insurance may not fully provide. Public health insurance ensures broader access to essential medical services with lower out-of-pocket costs, benefiting those with limited income or pre-existing conditions. Choosing between the two depends on individual work status, health needs, and financial priorities.

Connection

Gig worker insurance often provides coverage tailored to independent contractors lacking traditional employee benefits, while public health insurance programs like Medicaid extend essential access to healthcare for low-income or uninsured gig workers. Both systems address coverage gaps by offering affordable or subsidized options to protect gig workers from medical expenses and income loss due to illness or injury. Coordination between gig worker insurance schemes and public health insurance ensures comprehensive support, reducing financial vulnerability in the growing gig economy.

Key Terms

**Public Health Insurance:**

Public Health Insurance offers comprehensive coverage including preventive care, hospitalization, and chronic disease management, often with lower premiums subsidized by government programs. It guarantees access to a wide network of healthcare providers and covers essential medical services critical for maintaining public health standards. Explore how Public Health Insurance compares to gig worker insurance options to determine the best fit for your healthcare needs.

Universal Coverage

Public health insurance aims to provide universal coverage by offering affordable healthcare access to all citizens regardless of employment status, ensuring gig workers are not excluded from essential medical benefits. Gig worker insurance often lacks comprehensive coverage and affordability, leaving many independent contractors vulnerable to high out-of-pocket costs and limited preventive care. Explore more about how universal coverage models can bridge gaps between public health insurance and gig worker needs.

Government Funding

Government funding for public health insurance primarily originates from taxpayer dollars and federal programs such as Medicaid and Medicare, ensuring broad coverage for low-income families, seniors, and individuals with disabilities. Gig worker insurance often relies on specialized government initiatives and subsidies aimed at extending coverage to independent contractors, who typically lack access to employer-sponsored plans. Explore how these funding models impact coverage options and affordability for gig economy participants.

Source and External Links

Public health insurance option - Wikipedia - Proposes a government-run health insurance agency to compete with private insurers in the U.S.

Health Insurance - How it Works - Explains ways to get health insurance, including through public programs like Medicaid and Medicare.

Health insurance | USAGov - Provides information on public health insurance programs such as Medicaid, Medicare, and the ACA Marketplace.

dowidth.com

dowidth.com