Pet insurance platforms specialize in coverage plans that protect against veterinary expenses, including accidents, illnesses, and routine care for animals, while disability insurance platforms focus on providing income protection benefits to individuals unable to work due to injury or illness. Pet insurance appeals mainly to pet owners seeking financial support for pet healthcare, whereas disability insurance targets wage earners aiming to maintain financial stability during periods of disability. Explore more to understand the unique benefits and options each insurance platform offers.

Why it is important

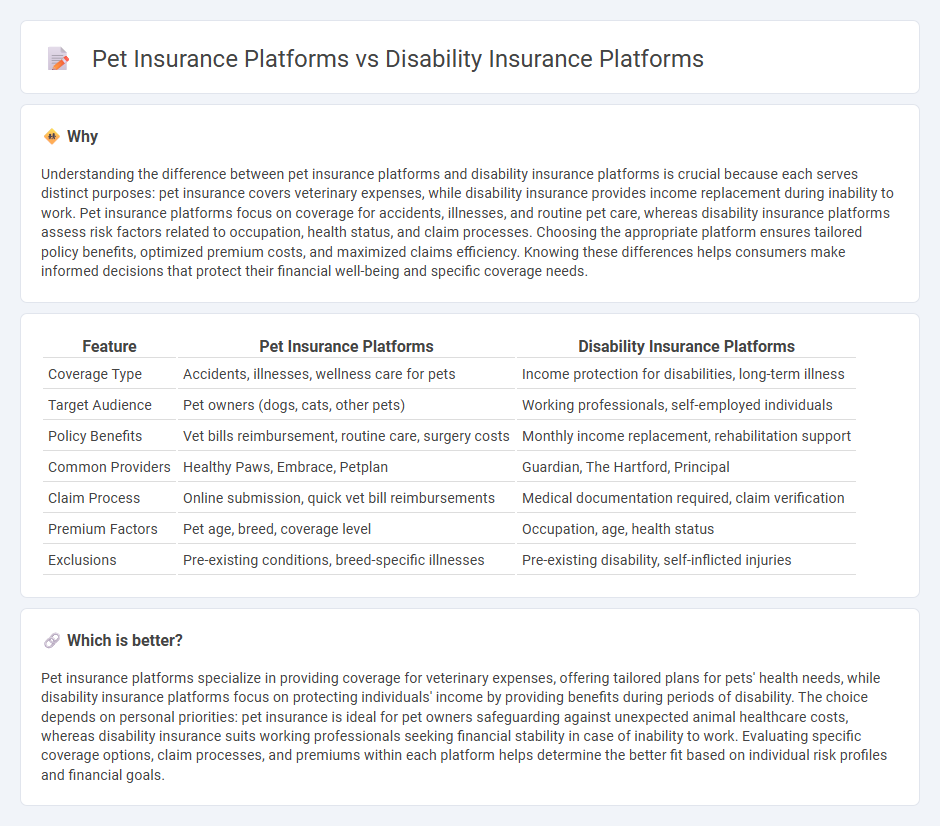

Understanding the difference between pet insurance platforms and disability insurance platforms is crucial because each serves distinct purposes: pet insurance covers veterinary expenses, while disability insurance provides income replacement during inability to work. Pet insurance platforms focus on coverage for accidents, illnesses, and routine pet care, whereas disability insurance platforms assess risk factors related to occupation, health status, and claim processes. Choosing the appropriate platform ensures tailored policy benefits, optimized premium costs, and maximized claims efficiency. Knowing these differences helps consumers make informed decisions that protect their financial well-being and specific coverage needs.

Comparison Table

| Feature | Pet Insurance Platforms | Disability Insurance Platforms |

|---|---|---|

| Coverage Type | Accidents, illnesses, wellness care for pets | Income protection for disabilities, long-term illness |

| Target Audience | Pet owners (dogs, cats, other pets) | Working professionals, self-employed individuals |

| Policy Benefits | Vet bills reimbursement, routine care, surgery costs | Monthly income replacement, rehabilitation support |

| Common Providers | Healthy Paws, Embrace, Petplan | Guardian, The Hartford, Principal |

| Claim Process | Online submission, quick vet bill reimbursements | Medical documentation required, claim verification |

| Premium Factors | Pet age, breed, coverage level | Occupation, age, health status |

| Exclusions | Pre-existing conditions, breed-specific illnesses | Pre-existing disability, self-inflicted injuries |

Which is better?

Pet insurance platforms specialize in providing coverage for veterinary expenses, offering tailored plans for pets' health needs, while disability insurance platforms focus on protecting individuals' income by providing benefits during periods of disability. The choice depends on personal priorities: pet insurance is ideal for pet owners safeguarding against unexpected animal healthcare costs, whereas disability insurance suits working professionals seeking financial stability in case of inability to work. Evaluating specific coverage options, claim processes, and premiums within each platform helps determine the better fit based on individual risk profiles and financial goals.

Connection

Pet insurance platforms and disability insurance platforms share a focus on risk management and financial protection for unforeseen circumstances affecting individuals and their dependents. Both types of platforms utilize data analytics, customer profiling, and digital claims processing to enhance user experience and streamline coverage options. Integration between these platforms is emerging, offering bundled policies that cater to comprehensive personal and family well-being.

Key Terms

**Disability Insurance Platforms:**

Disability insurance platforms specialize in providing tailored coverage options that protect individuals' income in case of injury or illness, leveraging advanced algorithms to streamline claims processing and policy management. These platforms often integrate real-time risk assessment tools and offer customizable plans to meet diverse professional and personal needs. Explore our detailed comparison to better understand the unique features and benefits of top disability insurance platforms.

Elimination Period

Disability insurance platforms typically feature elimination periods ranging from 30 to 180 days, designed to ensure claimants are unable to work before benefits begin, whereas pet insurance platforms usually do not have elimination periods, allowing coverage to start immediately after policy activation. The elimination period in disability insurance impacts premium costs and waiting times for claim payouts, while the absence of such a period in pet insurance offers quicker access to veterinary claim reimbursements. Explore the differences in insurance platform policies and their impact on coverage timing for a deeper understanding.

Benefit Amount

Disability insurance platforms typically offer benefit amounts based on a percentage of the policyholder's income, often ranging from 50% to 70%, designed to replace lost wages during periods of incapacitation. Pet insurance platforms, on the other hand, provide benefit amounts that cover veterinary expenses, including treatments, surgeries, and medications, with limits varying widely depending on the plan, often capped annually or per condition. Explore the differences in benefit structures and coverage limits to understand which insurance platform best suits your needs.

Source and External Links

Guardian Life - Offers affordable individual and group long-term disability insurance plans, including customizable options for the self-employed and those seeking to supplement workplace coverage.

The Standard - Provides workplace disability insurance that replaces a portion of your income during disability, with features like partial benefit payments after returning to work and resumption of benefits without a new waiting period for recurring disabilities.

MetLife - Delivers group disability insurance through employers, featuring online claim submission, claim tracking, and absence management services, with support for both short- and long-term disability needs.

dowidth.com

dowidth.com