Pay-as-you-drive insurance calculates premiums based on actual miles driven, offering personalized cost savings and promoting safer driving habits. Third-party insurance covers damages or injuries caused to others, fulfilling legal requirements but not protecting the policyholder's own vehicle. Explore more to determine which insurance type best suits your driving needs and budget.

Why it is important

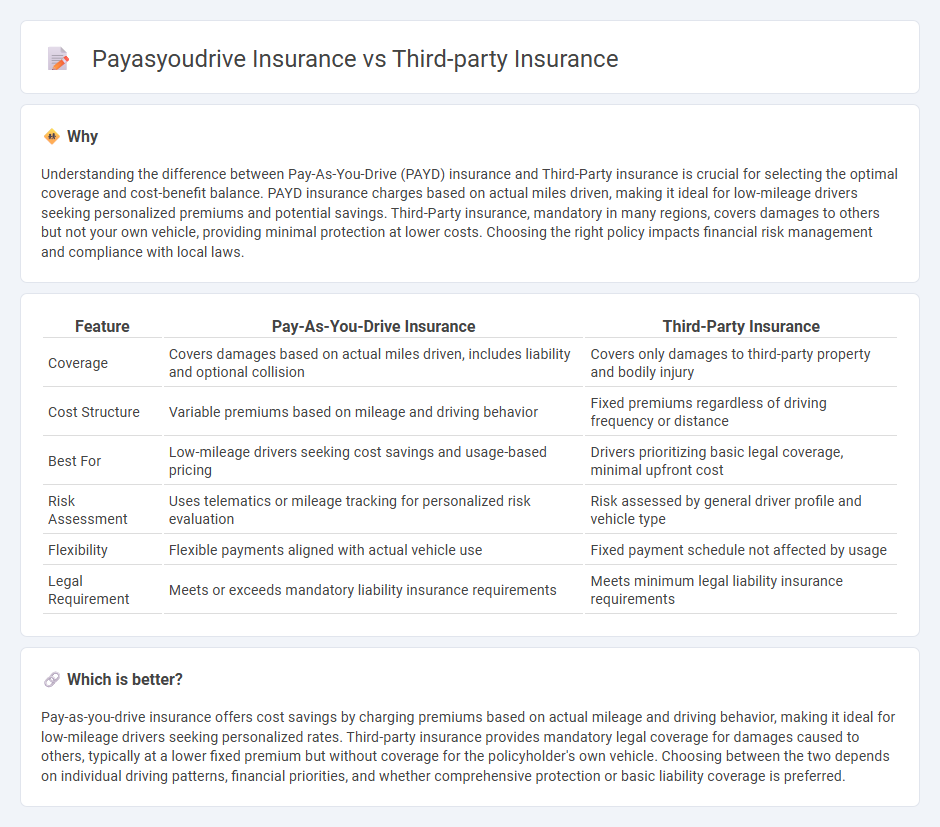

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Third-Party insurance is crucial for selecting the optimal coverage and cost-benefit balance. PAYD insurance charges based on actual miles driven, making it ideal for low-mileage drivers seeking personalized premiums and potential savings. Third-Party insurance, mandatory in many regions, covers damages to others but not your own vehicle, providing minimal protection at lower costs. Choosing the right policy impacts financial risk management and compliance with local laws.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Third-Party Insurance |

|---|---|---|

| Coverage | Covers damages based on actual miles driven, includes liability and optional collision | Covers only damages to third-party property and bodily injury |

| Cost Structure | Variable premiums based on mileage and driving behavior | Fixed premiums regardless of driving frequency or distance |

| Best For | Low-mileage drivers seeking cost savings and usage-based pricing | Drivers prioritizing basic legal coverage, minimal upfront cost |

| Risk Assessment | Uses telematics or mileage tracking for personalized risk evaluation | Risk assessed by general driver profile and vehicle type |

| Flexibility | Flexible payments aligned with actual vehicle use | Fixed payment schedule not affected by usage |

| Legal Requirement | Meets or exceeds mandatory liability insurance requirements | Meets minimum legal liability insurance requirements |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual mileage and driving behavior, making it ideal for low-mileage drivers seeking personalized rates. Third-party insurance provides mandatory legal coverage for damages caused to others, typically at a lower fixed premium but without coverage for the policyholder's own vehicle. Choosing between the two depends on individual driving patterns, financial priorities, and whether comprehensive protection or basic liability coverage is preferred.

Connection

Pay-as-you-drive insurance links directly to third-party insurance by providing coverage tailored to actual road usage, which typically includes mandatory third-party liability protection. This model enables policyholders to pay premiums based on miles driven while ensuring compliance with legal requirements for third-party injury and property damage. The integration optimizes cost efficiency for drivers and enhances insurance accessibility by aligning premium costs with individual driving habits.

Key Terms

Liability Coverage

Third-party insurance primarily covers liability for damages or injuries caused to others in the event of an accident, protecting the insured from financial loss due to legal claims. Pay-as-you-drive (PAYD) insurance offers a similar liability coverage structure but adjusts premiums based on actual driving behavior, mileage, and risk assessment, promoting cost-efficiency and personalized pricing. Explore how these insurance models differ in protecting your financial responsibilities and optimizing your coverage.

Usage-based Premiums

Third-party insurance typically offers fixed premiums based on broad risk factors, while pay-as-you-drive (PAYD) insurance calculates premiums dynamically according to actual driving behavior and mileage, leveraging telematics data. PAYD models promote cost efficiency and risk sensitivity by charging drivers only for the miles driven, encouraging safer driving habits and reducing unnecessary expenses. Explore the advantages of usage-based premiums to see which insurance model aligns best with your lifestyle and budget.

Telematics

Third-party insurance typically covers damages to others and their property, whereas pay-as-you-drive insurance uses telematics technology to monitor driving behavior and mileage, offering personalized premiums based on actual risk. Telematics devices collect data such as speed, braking patterns, and distance traveled, leading to potentially significant cost savings for cautious drivers. Discover how telematics can revolutionize your insurance costs and coverage options.

Source and External Links

First-Party Coverage vs. Third-Party Coverage - This webpage explains the difference between first-party and third-party insurance, highlighting that third-party coverage protects against losses for which the policyholder is liable to others.

What is Third-Party Liability Insurance? - This article discusses third-party insurance, focusing on its role in protecting businesses from third-party claims and financial burdens.

What is Third Party Liability Insurance? - This webpage provides an overview of third-party liability insurance, covering damages or injuries to others for which the policyholder is responsible.

dowidth.com

dowidth.com