Digital health insurance leverages technology to provide streamlined access to medical coverage, offering personalized plans, real-time claims processing, and telehealth services. Microinsurance targets low-income populations by offering affordable, low-premium policies that cover specific risks like illness or accident, particularly in emerging markets. Discover how these innovative insurance models are transforming healthcare accessibility worldwide.

Why it is important

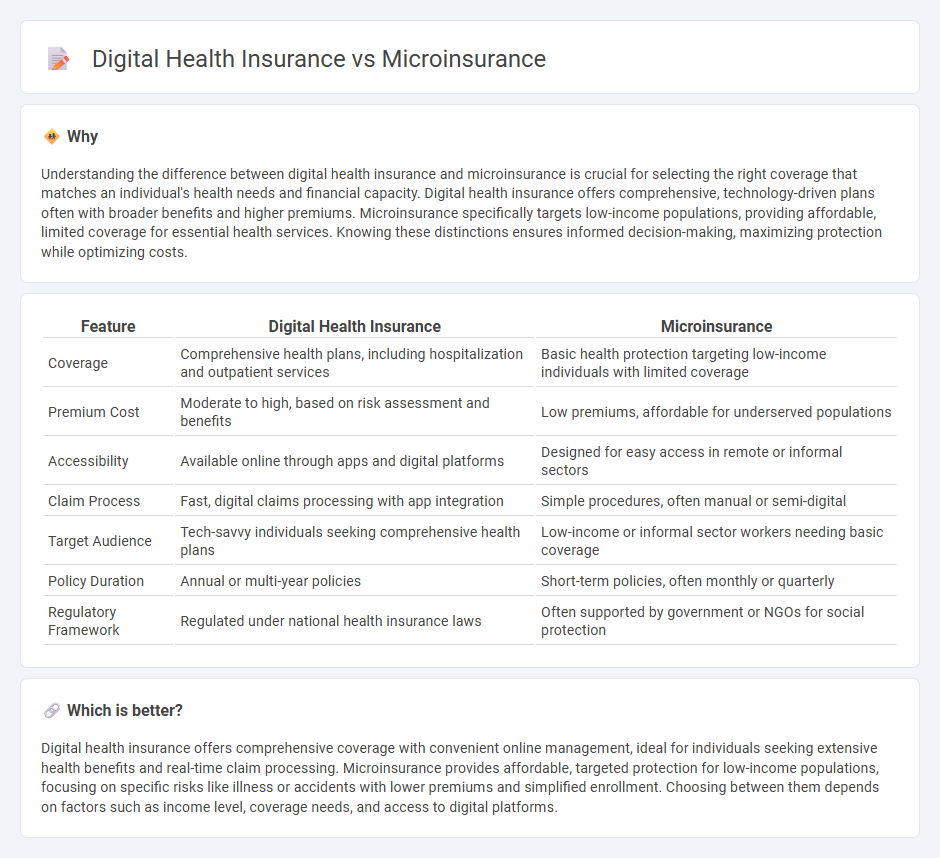

Understanding the difference between digital health insurance and microinsurance is crucial for selecting the right coverage that matches an individual's health needs and financial capacity. Digital health insurance offers comprehensive, technology-driven plans often with broader benefits and higher premiums. Microinsurance specifically targets low-income populations, providing affordable, limited coverage for essential health services. Knowing these distinctions ensures informed decision-making, maximizing protection while optimizing costs.

Comparison Table

| Feature | Digital Health Insurance | Microinsurance |

|---|---|---|

| Coverage | Comprehensive health plans, including hospitalization and outpatient services | Basic health protection targeting low-income individuals with limited coverage |

| Premium Cost | Moderate to high, based on risk assessment and benefits | Low premiums, affordable for underserved populations |

| Accessibility | Available online through apps and digital platforms | Designed for easy access in remote or informal sectors |

| Claim Process | Fast, digital claims processing with app integration | Simple procedures, often manual or semi-digital |

| Target Audience | Tech-savvy individuals seeking comprehensive health plans | Low-income or informal sector workers needing basic coverage |

| Policy Duration | Annual or multi-year policies | Short-term policies, often monthly or quarterly |

| Regulatory Framework | Regulated under national health insurance laws | Often supported by government or NGOs for social protection |

Which is better?

Digital health insurance offers comprehensive coverage with convenient online management, ideal for individuals seeking extensive health benefits and real-time claim processing. Microinsurance provides affordable, targeted protection for low-income populations, focusing on specific risks like illness or accidents with lower premiums and simplified enrollment. Choosing between them depends on factors such as income level, coverage needs, and access to digital platforms.

Connection

Digital health insurance leverages technology to provide accessible and affordable coverage, enabling microinsurance models to target low-income populations with tailored, small-scale policies. Microinsurance relies on digital platforms for seamless enrollment, claims processing, and customer engagement, enhancing efficiency and scalability in underserved markets. The integration of digital tools and microinsurance frameworks ensures inclusive health coverage by reducing administrative costs and improving risk assessment through data analytics.

Key Terms

**Microinsurance:**

Microinsurance provides affordable coverage tailored to low-income individuals, focusing on essential health, life, and property risks with simplified policies and quick claim settlements. It leverages community-based distribution and minimal premiums to increase accessibility among underserved populations. Explore more to understand how microinsurance bridges the protection gap for vulnerable segments.

Affordability

Microinsurance offers affordable coverage by targeting low-income populations with low premiums and simplified products, ensuring accessibility for the financially vulnerable. Digital health insurance leverages technology to reduce administrative costs and streamline claims processing, enabling cost-effective plans with enhanced user experience. Explore the evolving landscape of affordable health coverage to find solutions tailored to your needs.

Accessibility

Microinsurance provides affordable coverage tailored for low-income populations, enhancing accessibility through simplified enrollment and minimal premiums. Digital health insurance leverages mobile technology and online platforms to offer instant access, streamlined claims, and personalized plans, improving accessibility for tech-savvy users. Explore how these innovative models are transforming insurance accessibility in underserved communities.

Source and External Links

Background on: microinsurance and emerging markets | III - Microinsurance provides low-cost insurance to individuals generally not covered by traditional insurance or government programs and is characterized by high volumes, low cost, and efficient administration, often distributed through microfinance and humanitarian organizations.

Microinsurance | Insurance | Milliman | Worldwide - Microinsurance is designed to be affordable and accessible for low-income individuals, covering risks that could lead them into poverty, with a focus on simple, understood, accessible, valuable, and efficient products.

Unlocking the Global Potential of Microinsurance and Life Insurance - Microinsurance is an emerging financial service aimed at protecting low-income households from financial shocks, leveraging mobile technology and partnerships with mobile operators to reduce costs and reach remote clients.

dowidth.com

dowidth.com