Digital nomad insurance provides tailored coverage for remote workers traveling internationally, including health, travel, and equipment protection. Working holiday insurance focuses on short-term coverage designed for temporary employment and travel-related risks in a specific country. Explore the key differences to choose the best insurance for your global lifestyle.

Why it is important

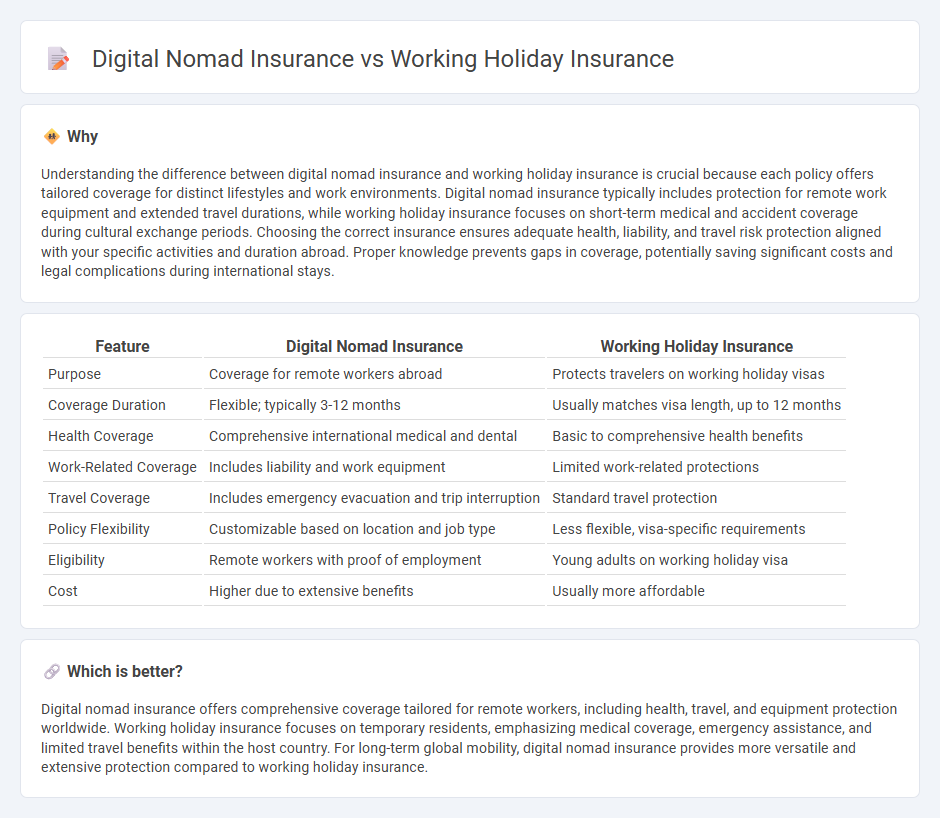

Understanding the difference between digital nomad insurance and working holiday insurance is crucial because each policy offers tailored coverage for distinct lifestyles and work environments. Digital nomad insurance typically includes protection for remote work equipment and extended travel durations, while working holiday insurance focuses on short-term medical and accident coverage during cultural exchange periods. Choosing the correct insurance ensures adequate health, liability, and travel risk protection aligned with your specific activities and duration abroad. Proper knowledge prevents gaps in coverage, potentially saving significant costs and legal complications during international stays.

Comparison Table

| Feature | Digital Nomad Insurance | Working Holiday Insurance |

|---|---|---|

| Purpose | Coverage for remote workers abroad | Protects travelers on working holiday visas |

| Coverage Duration | Flexible; typically 3-12 months | Usually matches visa length, up to 12 months |

| Health Coverage | Comprehensive international medical and dental | Basic to comprehensive health benefits |

| Work-Related Coverage | Includes liability and work equipment | Limited work-related protections |

| Travel Coverage | Includes emergency evacuation and trip interruption | Standard travel protection |

| Policy Flexibility | Customizable based on location and job type | Less flexible, visa-specific requirements |

| Eligibility | Remote workers with proof of employment | Young adults on working holiday visa |

| Cost | Higher due to extensive benefits | Usually more affordable |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for remote workers, including health, travel, and equipment protection worldwide. Working holiday insurance focuses on temporary residents, emphasizing medical coverage, emergency assistance, and limited travel benefits within the host country. For long-term global mobility, digital nomad insurance provides more versatile and extensive protection compared to working holiday insurance.

Connection

Digital nomad insurance and working holiday insurance both provide essential coverage tailored to individuals living and working abroad temporarily, focusing on health, travel, and liability protection. These policies often include emergency medical care, trip interruption, and personal belongings coverage, addressing the unique risks faced by mobile professionals and travelers. Their connection lies in supporting flexible, location-independent lifestyles with comprehensive insurance solutions that adapt to diverse international environments.

Key Terms

Trip Duration

Working holiday insurance typically covers short-term stays ranging from six months to one year, aligning with the duration of most working holiday visas. Digital nomad insurance caters to longer or flexible trip durations, often offering month-to-month plans that accommodate extended or indefinite remote work abroad. Explore our detailed guide to discover which insurance best suits your trip length and lifestyle.

Coverage Area

Working holiday insurance typically covers medical emergencies, trip cancellations, and limited personal liabilities within the host country, often excluding extended stays or remote work outside designated regions. Digital nomad insurance provides broader global coverage tailored to remote workers, including health, travel, and equipment protection across multiple countries. Explore detailed comparisons to choose the best insurance coverage for your lifestyle.

Employment Activities

Working holiday insurance specifically covers temporary employment and travel-related incidents during short-term stays abroad, often including health, accidental injury, and job loss protection. Digital nomad insurance offers comprehensive coverage tailored to remote workers, including professional liability, equipment protection, and extended health care for long-term global employment. Discover how each insurance type supports your unique work lifestyle and legal requirements by exploring detailed policy options.

Source and External Links

Working Holiday Travel - Go Walkabout - Offers comprehensive insurance coverage for working holidays, including medical costs and repatriation, suitable for various job roles while traveling abroad.

MyTravel Cover for WHPs - APRIL International - Provides health insurance for working holiday programs, covering emergency and accidents with flexible geographic coverage options.

Working holiday visa travel insurance - Avi-international - Offers full coverage for professional and manual activities during working holidays, including medical expenses and emergency evacuation.

dowidth.com

dowidth.com