Pay-as-you-drive insurance calculates premiums based on the actual miles driven, offering cost savings and personalized coverage for low-mileage drivers. Third-party car insurance provides basic protection against damages or injuries caused to others, typically required by law but lacking coverage for the insured's own vehicle. Explore the benefits and limitations of each insurance type to determine the best fit for your driving habits and needs.

Why it is important

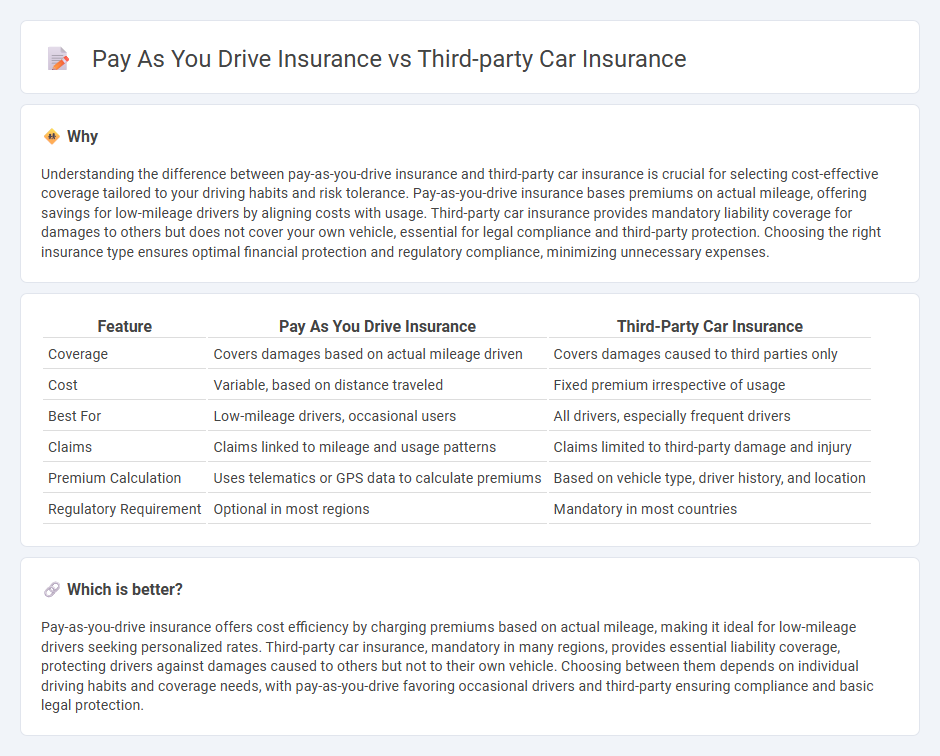

Understanding the difference between pay-as-you-drive insurance and third-party car insurance is crucial for selecting cost-effective coverage tailored to your driving habits and risk tolerance. Pay-as-you-drive insurance bases premiums on actual mileage, offering savings for low-mileage drivers by aligning costs with usage. Third-party car insurance provides mandatory liability coverage for damages to others but does not cover your own vehicle, essential for legal compliance and third-party protection. Choosing the right insurance type ensures optimal financial protection and regulatory compliance, minimizing unnecessary expenses.

Comparison Table

| Feature | Pay As You Drive Insurance | Third-Party Car Insurance |

|---|---|---|

| Coverage | Covers damages based on actual mileage driven | Covers damages caused to third parties only |

| Cost | Variable, based on distance traveled | Fixed premium irrespective of usage |

| Best For | Low-mileage drivers, occasional users | All drivers, especially frequent drivers |

| Claims | Claims linked to mileage and usage patterns | Claims limited to third-party damage and injury |

| Premium Calculation | Uses telematics or GPS data to calculate premiums | Based on vehicle type, driver history, and location |

| Regulatory Requirement | Optional in most regions | Mandatory in most countries |

Which is better?

Pay-as-you-drive insurance offers cost efficiency by charging premiums based on actual mileage, making it ideal for low-mileage drivers seeking personalized rates. Third-party car insurance, mandatory in many regions, provides essential liability coverage, protecting drivers against damages caused to others but not to their own vehicle. Choosing between them depends on individual driving habits and coverage needs, with pay-as-you-drive favoring occasional drivers and third-party ensuring compliance and basic legal protection.

Connection

Pay-as-you-drive insurance and third-party car insurance are connected through their focus on flexible, cost-effective coverage tailored to individual driving habits. Pay-as-you-drive insurance calculates premiums based on actual miles driven, making it an affordable option for low-mileage drivers who typically require minimal third-party liability protection. Both insurance types prioritize financial efficiency while maintaining essential legal coverage for damages or injuries caused to others in an accident.

Key Terms

Coverage Scope

Third-party car insurance primarily covers damages and injuries caused to others, excluding any expenses related to the insured vehicle itself. Pay-as-you-drive insurance adjusts premiums based on actual miles driven, offering a cost-effective solution with coverage that can include liability, collision, and comprehensive options tailored to individual driving habits. Explore the nuanced differences and benefits of each policy to determine the best fit for your driving needs.

Premium Calculation

Third-party car insurance premiums are primarily calculated based on factors such as the driver's age, driving history, vehicle type, and geographic location, emphasizing coverage for damages caused to others. Pay-as-you-drive (PAYD) insurance calculates premiums dynamically by tracking mileage and driving behavior, offering a variable cost structure that can lead to savings for low-mileage or safe drivers. Explore comprehensive comparisons to determine which premium calculation model best suits your driving habits and financial goals.

Usage-Based Policy

Third-party car insurance provides coverage against damages caused to others, while pay-as-you-drive insurance calculates premiums based on actual vehicle usage, promoting cost efficiency for low-mileage drivers. Usage-Based Policies leverage telematics technology to monitor driving behavior, offering personalized rates that reflect risk more accurately. Discover how switching to this innovative insurance model can optimize your expenses and enhance coverage.

Source and External Links

Third-Party Car Insurance - Third-party car insurance provides the minimum legal cover, protecting you only against claims for damage or injury you cause to others, but it does not cover damage to your own car or injuries you sustain, making it often suitable for older or infrequently used vehicles.

What Is Third-Party Insurance? - Third-party insurance covers the costs of claims made by other parties for injury or damage you cause in an accident, preventing you from facing large out-of-pocket expenses for their losses.

What Is Third-Party Car Insurance & How Does It Work? - Third-party car insurance, also known as liability insurance, pays for injuries or property damage you cause to others, with claims handled by the injured party filing against your insurer, while damages to your own vehicle require separate coverage.

dowidth.com

dowidth.com