Buy now insurance offers immediate coverage by requiring medical underwriting and health assessments, ensuring premium rates tailored to individual risk profiles. Guaranteed issue insurance provides coverage without health questions or medical exams, making it accessible to applicants regardless of their medical history, but often at higher premiums and with limited benefits. Discover which insurance option best aligns with your financial goals and health needs.

Why it is important

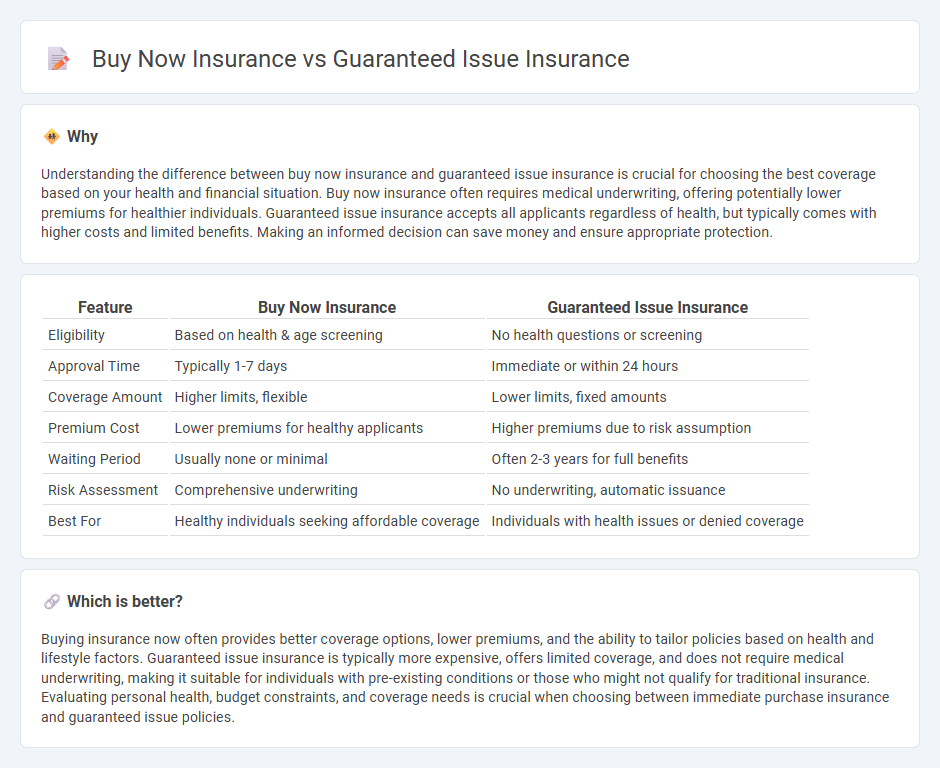

Understanding the difference between buy now insurance and guaranteed issue insurance is crucial for choosing the best coverage based on your health and financial situation. Buy now insurance often requires medical underwriting, offering potentially lower premiums for healthier individuals. Guaranteed issue insurance accepts all applicants regardless of health, but typically comes with higher costs and limited benefits. Making an informed decision can save money and ensure appropriate protection.

Comparison Table

| Feature | Buy Now Insurance | Guaranteed Issue Insurance |

|---|---|---|

| Eligibility | Based on health & age screening | No health questions or screening |

| Approval Time | Typically 1-7 days | Immediate or within 24 hours |

| Coverage Amount | Higher limits, flexible | Lower limits, fixed amounts |

| Premium Cost | Lower premiums for healthy applicants | Higher premiums due to risk assumption |

| Waiting Period | Usually none or minimal | Often 2-3 years for full benefits |

| Risk Assessment | Comprehensive underwriting | No underwriting, automatic issuance |

| Best For | Healthy individuals seeking affordable coverage | Individuals with health issues or denied coverage |

Which is better?

Buying insurance now often provides better coverage options, lower premiums, and the ability to tailor policies based on health and lifestyle factors. Guaranteed issue insurance is typically more expensive, offers limited coverage, and does not require medical underwriting, making it suitable for individuals with pre-existing conditions or those who might not qualify for traditional insurance. Evaluating personal health, budget constraints, and coverage needs is crucial when choosing between immediate purchase insurance and guaranteed issue policies.

Connection

Buy now insurance often includes guaranteed issue insurance policies that provide coverage without requiring medical exams or health questions, ensuring immediate protection regardless of health status. These policies appeal to individuals seeking quick enrollment and assurance of acceptance despite pre-existing conditions. Guaranteed issue insurance eliminates traditional underwriting barriers, making buy now insurance accessible and straightforward for high-risk applicants.

Key Terms

Underwriting

Guaranteed issue insurance requires no medical underwriting, making coverage accessible regardless of health conditions or age, ideal for those with pre-existing conditions. Buy now insurance often involves detailed underwriting to assess risk, potentially resulting in tailored premiums but denied coverage for high-risk applicants. Discover how underwriting impacts your insurance options and make an informed decision today.

Eligibility

Guaranteed issue insurance offers coverage without medical exams or health questions, making it accessible to individuals with pre-existing conditions or high-risk health profiles. Buy now insurance requires applicants to meet specific eligibility criteria, including health assessments and age limits, which can affect approval and premiums. Explore our detailed comparison to find the best insurance option tailored to your needs.

Coverage Activation

Guaranteed issue insurance activates coverage regardless of health conditions, offering assurance to individuals with pre-existing ailments or those denied traditional policies. Buy now insurance requires approval and typically involves underwriting, leading to faster coverage for healthy applicants but possible delays for others. Explore detailed comparisons and activation criteria to select the best option for your needs.

Source and External Links

Guaranteed issue - Wikipedia - Guaranteed issue in health insurance means a policy is offered to any eligible applicant without regard to health status, often mandated by law such as the ACA requiring all health policies be sold on this basis.

What is guaranteed issue? - HealthInsurance.org - Guaranteed issue health insurance coverage is guaranteed to applicants regardless of health, age, or income, and applies to all individual-market plans since 2014 under the ACA, with enrollment limited to certain periods.

What Is Guaranteed Life Insurance? - Progressive - Guaranteed issue life insurance is permanent life insurance without health questions or exams, ideal for older or seriously ill individuals, usually with lower coverage amounts and a waiting period for full benefits.

dowidth.com

dowidth.com