An insurance sandbox is a regulatory framework that allows insurers and startups to test innovative products and services in a controlled environment without full compliance obligations. Insurtech incubators focus on nurturing early-stage insurance technology startups by providing resources, mentorship, and market access to accelerate growth. Explore the key differences between insurance sandboxes and insurtech incubators to optimize innovation strategies.

Why it is important

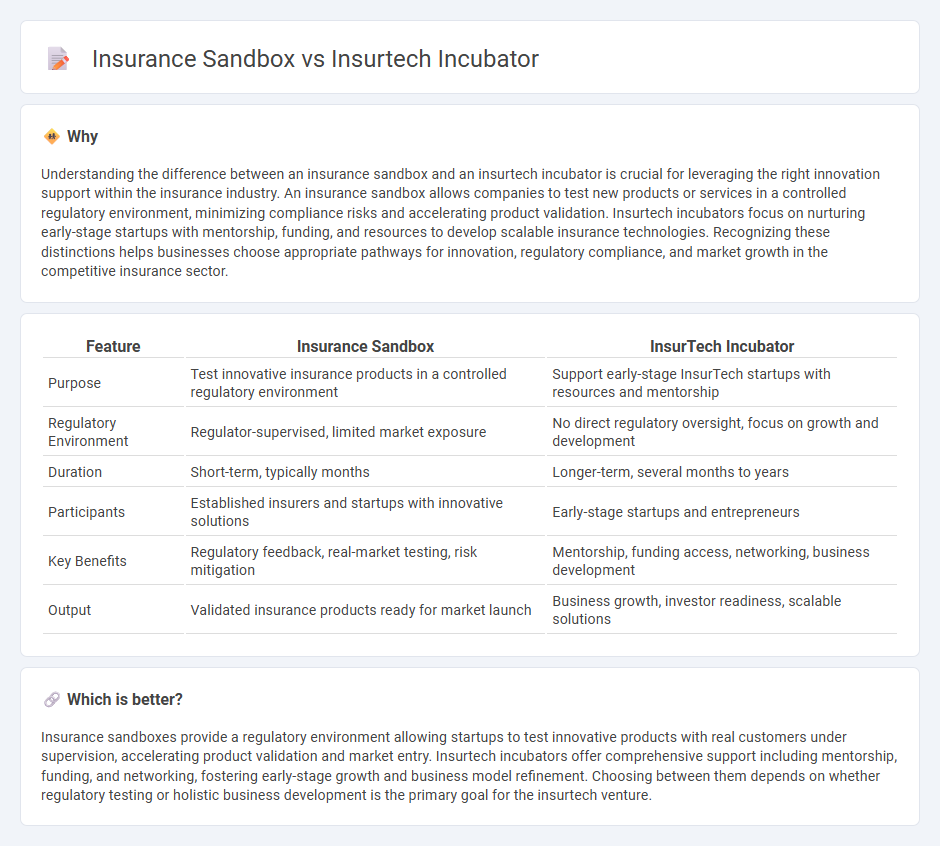

Understanding the difference between an insurance sandbox and an insurtech incubator is crucial for leveraging the right innovation support within the insurance industry. An insurance sandbox allows companies to test new products or services in a controlled regulatory environment, minimizing compliance risks and accelerating product validation. Insurtech incubators focus on nurturing early-stage startups with mentorship, funding, and resources to develop scalable insurance technologies. Recognizing these distinctions helps businesses choose appropriate pathways for innovation, regulatory compliance, and market growth in the competitive insurance sector.

Comparison Table

| Feature | Insurance Sandbox | InsurTech Incubator |

|---|---|---|

| Purpose | Test innovative insurance products in a controlled regulatory environment | Support early-stage InsurTech startups with resources and mentorship |

| Regulatory Environment | Regulator-supervised, limited market exposure | No direct regulatory oversight, focus on growth and development |

| Duration | Short-term, typically months | Longer-term, several months to years |

| Participants | Established insurers and startups with innovative solutions | Early-stage startups and entrepreneurs |

| Key Benefits | Regulatory feedback, real-market testing, risk mitigation | Mentorship, funding access, networking, business development |

| Output | Validated insurance products ready for market launch | Business growth, investor readiness, scalable solutions |

Which is better?

Insurance sandboxes provide a regulatory environment allowing startups to test innovative products with real customers under supervision, accelerating product validation and market entry. Insurtech incubators offer comprehensive support including mentorship, funding, and networking, fostering early-stage growth and business model refinement. Choosing between them depends on whether regulatory testing or holistic business development is the primary goal for the insurtech venture.

Connection

Insurance sandboxes provide a regulatory framework for testing innovative insurance products under controlled conditions, enabling startups and insurtech companies to experiment without full compliance burdens. Insurtech incubators support these startups by offering resources, mentorship, and business development opportunities, accelerating the commercialization of sandbox-tested solutions. Together, they foster innovation by bridging regulatory support and entrepreneurial growth within the insurance technology ecosystem.

Key Terms

**Insurtech Incubator:**

Insurtech incubators nurture early-stage startups by providing mentorship, funding, and resources to accelerate innovation in the insurance industry. These incubators focus on developing scalable business models, refining technology solutions, and creating market-ready products. Discover how insurtech incubators drive transformation and support emerging insurance technologies.

Startup Acceleration

An insurtech incubator provides startups with resources, mentorship, and networking opportunities aimed at accelerating growth and bringing innovative insurance solutions to market faster. Insurance sandboxes offer a controlled regulatory environment for testing new products and business models without fully complying with standard insurance regulations, ensuring compliance and risk mitigation. Explore how these platforms drive startup acceleration and innovation in the insurance sector.

Mentorship

Insurtech incubators provide structured mentorship programs connecting startups with industry experts, fostering innovation and business growth through tailored guidance and networking opportunities. Insurance sandboxes offer a regulatory safe space for experimentation but typically provide less direct mentorship, focusing more on compliance and testing new products under supervision. Explore how mentorship shapes success in these environments and discover which model best supports your insurtech journey.

Source and External Links

Insurtech Gateway Incubators - Supports early-stage founders in designing insurance products, providing underwriting capacity, regulatory compliance, and pre-seed funding, with locations in London and Sydney.

Top 10 Insurtech Incubators and Accelerators - Provides a list of leading insurtech accelerators that foster innovation in the insurance industry, supporting startups to transform the landscape.

Global Insurance Accelerator - A mentor-driven program supporting early-stage insurtech startups in Iowa, focusing on validating product market fit and preparing them for growth.

dowidth.com

dowidth.com