Cyber insurance protects businesses against financial losses from cyberattacks and data breaches, covering costs such as legal fees, notification expenses, and system repairs. Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, and prescription medications, ensuring access to necessary healthcare services. Explore the key differences and benefits of cyber insurance versus health insurance to choose the best policy for your needs.

Why it is important

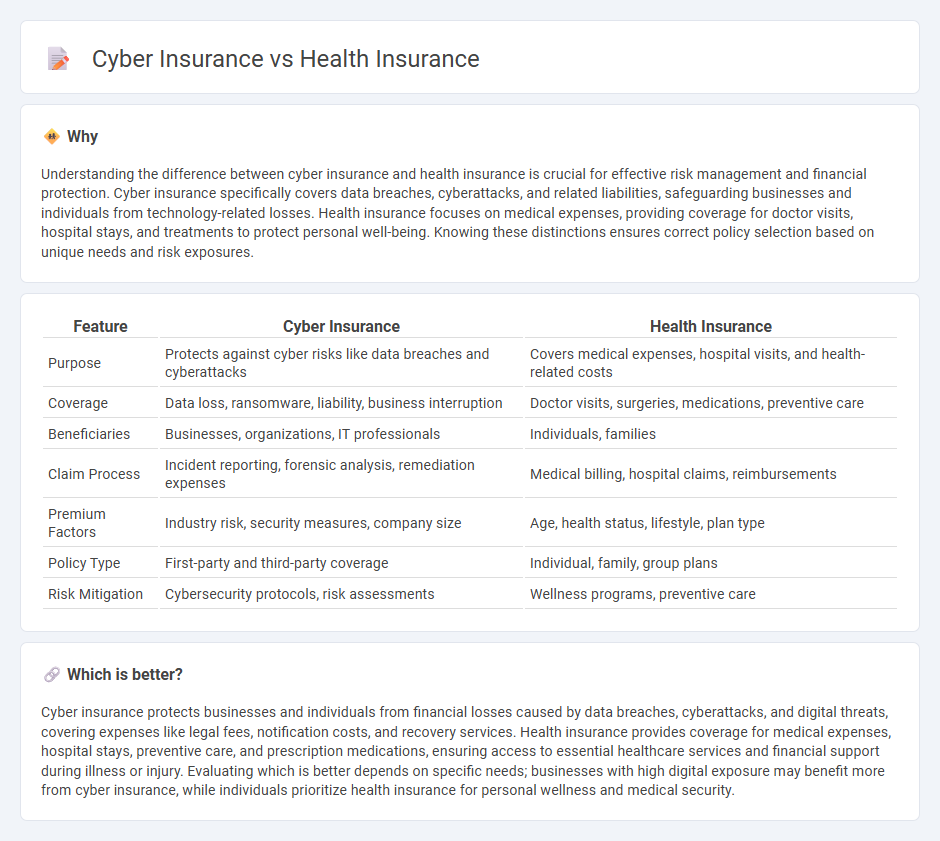

Understanding the difference between cyber insurance and health insurance is crucial for effective risk management and financial protection. Cyber insurance specifically covers data breaches, cyberattacks, and related liabilities, safeguarding businesses and individuals from technology-related losses. Health insurance focuses on medical expenses, providing coverage for doctor visits, hospital stays, and treatments to protect personal well-being. Knowing these distinctions ensures correct policy selection based on unique needs and risk exposures.

Comparison Table

| Feature | Cyber Insurance | Health Insurance |

|---|---|---|

| Purpose | Protects against cyber risks like data breaches and cyberattacks | Covers medical expenses, hospital visits, and health-related costs |

| Coverage | Data loss, ransomware, liability, business interruption | Doctor visits, surgeries, medications, preventive care |

| Beneficiaries | Businesses, organizations, IT professionals | Individuals, families |

| Claim Process | Incident reporting, forensic analysis, remediation expenses | Medical billing, hospital claims, reimbursements |

| Premium Factors | Industry risk, security measures, company size | Age, health status, lifestyle, plan type |

| Policy Type | First-party and third-party coverage | Individual, family, group plans |

| Risk Mitigation | Cybersecurity protocols, risk assessments | Wellness programs, preventive care |

Which is better?

Cyber insurance protects businesses and individuals from financial losses caused by data breaches, cyberattacks, and digital threats, covering expenses like legal fees, notification costs, and recovery services. Health insurance provides coverage for medical expenses, hospital stays, preventive care, and prescription medications, ensuring access to essential healthcare services and financial support during illness or injury. Evaluating which is better depends on specific needs; businesses with high digital exposure may benefit more from cyber insurance, while individuals prioritize health insurance for personal wellness and medical security.

Connection

Cyber insurance and health insurance are connected through the rising risks of data breaches affecting sensitive health information stored by healthcare providers and insurers. Cyber insurance policies help cover the financial losses, legal fees, and regulatory fines resulting from cyberattacks targeting electronic health records. Health insurance companies increasingly invest in cyber insurance to protect patient data confidentiality and maintain compliance with healthcare regulations such as HIPAA.

Key Terms

**Health Insurance:**

Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care, protecting individuals from high healthcare costs. Policies vary in terms of premiums, deductibles, co-pays, and coverage limits, often influenced by factors such as age, location, and employer benefits. Explore comprehensive health insurance options to safeguard your well-being and financial stability.

Premium

Health insurance premiums are determined by factors such as age, medical history, and coverage level, often resulting in predictable and stable payments. Cyber insurance premiums vary widely based on the size of the business, type of data protected, and cybersecurity posture, reflecting the evolving nature of cyber risks. Explore the nuances of premium calculations to better understand the financial commitments of each insurance type.

Deductible

Health insurance deductibles typically range from $500 to $3,000 depending on the plan, requiring policyholders to pay this amount out-of-pocket before coverage begins. In contrast, cyber insurance deductibles can vary widely based on the policy and risk profile, often starting around $5,000 and increasing with coverage limits due to the high costs associated with cyber incidents. Explore detailed comparisons to understand how deductible structures impact coverage and out-of-pocket expenses in both insurance types.

Source and External Links

Health insurance on USAGov - Provides information on health insurance programs like Medicaid, Medicare, and the ACA Health Insurance Marketplace.

UnitedHealthcare Individual & Family Plans - Offers various health insurance plans, including short-term and ACA Marketplace plans, with tailored benefits.

Anthem Blue Cross Blue Shield - Offers affordable health, dental, and vision coverage with financial assistance options for qualified individuals.

dowidth.com

dowidth.com