Pet health insurance covers veterinary expenses such as vaccinations, surgeries, and emergency care to ensure the well-being of your pets, while homeowners insurance protects your property and belongings against risks like fire, theft, and natural disasters. These two types of insurance serve distinct purposes but both provide financial security tailored to different aspects of personal property and health. Explore the benefits and coverage options of pet health insurance versus homeowners insurance to make an informed decision.

Why it is important

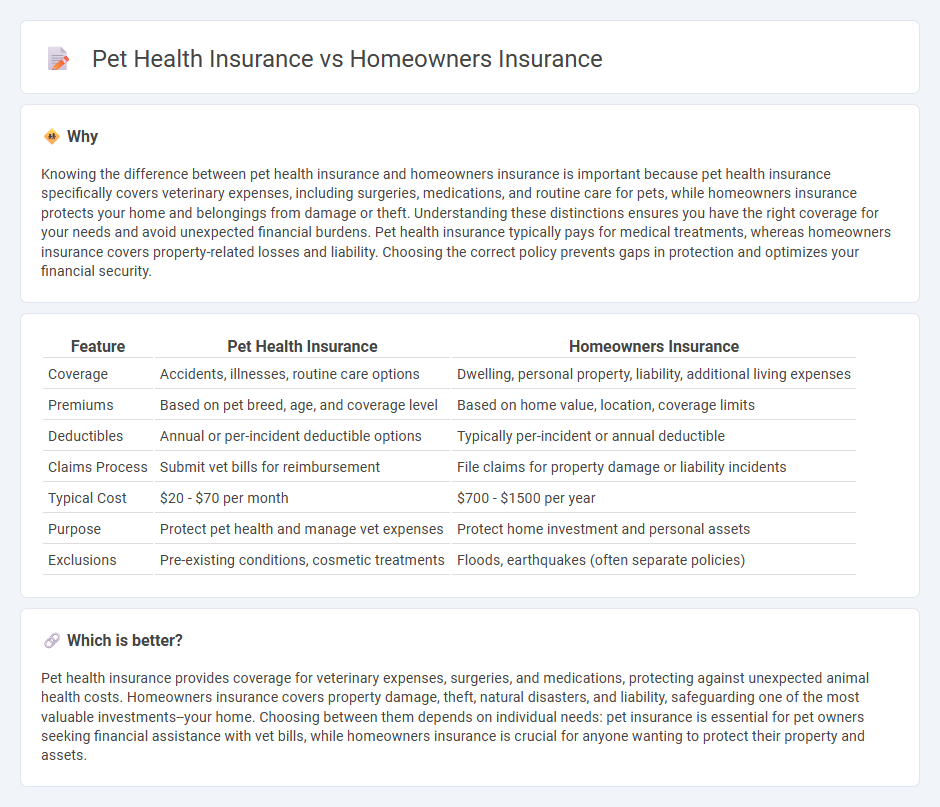

Knowing the difference between pet health insurance and homeowners insurance is important because pet health insurance specifically covers veterinary expenses, including surgeries, medications, and routine care for pets, while homeowners insurance protects your home and belongings from damage or theft. Understanding these distinctions ensures you have the right coverage for your needs and avoid unexpected financial burdens. Pet health insurance typically pays for medical treatments, whereas homeowners insurance covers property-related losses and liability. Choosing the correct policy prevents gaps in protection and optimizes your financial security.

Comparison Table

| Feature | Pet Health Insurance | Homeowners Insurance |

|---|---|---|

| Coverage | Accidents, illnesses, routine care options | Dwelling, personal property, liability, additional living expenses |

| Premiums | Based on pet breed, age, and coverage level | Based on home value, location, coverage limits |

| Deductibles | Annual or per-incident deductible options | Typically per-incident or annual deductible |

| Claims Process | Submit vet bills for reimbursement | File claims for property damage or liability incidents |

| Typical Cost | $20 - $70 per month | $700 - $1500 per year |

| Purpose | Protect pet health and manage vet expenses | Protect home investment and personal assets |

| Exclusions | Pre-existing conditions, cosmetic treatments | Floods, earthquakes (often separate policies) |

Which is better?

Pet health insurance provides coverage for veterinary expenses, surgeries, and medications, protecting against unexpected animal health costs. Homeowners insurance covers property damage, theft, natural disasters, and liability, safeguarding one of the most valuable investments--your home. Choosing between them depends on individual needs: pet insurance is essential for pet owners seeking financial assistance with vet bills, while homeowners insurance is crucial for anyone wanting to protect their property and assets.

Connection

Pet health insurance and homeowners insurance both provide financial protection related to a household environment, with pet health insurance covering veterinary expenses and homeowners insurance protecting against property damage and liability. Homeowners insurance policies may include liability coverage for pet-related incidents, linking the two through potential claims involving pets. Combining these insurances can offer comprehensive risk management for pet owners, ensuring both medical care for pets and protection from property damage or injury claims.

Key Terms

Dwelling Coverage

Dwelling coverage under homeowners insurance protects the physical structure of your home against damages caused by events like fire, storms, or vandalism. Pet health insurance, in contrast, covers veterinary expenses related to illnesses or injuries but offers no protection for property or structural damage. Explore the key differences between these insurance types to safeguard both your home and your pets effectively.

Liability Coverage

Homeowners insurance typically includes liability coverage that protects against accidents or injuries occurring on your property, covering legal fees and medical expenses if a visitor is harmed. Pet health insurance, however, focuses solely on veterinary care costs for pets and does not provide liability protection for damages or injuries caused by the animal to others. To understand how liability coverage differs and which option suits your needs, explore detailed comparisons between homeowners and pet health insurance policies.

Veterinary Expenses

Homeowners insurance typically does not cover veterinary expenses, as it primarily protects property and liability risks associated with the home. Pet health insurance specifically covers veterinary costs including accidents, illnesses, and routine care for pets, offering financial relief for unexpected medical bills. Explore how pet health insurance plans can safeguard your pet's well-being and your finances.

Source and External Links

Homeowners Insurance: Get a Home Insurance Quote | Allstate - Offers homeowners insurance to protect your house and family, with options for quotes and coverage details.

Homeowners Insurance - Get a Home Insurance Quote - Provides customizable homeowners insurance policies based on factors like location, home construction, and personal property, with coverage for damages after paying a premium and deductible.

Homeowners Insurance - Online Quotes - Protects your home, personal belongings, and offers liability coverage, including help with repairs, replacement, and temporary housing if your home is uninhabitable due to a covered loss.

dowidth.com

dowidth.com