Cyber insurance covers financial losses from data breaches, hacking, and other online threats, protecting businesses from digital risks. Marine insurance safeguards vessels, cargo, and shipping operations against physical damages or losses during transit over water. Explore the detailed differences and benefits of cyber and marine insurance to choose the right protection for your needs.

Why it is important

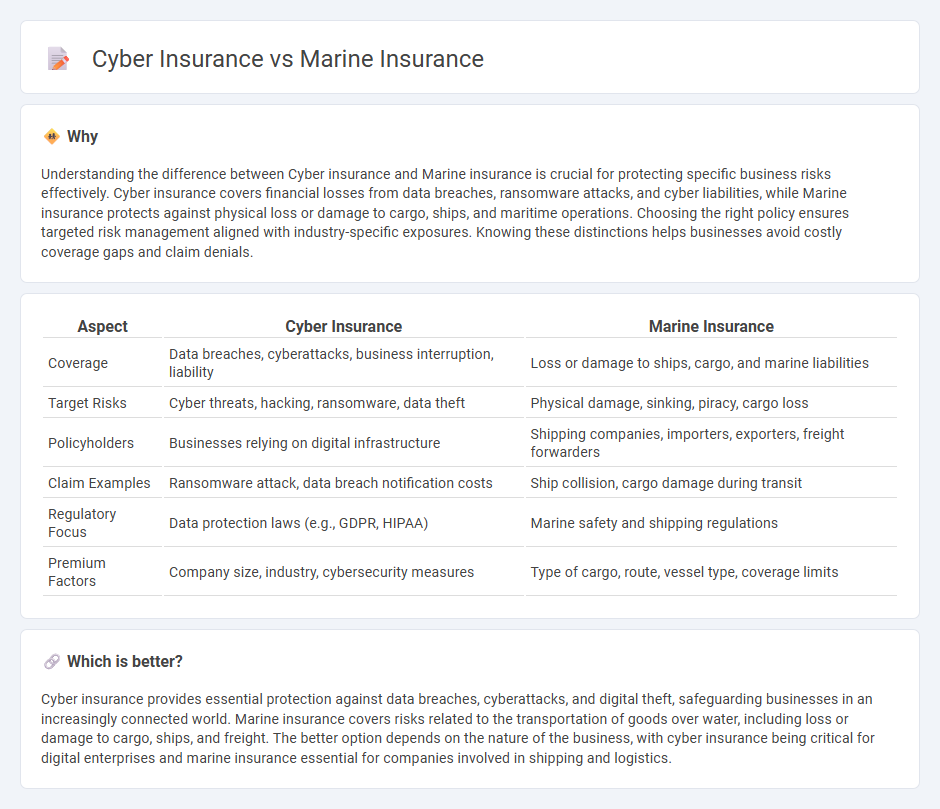

Understanding the difference between Cyber insurance and Marine insurance is crucial for protecting specific business risks effectively. Cyber insurance covers financial losses from data breaches, ransomware attacks, and cyber liabilities, while Marine insurance protects against physical loss or damage to cargo, ships, and maritime operations. Choosing the right policy ensures targeted risk management aligned with industry-specific exposures. Knowing these distinctions helps businesses avoid costly coverage gaps and claim denials.

Comparison Table

| Aspect | Cyber Insurance | Marine Insurance |

|---|---|---|

| Coverage | Data breaches, cyberattacks, business interruption, liability | Loss or damage to ships, cargo, and marine liabilities |

| Target Risks | Cyber threats, hacking, ransomware, data theft | Physical damage, sinking, piracy, cargo loss |

| Policyholders | Businesses relying on digital infrastructure | Shipping companies, importers, exporters, freight forwarders |

| Claim Examples | Ransomware attack, data breach notification costs | Ship collision, cargo damage during transit |

| Regulatory Focus | Data protection laws (e.g., GDPR, HIPAA) | Marine safety and shipping regulations |

| Premium Factors | Company size, industry, cybersecurity measures | Type of cargo, route, vessel type, coverage limits |

Which is better?

Cyber insurance provides essential protection against data breaches, cyberattacks, and digital theft, safeguarding businesses in an increasingly connected world. Marine insurance covers risks related to the transportation of goods over water, including loss or damage to cargo, ships, and freight. The better option depends on the nature of the business, with cyber insurance being critical for digital enterprises and marine insurance essential for companies involved in shipping and logistics.

Connection

Cyber insurance and marine insurance intersect through their shared focus on risk management for maritime businesses relying on digital technology. Marine insurance increasingly covers cyber-related threats such as ransomware attacks on shipping logistics and navigation systems, highlighting the integration of cyber risk coverage into traditional maritime policies. This convergence addresses the growing vulnerabilities in global supply chains caused by cyber incidents affecting marine operations.

Key Terms

Marine insurance:

Marine insurance covers risks associated with the transportation of goods and vessels over water, safeguarding against losses from perils like shipwreck, piracy, and cargo damage. It plays a critical role in global trade by protecting valuable maritime assets and ensuring financial stability for shipping companies. Discover more about the comprehensive benefits and coverage options of marine insurance to better protect your maritime interests.

Hull

Hull insurance, a specialized branch of marine insurance, covers physical damage to a ship's structure and machinery, protecting vessel owners from costly repairs or total loss. Cyber insurance, contrastingly, addresses digital threats such as data breaches, cyberattacks, and operational disruptions affecting maritime operations and communication systems. Explore the distinct benefits and coverage details of hull and cyber insurance in the marine industry to safeguard your assets effectively.

Cargo

Marine insurance for cargo provides comprehensive coverage against risks like vessel damage, piracy, and natural disasters during sea transport, ensuring protection of goods across international waters. Cyber insurance for cargo addresses digital threats impacting supply chain operations, such as data breaches, ransomware attacks, and system failures that can disrupt logistics and freight management. Discover how these distinct insurance types safeguard your cargo and optimize risk management in global trade.

Source and External Links

Marine insurance - Wikipedia - Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred or held, including a specialized legal framework and standard policy forms like the MAR 91 form used in underwriting.

What Is Marine Insurance? - Hylant - Marine insurance includes ocean marine coverage protecting cargo transport risks, docks, piers, and wharves insurance for property and business income protection, as well as bumbershoot coverage for excess liability across maritime business operations.

Inland & Ocean Marine Insurance - Markel - Markel provides customizable inland and ocean marine insurance solutions for a variety of clients including vessel owners, marinas, boat manufacturers, and marine businesses, offering coverage for boats, yachts, and related marine risks with dedicated claims support.

dowidth.com

dowidth.com