Peer-to-peer insurance connects individuals who pool their premiums to cover each other's risks, promoting transparency and reducing administrative costs. Group insurance, typically offered by employers or organizations, provides coverage to members under a single contract, often benefiting from lower rates due to bulk enrollment. Explore the advantages and differences between peer-to-peer and group insurance to find the best fit for your coverage needs.

Why it is important

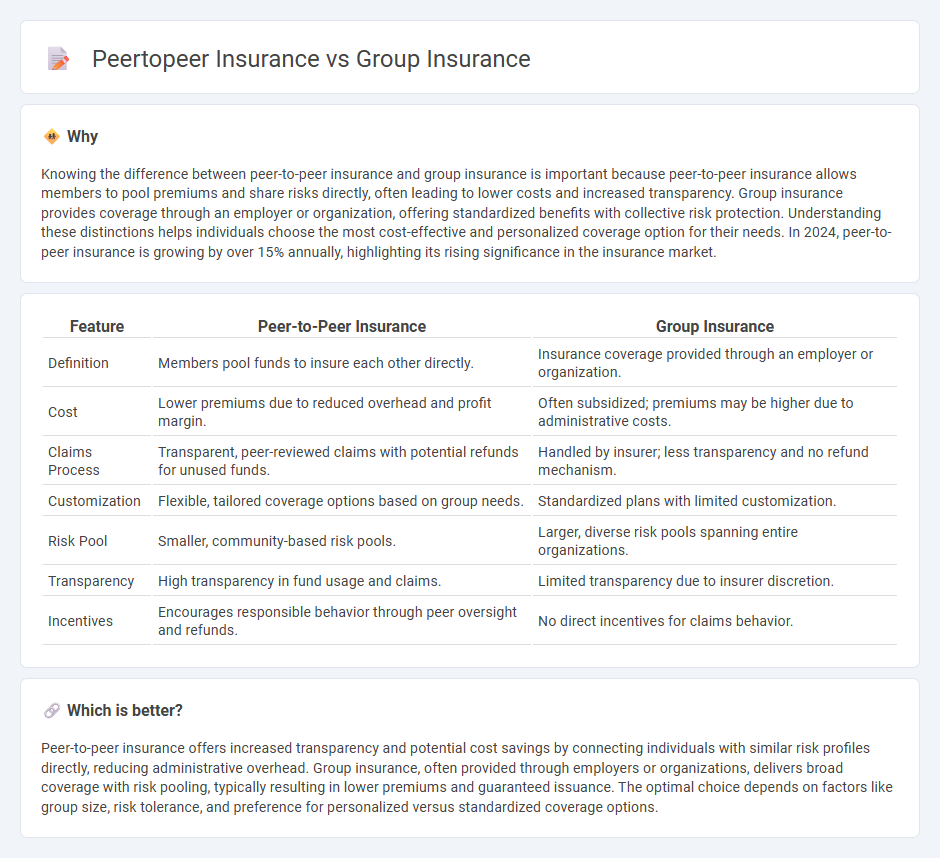

Knowing the difference between peer-to-peer insurance and group insurance is important because peer-to-peer insurance allows members to pool premiums and share risks directly, often leading to lower costs and increased transparency. Group insurance provides coverage through an employer or organization, offering standardized benefits with collective risk protection. Understanding these distinctions helps individuals choose the most cost-effective and personalized coverage option for their needs. In 2024, peer-to-peer insurance is growing by over 15% annually, highlighting its rising significance in the insurance market.

Comparison Table

| Feature | Peer-to-Peer Insurance | Group Insurance |

|---|---|---|

| Definition | Members pool funds to insure each other directly. | Insurance coverage provided through an employer or organization. |

| Cost | Lower premiums due to reduced overhead and profit margin. | Often subsidized; premiums may be higher due to administrative costs. |

| Claims Process | Transparent, peer-reviewed claims with potential refunds for unused funds. | Handled by insurer; less transparency and no refund mechanism. |

| Customization | Flexible, tailored coverage options based on group needs. | Standardized plans with limited customization. |

| Risk Pool | Smaller, community-based risk pools. | Larger, diverse risk pools spanning entire organizations. |

| Transparency | High transparency in fund usage and claims. | Limited transparency due to insurer discretion. |

| Incentives | Encourages responsible behavior through peer oversight and refunds. | No direct incentives for claims behavior. |

Which is better?

Peer-to-peer insurance offers increased transparency and potential cost savings by connecting individuals with similar risk profiles directly, reducing administrative overhead. Group insurance, often provided through employers or organizations, delivers broad coverage with risk pooling, typically resulting in lower premiums and guaranteed issuance. The optimal choice depends on factors like group size, risk tolerance, and preference for personalized versus standardized coverage options.

Connection

Peer-to-peer insurance and group insurance both leverage collective risk pooling to reduce individual costs and enhance coverage reliability. In peer-to-peer insurance, groups of individuals with similar risk profiles band together to share premiums and claims, mirroring the risk-sharing principle central to traditional group insurance. Both models utilize social bonds and transparency to lower administrative costs and increase trust among members, fostering a collaborative approach to risk management.

Key Terms

Risk Pooling

Group insurance consolidates risk among a large number of policyholders, spreading potential losses across all members to reduce individual financial burden. Peer-to-peer insurance leverages smaller, closely connected groups to create a more transparent risk pool, often fostering trust and minimizing administrative costs. Explore how these models optimize risk sharing and financial protection to determine the best fit for your insurance needs.

Underwriting

Group insurance underwriting evaluates risks across a collective pool, leveraging aggregated data to offer more predictable premiums and reduced volatility. Peer-to-peer insurance underwriting assesses individual risk profiles within smaller, socially connected groups, promoting transparency and potentially lowering costs through shared accountability. Explore the nuances of underwriting mechanisms in both models to understand their impact on insurance pricing and risk management.

Claims Management

Group insurance streamlines claims management through centralized processing, enabling faster settlement and reduced administrative costs. Peer-to-peer insurance leverages decentralized platforms, promoting transparency and shared risk among members, which can lead to more personalized claim resolutions. Explore the differences in claims handling approaches to determine the best fit for your insurance needs.

Source and External Links

What is group insurance? Benefits and limitations [2025] | Thatch Blog - Group insurance offers a single health coverage policy to a large number of people through an employer or organization, often with the employer contributing to premiums and coverage being standardized for all eligible members under one master policy.

What is Group Insurance & How Does It Work? - MetLife - Group insurance is coverage provided as part of an employee benefits package by an employer, typically at a lower cost than individual insurance, and employees can enroll or decline coverage, with premiums often deducted from paychecks.

Group insurance - Wikipedia - Group insurance covers a group of people such as employees or organization members and can be compulsory or voluntary, with underwriting requirements generally less strict than individual insurance and with some regional variations worldwide.

dowidth.com

dowidth.com