Pandemic business interruption insurance provides coverage for losses due to government-mandated shutdowns and supply chain disruptions caused by infectious disease outbreaks, while terrorism insurance protects against property damage and business income loss from terrorist acts. Both policies address unique, high-impact risks that can severely affect business continuity and financial stability. Explore detailed comparisons to determine which coverage suits your risk management strategy.

Why it is important

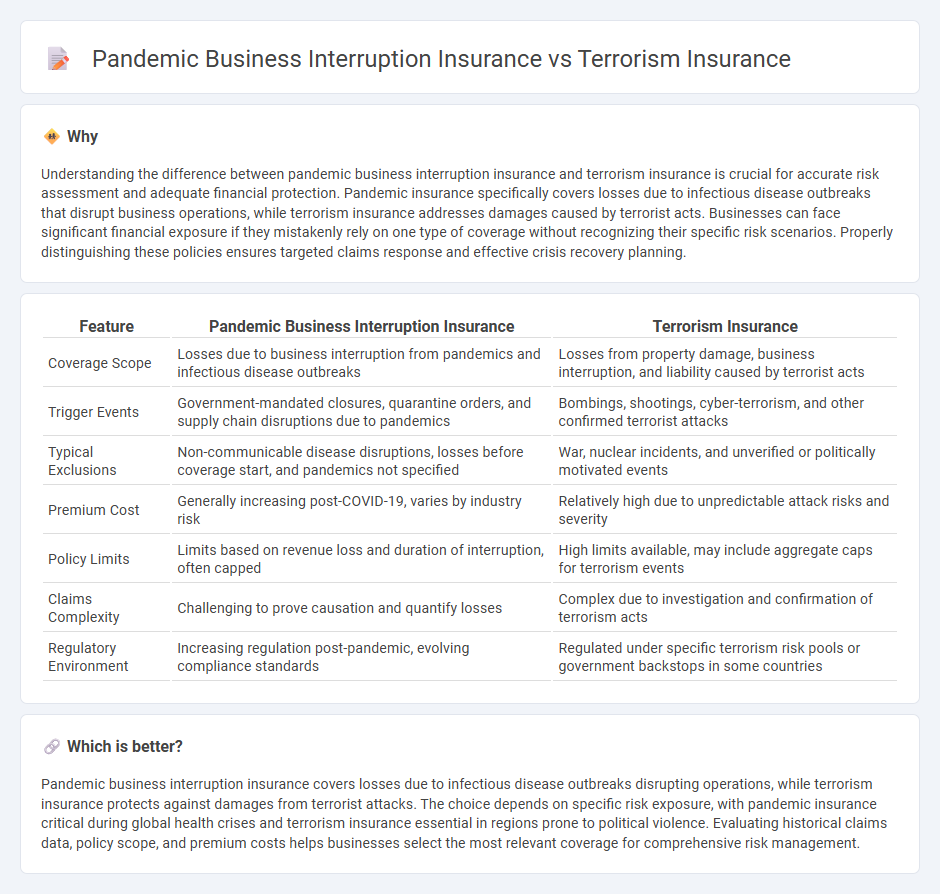

Understanding the difference between pandemic business interruption insurance and terrorism insurance is crucial for accurate risk assessment and adequate financial protection. Pandemic insurance specifically covers losses due to infectious disease outbreaks that disrupt business operations, while terrorism insurance addresses damages caused by terrorist acts. Businesses can face significant financial exposure if they mistakenly rely on one type of coverage without recognizing their specific risk scenarios. Properly distinguishing these policies ensures targeted claims response and effective crisis recovery planning.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Terrorism Insurance |

|---|---|---|

| Coverage Scope | Losses due to business interruption from pandemics and infectious disease outbreaks | Losses from property damage, business interruption, and liability caused by terrorist acts |

| Trigger Events | Government-mandated closures, quarantine orders, and supply chain disruptions due to pandemics | Bombings, shootings, cyber-terrorism, and other confirmed terrorist attacks |

| Typical Exclusions | Non-communicable disease disruptions, losses before coverage start, and pandemics not specified | War, nuclear incidents, and unverified or politically motivated events |

| Premium Cost | Generally increasing post-COVID-19, varies by industry risk | Relatively high due to unpredictable attack risks and severity |

| Policy Limits | Limits based on revenue loss and duration of interruption, often capped | High limits available, may include aggregate caps for terrorism events |

| Claims Complexity | Challenging to prove causation and quantify losses | Complex due to investigation and confirmation of terrorism acts |

| Regulatory Environment | Increasing regulation post-pandemic, evolving compliance standards | Regulated under specific terrorism risk pools or government backstops in some countries |

Which is better?

Pandemic business interruption insurance covers losses due to infectious disease outbreaks disrupting operations, while terrorism insurance protects against damages from terrorist attacks. The choice depends on specific risk exposure, with pandemic insurance critical during global health crises and terrorism insurance essential in regions prone to political violence. Evaluating historical claims data, policy scope, and premium costs helps businesses select the most relevant coverage for comprehensive risk management.

Connection

Pandemic business interruption insurance and terrorism insurance both address coverage for unforeseen, large-scale disruptions that cause financial losses to businesses. These policies often exclude or specifically define events like pandemics and acts of terrorism due to their catastrophic and systemic impact on commerce. Insurers analyze the risk overlap and policy language to clarify coverage boundaries, ensuring businesses understand protections against multifunctional threats.

Key Terms

### Terrorism Insurance

Terrorism insurance provides financial protection against losses caused by acts of terrorism, including damage to property, business interruption, and liability claims. This specialized coverage addresses risks associated with bombings, shootings, and other violent acts intended to cause widespread harm and disruption. Explore the specific benefits and policy options of terrorism insurance to better safeguard your business assets.

Terrorism Risk Insurance Act (TRIA)

Terrorism Risk Insurance Act (TRIA) provides a federal backstop to cover losses from certified acts of terrorism, ensuring insurers can offer terrorism insurance without bearing excessive risk. Pandemic business interruption insurance, however, is typically excluded from TRIA coverage and requires separate policies due to the unique nature of infectious disease outbreaks and widespread economic impact. Explore the differences and implications of TRIA on your risk management strategy to safeguard your business effectively.

Certified Act of Terrorism

Certified Acts of Terrorism under the Terrorism Risk Insurance Act (TRIA) trigger specific compensation mechanisms for losses caused by terrorism, which are distinct from coverage under pandemic business interruption insurance. Terrorism insurance covers direct losses from acts officially certified by the Secretary of the Treasury, while pandemic business interruption insurance addresses economic disruptions from infectious disease outbreaks but often excludes acts of terrorism. Explore key policy differences and statutory definitions to understand coverage specifics and claims processes.

Source and External Links

Insurance and Terrorism Risk - The Terrorism Risk Insurance Act (TRIA) requires all insurers covering commercial property and casualty lines to participate in a federal program that reimburses 90% of covered terrorism losses above a deductible, with the federal government's annual liability capped at $100 billion, and mandates clear disclosure of terrorism coverage to policyholders.

Terrorism Insurance: Who Insures and Who is Insured - After the 9/11 attacks, many global insurers excluded terrorism coverage from standard policies, leading governments to establish special schemes or pools to help insurers manage the risk, while households and corporations with insufficient coverage remain vulnerable to large financial losses from terrorist acts.

Terrorism Insurance - Terrorism insurance is a specialized form of coverage designed to protect property owners and businesses from losses caused by acts of terrorism, which are typically excluded from standard property insurance policies following major terrorist events.

dowidth.com

dowidth.com