Earthquake microinsurance provides targeted coverage against financial losses caused by seismic events, protecting individuals and businesses from the immediate impact of property damage and reconstruction costs. Business interruption microinsurance addresses income loss during periods when operations are halted due to insured events, ensuring cash flow stability and operational continuity. Explore the key differences and benefits of these microinsurance types to safeguard your assets effectively.

Why it is important

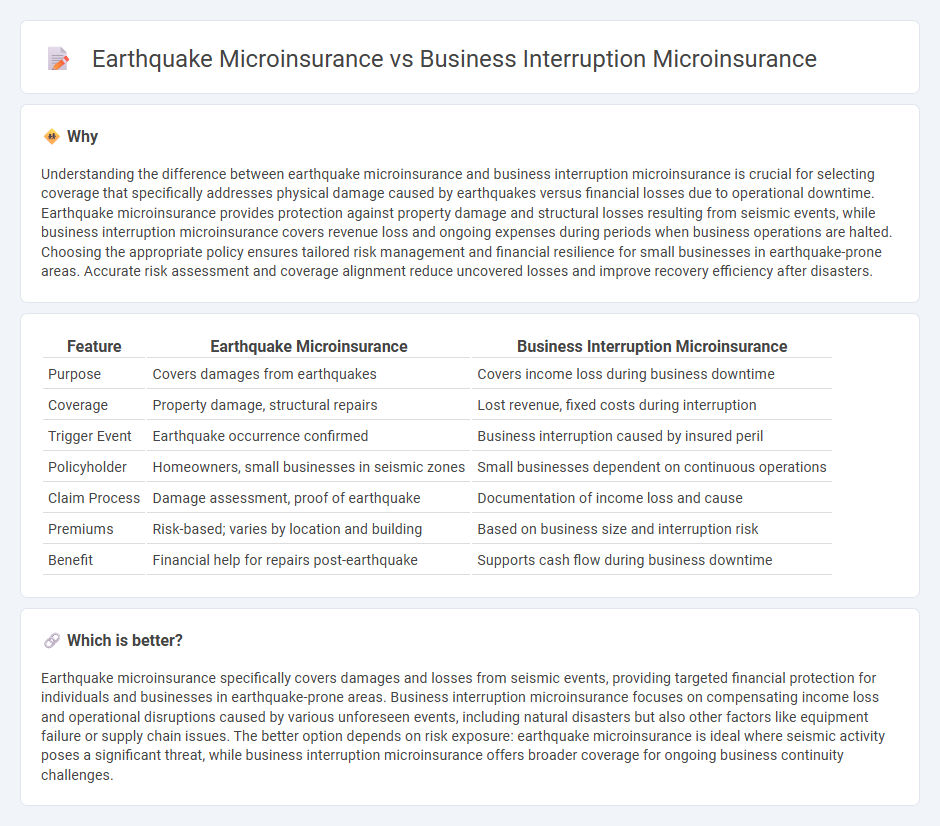

Understanding the difference between earthquake microinsurance and business interruption microinsurance is crucial for selecting coverage that specifically addresses physical damage caused by earthquakes versus financial losses due to operational downtime. Earthquake microinsurance provides protection against property damage and structural losses resulting from seismic events, while business interruption microinsurance covers revenue loss and ongoing expenses during periods when business operations are halted. Choosing the appropriate policy ensures tailored risk management and financial resilience for small businesses in earthquake-prone areas. Accurate risk assessment and coverage alignment reduce uncovered losses and improve recovery efficiency after disasters.

Comparison Table

| Feature | Earthquake Microinsurance | Business Interruption Microinsurance |

|---|---|---|

| Purpose | Covers damages from earthquakes | Covers income loss during business downtime |

| Coverage | Property damage, structural repairs | Lost revenue, fixed costs during interruption |

| Trigger Event | Earthquake occurrence confirmed | Business interruption caused by insured peril |

| Policyholder | Homeowners, small businesses in seismic zones | Small businesses dependent on continuous operations |

| Claim Process | Damage assessment, proof of earthquake | Documentation of income loss and cause |

| Premiums | Risk-based; varies by location and building | Based on business size and interruption risk |

| Benefit | Financial help for repairs post-earthquake | Supports cash flow during business downtime |

Which is better?

Earthquake microinsurance specifically covers damages and losses from seismic events, providing targeted financial protection for individuals and businesses in earthquake-prone areas. Business interruption microinsurance focuses on compensating income loss and operational disruptions caused by various unforeseen events, including natural disasters but also other factors like equipment failure or supply chain issues. The better option depends on risk exposure: earthquake microinsurance is ideal where seismic activity poses a significant threat, while business interruption microinsurance offers broader coverage for ongoing business continuity challenges.

Connection

Earthquake microinsurance and business interruption microinsurance both address financial risks caused by natural disasters, providing targeted coverage for small businesses facing earthquake-related damages and the resulting operational losses. By offering affordable protection against physical destruction and income disruption, these microinsurance products help stabilize local economies and support quicker recovery efforts. Their connection lies in mitigating the comprehensive impact of earthquakes, combining property repair costs with compensation for business downtime.

Key Terms

Business Interruption Microinsurance:

Business Interruption Microinsurance provides targeted financial protection for small and micro businesses against income loss due to operational disruptions caused by events like fires, floods, or supplier issues. Unlike Earthquake Microinsurance, which exclusively covers damages and losses from seismic events, Business Interruption Microinsurance offers broader coverage for various interruptions, helping businesses maintain cash flow and recover swiftly. Explore how Business Interruption Microinsurance can safeguard your enterprise against diverse risks and sustain your revenue stream.

Loss of Income

Business interruption microinsurance primarily targets compensating loss of income due to operational halts caused by events like natural disasters, including earthquakes, while earthquake microinsurance specifically covers damages and income loss directly resulting from seismic activities. Loss of income in business interruption microinsurance is often broader, addressing various risks disrupting business functions, whereas earthquake microinsurance focuses narrowly on earthquake-induced economic impacts. Explore detailed comparisons to understand which microinsurance product better safeguards your business revenue streams.

Coverage Period

Business interruption microinsurance typically offers coverage for a defined short-term period, often ranging from weeks to a few months, to quickly restore operations after disruptions. Earthquake microinsurance coverage periods tend to be annual, protecting against seismic events occurring throughout the policy year. Explore our detailed comparison to understand which microinsurance best suits your risk management strategy.

Source and External Links

Secure Your Future: Business Interruption Insurance Explained - This article explains business interruption insurance as a coverage that compensates for lost income due to temporary business closure from covered losses.

What Is Business Interruption Insurance? - Business interruption insurance helps replace lost income and pays for extra expenses when a business is affected by a covered peril.

Business Interruption Insurance and Coverage Basics - Chubb explains that business interruption insurance covers operating expenses and lost income for a set period if a business is unable to operate normally due to physical damage.

dowidth.com

dowidth.com