Pet health insurance provides coverage for veterinary expenses, including routine check-ups, emergency treatments, and specialized care to ensure the well-being of your pets. Condo insurance protects your property investment by covering structural damage, personal belongings, and liability risks within a condominium unit. Explore the key differences and benefits of pet health and condo insurance to make informed decisions for your protection needs.

Why it is important

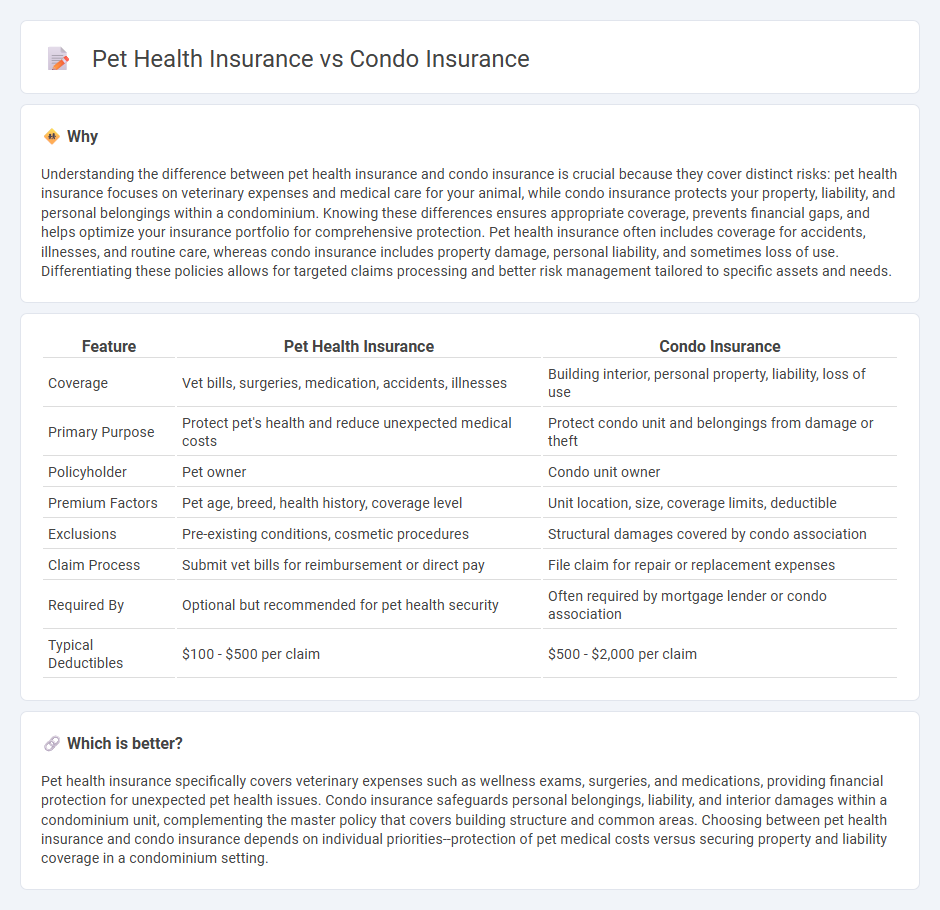

Understanding the difference between pet health insurance and condo insurance is crucial because they cover distinct risks: pet health insurance focuses on veterinary expenses and medical care for your animal, while condo insurance protects your property, liability, and personal belongings within a condominium. Knowing these differences ensures appropriate coverage, prevents financial gaps, and helps optimize your insurance portfolio for comprehensive protection. Pet health insurance often includes coverage for accidents, illnesses, and routine care, whereas condo insurance includes property damage, personal liability, and sometimes loss of use. Differentiating these policies allows for targeted claims processing and better risk management tailored to specific assets and needs.

Comparison Table

| Feature | Pet Health Insurance | Condo Insurance |

|---|---|---|

| Coverage | Vet bills, surgeries, medication, accidents, illnesses | Building interior, personal property, liability, loss of use |

| Primary Purpose | Protect pet's health and reduce unexpected medical costs | Protect condo unit and belongings from damage or theft |

| Policyholder | Pet owner | Condo unit owner |

| Premium Factors | Pet age, breed, health history, coverage level | Unit location, size, coverage limits, deductible |

| Exclusions | Pre-existing conditions, cosmetic procedures | Structural damages covered by condo association |

| Claim Process | Submit vet bills for reimbursement or direct pay | File claim for repair or replacement expenses |

| Required By | Optional but recommended for pet health security | Often required by mortgage lender or condo association |

| Typical Deductibles | $100 - $500 per claim | $500 - $2,000 per claim |

Which is better?

Pet health insurance specifically covers veterinary expenses such as wellness exams, surgeries, and medications, providing financial protection for unexpected pet health issues. Condo insurance safeguards personal belongings, liability, and interior damages within a condominium unit, complementing the master policy that covers building structure and common areas. Choosing between pet health insurance and condo insurance depends on individual priorities--protection of pet medical costs versus securing property and liability coverage in a condominium setting.

Connection

Pet health insurance and condo insurance both provide financial protection against unexpected expenses, with pet health insurance covering veterinary bills while condo insurance safeguards property and liability risks within a condominium unit. Both policies often include liability coverage that can protect owners from claims arising from accidents or damages caused by pets or incidents within the condo premises. Combining or coordinating these insurances helps condo owners manage overall risk and ensures comprehensive coverage for both pet-related health issues and property-related damages.

Key Terms

Condo Insurance:

Condo insurance protects your dwelling, personal belongings, and liability within a condominium unit, typically covering structural elements, interior fixtures, and loss of use. It differs from pet health insurance, which solely focuses on veterinary costs and medical treatments for pets. Explore more to understand how condo insurance safeguards your property investment and financial security.

Dwelling Coverage

Dwelling coverage in condo insurance protects the structure and permanent fixtures within your unit, covering damages caused by fire, water, or vandalism. Pet health insurance, by contrast, focuses exclusively on veterinary expenses and medical treatments for your pets, offering no protection for property or dwelling-related claims. Explore further to understand which insurance best suits your protection needs.

Personal Property

Condo insurance primarily covers personal property losses or damages caused by events such as theft, fire, or water damage within the condo unit, offering financial protection for furniture, electronics, and other belongings. Pet health insurance, however, focuses on veterinary expenses and medical treatments for pets, not providing coverage for personal property. To understand how these insurance types protect your assets differently, explore the detailed benefits and coverage options available.

Source and External Links

Learn how condo insurance works - Condo insurance (HO-6) covers your condo unit structure per HOA documents, personal liability, property loss, additional living expenses, and loss assessments for special HOA charges beyond their policy limits.

Condo Insurance - Get a Free Quote Fast - GEICO - GEICO condo insurance protects your personal property, unit upgrades, personal liability, and additional living expenses if your condo becomes uninhabitable, with discounts for bundling and safety equipment.

Condo Insurance | Get a Free Online Quote - Liberty Mutual - Condo insurance covers property damage to your unit, personal belongings, liability, and temporary living costs, typically costing less than homeowners insurance as it only covers inside your unit.

dowidth.com

dowidth.com