Crop insurance protects farmers against losses due to natural disasters, pests, or adverse weather conditions, ensuring financial stability for agricultural production. Earthquake insurance specifically covers damages to property and structures resulting from seismic activity, addressing risks that standard homeowners' policies often exclude. Explore the distinct benefits and coverage details of crop and earthquake insurance to safeguard your assets effectively.

Why it is important

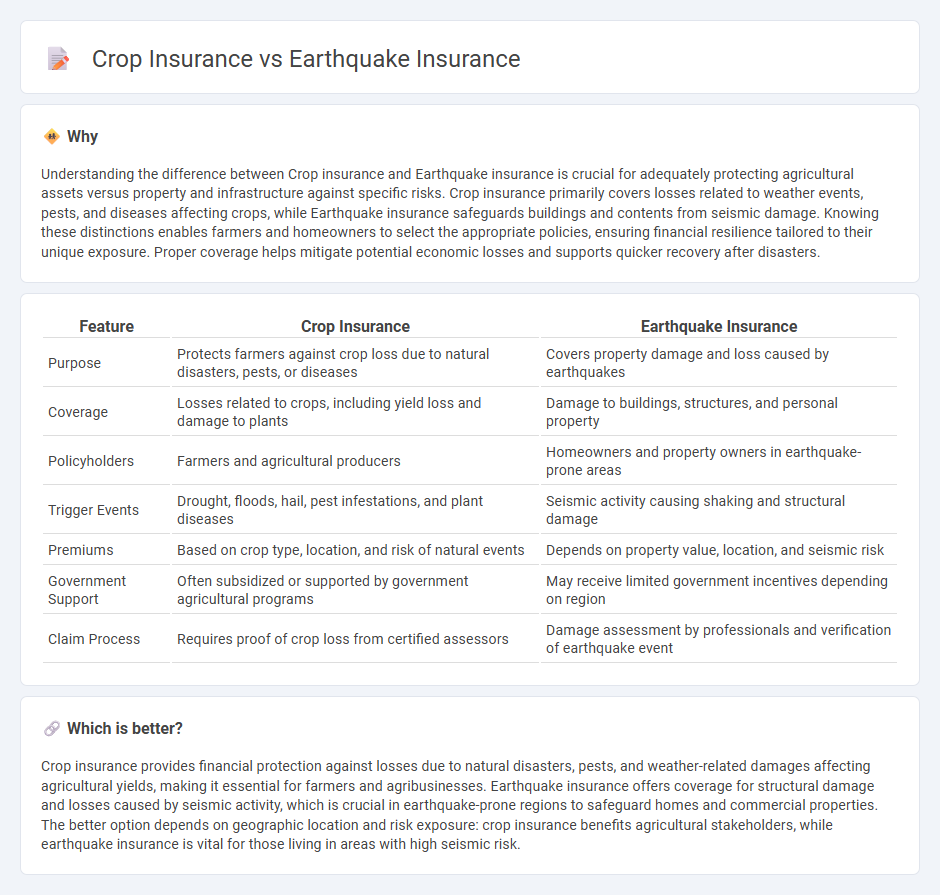

Understanding the difference between Crop insurance and Earthquake insurance is crucial for adequately protecting agricultural assets versus property and infrastructure against specific risks. Crop insurance primarily covers losses related to weather events, pests, and diseases affecting crops, while Earthquake insurance safeguards buildings and contents from seismic damage. Knowing these distinctions enables farmers and homeowners to select the appropriate policies, ensuring financial resilience tailored to their unique exposure. Proper coverage helps mitigate potential economic losses and supports quicker recovery after disasters.

Comparison Table

| Feature | Crop Insurance | Earthquake Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to natural disasters, pests, or diseases | Covers property damage and loss caused by earthquakes |

| Coverage | Losses related to crops, including yield loss and damage to plants | Damage to buildings, structures, and personal property |

| Policyholders | Farmers and agricultural producers | Homeowners and property owners in earthquake-prone areas |

| Trigger Events | Drought, floods, hail, pest infestations, and plant diseases | Seismic activity causing shaking and structural damage |

| Premiums | Based on crop type, location, and risk of natural events | Depends on property value, location, and seismic risk |

| Government Support | Often subsidized or supported by government agricultural programs | May receive limited government incentives depending on region |

| Claim Process | Requires proof of crop loss from certified assessors | Damage assessment by professionals and verification of earthquake event |

Which is better?

Crop insurance provides financial protection against losses due to natural disasters, pests, and weather-related damages affecting agricultural yields, making it essential for farmers and agribusinesses. Earthquake insurance offers coverage for structural damage and losses caused by seismic activity, which is crucial in earthquake-prone regions to safeguard homes and commercial properties. The better option depends on geographic location and risk exposure: crop insurance benefits agricultural stakeholders, while earthquake insurance is vital for those living in areas with high seismic risk.

Connection

Crop insurance and earthquake insurance are connected through their role in risk management for agricultural stakeholders who face losses due to natural disasters. Both types of insurance provide financial protection by covering damages caused by unpredictable events--crop insurance for weather-related damages like drought or floods, and earthquake insurance for seismic events affecting farm infrastructure. This connection highlights the importance of comprehensive insurance portfolios in safeguarding farmers' livelihoods and ensuring agricultural stability.

Key Terms

Peril Coverage

Earthquake insurance provides financial protection specifically against damage caused by seismic activity, covering structural repairs and losses to personal property triggered by earthquakes. Crop insurance, on the other hand, safeguards farmers from losses due to natural perils such as drought, floods, pests, and hail, ensuring income stability in unpredictable agricultural conditions. Explore detailed comparisons to understand which insurance best fits your risk management needs.

Premium

Earthquake insurance premiums are typically higher due to the unpredictable nature and potential severity of seismic events, often requiring specialized underwriting and risk assessment. Crop insurance premiums vary based on factors like crop type, location, and weather patterns, with subsidies sometimes available to reduce farmer costs. Explore detailed comparisons of premium structures and risk factors to make an informed insurance choice.

Policy Exclusions

Earthquake insurance typically excludes damages caused by floods, landslides, and tsunamis, while crop insurance often excludes losses due to improper farming practices or contamination. Policyholders should carefully review exclusions related to natural events and human activities unique to each insurance type to avoid coverage gaps. Explore comprehensive guides on earthquake and crop insurance policy exclusions to make informed decisions.

Source and External Links

Earthquake insurance | Office of the Insurance Commissioner - Earthquake insurance covers damages to homes and personal property when an earthquake occurs, often requiring a high deductible and can be added to existing policies or purchased separately.

Earthquake insurance - This type of insurance compensates for earthquake damage, typically featuring high deductibles and varying rates based on location and building type.

Earthquake Insurance - California Department of Insurance - The California Earthquake Authority offers basic earthquake insurance covering dwelling damages, with deductibles ranging from 5% to 25%, and does not include certain structures like landscaping or pools.

dowidth.com

dowidth.com