Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets, improving risk assessment accuracy and accelerating policy issuance. Blockchain-powered underwriting ensures data transparency and security by enabling decentralized, tamper-proof records that streamline claims and fraud detection. Explore the transformative potential of these technologies in revolutionizing the insurance underwriting process.

Why it is important

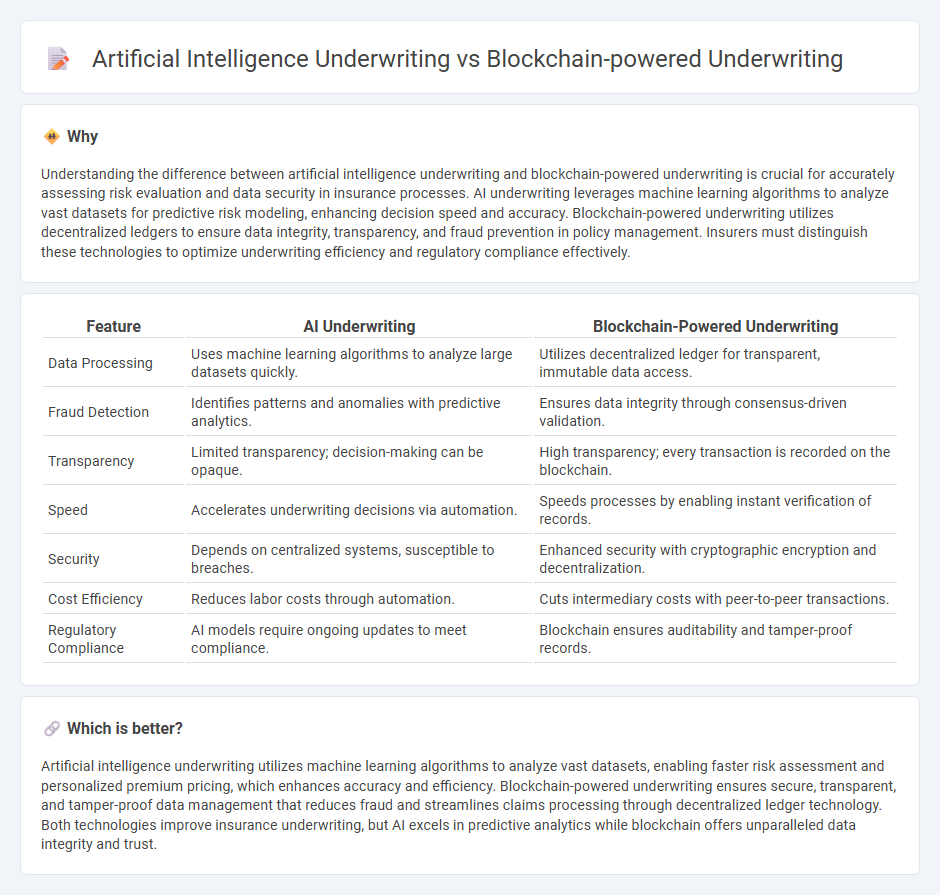

Understanding the difference between artificial intelligence underwriting and blockchain-powered underwriting is crucial for accurately assessing risk evaluation and data security in insurance processes. AI underwriting leverages machine learning algorithms to analyze vast datasets for predictive risk modeling, enhancing decision speed and accuracy. Blockchain-powered underwriting utilizes decentralized ledgers to ensure data integrity, transparency, and fraud prevention in policy management. Insurers must distinguish these technologies to optimize underwriting efficiency and regulatory compliance effectively.

Comparison Table

| Feature | AI Underwriting | Blockchain-Powered Underwriting |

|---|---|---|

| Data Processing | Uses machine learning algorithms to analyze large datasets quickly. | Utilizes decentralized ledger for transparent, immutable data access. |

| Fraud Detection | Identifies patterns and anomalies with predictive analytics. | Ensures data integrity through consensus-driven validation. |

| Transparency | Limited transparency; decision-making can be opaque. | High transparency; every transaction is recorded on the blockchain. |

| Speed | Accelerates underwriting decisions via automation. | Speeds processes by enabling instant verification of records. |

| Security | Depends on centralized systems, susceptible to breaches. | Enhanced security with cryptographic encryption and decentralization. |

| Cost Efficiency | Reduces labor costs through automation. | Cuts intermediary costs with peer-to-peer transactions. |

| Regulatory Compliance | AI models require ongoing updates to meet compliance. | Blockchain ensures auditability and tamper-proof records. |

Which is better?

Artificial intelligence underwriting utilizes machine learning algorithms to analyze vast datasets, enabling faster risk assessment and personalized premium pricing, which enhances accuracy and efficiency. Blockchain-powered underwriting ensures secure, transparent, and tamper-proof data management that reduces fraud and streamlines claims processing through decentralized ledger technology. Both technologies improve insurance underwriting, but AI excels in predictive analytics while blockchain offers unparalleled data integrity and trust.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets for precise risk assessment, while blockchain-powered underwriting enhances transparency and security through decentralized ledgers. The integration of AI with blockchain enables automated, tamper-proof decision-making processes, reducing fraud and improving efficiency in insurance underwriting. This synergy facilitates real-time data sharing among stakeholders, optimizing policy accuracy and accelerating claim settlements.

Key Terms

Smart Contracts

Blockchain-powered underwriting leverages decentralized ledgers and smart contracts to automate and secure insurance policy issuance, ensuring transparency and reducing fraud through immutable transaction records. Artificial intelligence underwriting utilizes machine learning algorithms and predictive analytics to assess risk, optimize pricing, and streamline claims processing with enhanced accuracy and speed. Explore how integrating smart contracts with AI can revolutionize underwriting efficiency and reliability.

Predictive Analytics

Blockchain-powered underwriting leverages decentralized ledger technology to enhance transparency, data security, and immutability in insurance risk assessment. Artificial intelligence underwriting employs predictive analytics algorithms to analyze vast datasets, identify patterns, and forecast risk with higher accuracy and speed. Explore the differences and advantages of these innovative underwriting approaches to optimize risk management strategies.

Automated Risk Assessment

Blockchain-powered underwriting enhances Automated Risk Assessment by ensuring transparent, tamper-proof data sharing among stakeholders, reducing fraud and improving trust in underwriting decisions. Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets, identify patterns, and predict risk with high accuracy and speed. Discover more about the transformative impact of these technologies on risk assessment and underwriting efficiency.

Source and External Links

Blockchain Transforming Insurance: Transparency Innovation - Blockchain enhances insurance underwriting by providing a decentralized, tamper-proof ledger that improves transparency, automates workflows through smart contracts, integrates real-time data for risk assessment, and reduces fraud, making the underwriting process more efficient and collaborative.

Blockchain: A Tool for Insurance | InsurTech Digital - Blockchain in insurance automates claims, improves policy management accuracy, reduces administrative costs, and ensures data integrity for underwriting by creating a single source of truth and enabling smart contract execution within distributed ledger networks.

Blockchain applications in reinsurance - Verification as a Service - Blockchain transforms reinsurance underwriting by allowing tamper-proof data sharing and better coordination between insurers and reinsurers, exemplified by companies like Lemonade using blockchain-powered smart contracts to enhance risk assessment and expedite underwriting decisions.

dowidth.com

dowidth.com