Buy-now-pay-later protection offers immediate coverage with deferred payment options, appealing to consumers seeking flexibility without upfront costs. Subscription-based insurance provides continuous, monthly coverage ideal for long-term, consistent protection tailored to evolving needs. Explore these plans further to determine which insurance model fits your financial strategy and lifestyle.

Why it is important

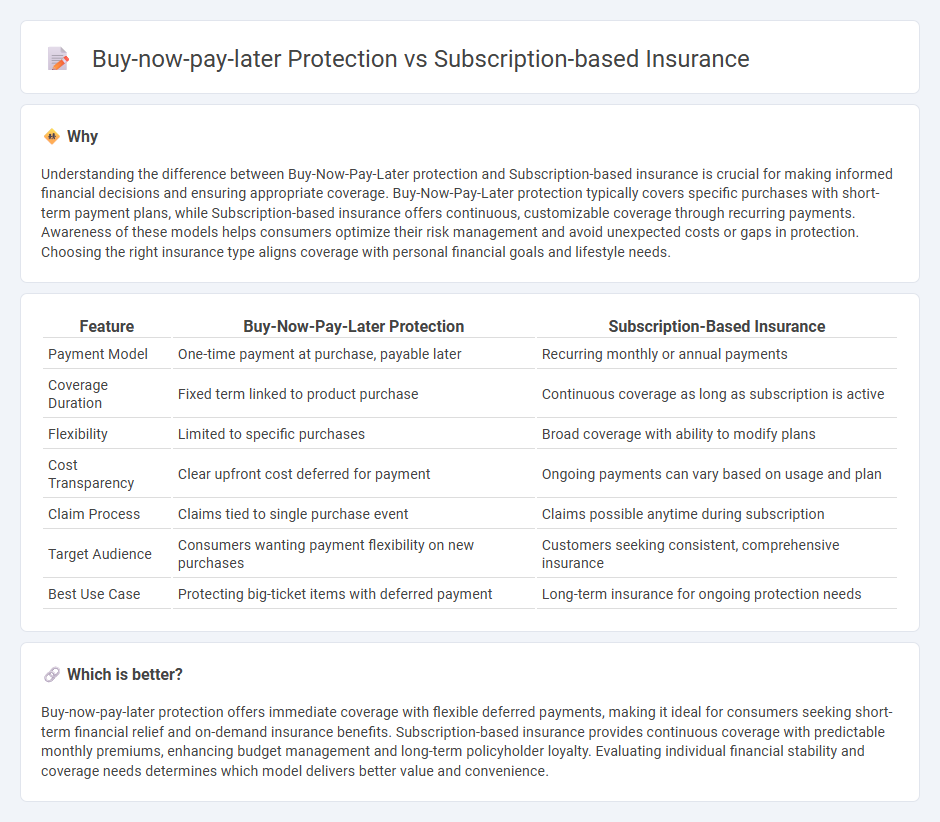

Understanding the difference between Buy-Now-Pay-Later protection and Subscription-based insurance is crucial for making informed financial decisions and ensuring appropriate coverage. Buy-Now-Pay-Later protection typically covers specific purchases with short-term payment plans, while Subscription-based insurance offers continuous, customizable coverage through recurring payments. Awareness of these models helps consumers optimize their risk management and avoid unexpected costs or gaps in protection. Choosing the right insurance type aligns coverage with personal financial goals and lifestyle needs.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Subscription-Based Insurance |

|---|---|---|

| Payment Model | One-time payment at purchase, payable later | Recurring monthly or annual payments |

| Coverage Duration | Fixed term linked to product purchase | Continuous coverage as long as subscription is active |

| Flexibility | Limited to specific purchases | Broad coverage with ability to modify plans |

| Cost Transparency | Clear upfront cost deferred for payment | Ongoing payments can vary based on usage and plan |

| Claim Process | Claims tied to single purchase event | Claims possible anytime during subscription |

| Target Audience | Consumers wanting payment flexibility on new purchases | Customers seeking consistent, comprehensive insurance |

| Best Use Case | Protecting big-ticket items with deferred payment | Long-term insurance for ongoing protection needs |

Which is better?

Buy-now-pay-later protection offers immediate coverage with flexible deferred payments, making it ideal for consumers seeking short-term financial relief and on-demand insurance benefits. Subscription-based insurance provides continuous coverage with predictable monthly premiums, enhancing budget management and long-term policyholder loyalty. Evaluating individual financial stability and coverage needs determines which model delivers better value and convenience.

Connection

Buy-now-pay-later protection integrates with subscription-based insurance by offering flexible payment options that align with recurring premium models. This connection enhances customer affordability and convenience, enabling seamless access to continuous insurance coverage while managing cash flow effectively. Both innovations leverage digital platforms to streamline enrollment and claims processing, fostering improved user experience and retention.

Key Terms

Premium Payment Structure

Subscription-based insurance offers a flexible premium payment structure with regular, often monthly, payments that align with ongoing coverage needs, providing predictable budgeting and easy cancellation options. Buy-now-pay-later protection typically involves a one-time upfront cost or installment payments tied to the purchase of a product, which may limit coverage duration and flexibility. Explore the detailed differences in payment structures to determine which model best suits your financial preferences.

Coverage Activation

Subscription-based insurance activates coverage immediately upon subscription, offering continuous protection without additional steps, while buy-now-pay-later protection typically requires activation at the point of purchase or repayment. Subscription models provide ongoing risk mitigation with predictable monthly fees, contrasted with buy-now-pay-later plans that align coverage duration to specific payment periods. Explore detailed comparisons to determine which coverage activation method suits your financial habits best.

Risk Assessment

Subscription-based insurance employs continuous risk assessment through real-time data analytics, allowing for dynamic policy adjustments aligned with user behavior and environmental changes. Buy-now-pay-later protection relies on a more static risk evaluation at the point of purchase, often lacking ongoing risk recalibration. Discover the nuances of risk management in these models to optimize your coverage strategy.

Source and External Links

Subscription Policy - A subscription policy is an insurance policy where multiple insurers share the risk of providing coverage, allowing each insurer to assume a level of risk aligned with its capacity.

Subscription Based Healthcare - Subscription-based healthcare involves paying a monthly or annual fee for access to a defined set of healthcare services, focusing on holistic and personalized care.

The Pros And Cons Of Subscription-Based Healthcare - This model requires patients to pay a fixed amount regularly for healthcare services, promoting preventive care and potentially higher quality patient care.

dowidth.com

dowidth.com