Natural catastrophe bonds transfer risk to capital market investors by paying scheduled coupons unless specific disaster triggers occur, enabling insurers to raise funds for catastrophe losses. Catastrophe swaps are derivative contracts where insurers exchange cash flows with counterparties to hedge potential catastrophe exposure by shifting risk through financial agreements. Explore how these innovative instruments enhance risk management strategies in the insurance industry.

Why it is important

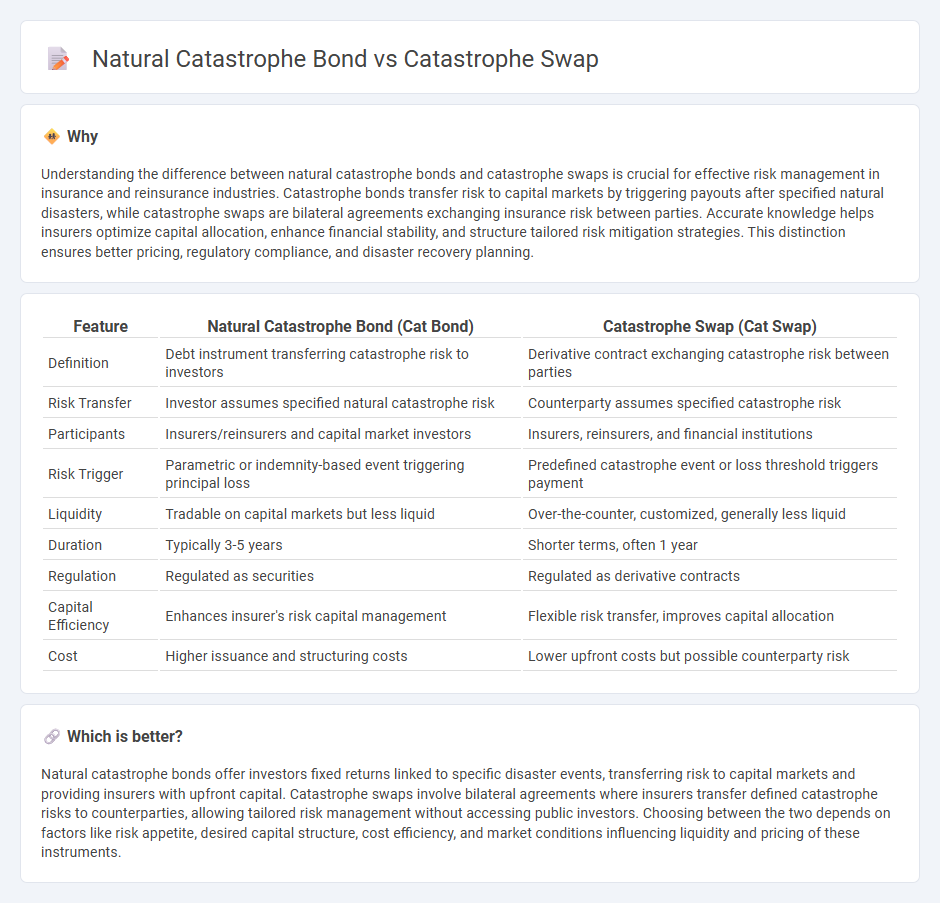

Understanding the difference between natural catastrophe bonds and catastrophe swaps is crucial for effective risk management in insurance and reinsurance industries. Catastrophe bonds transfer risk to capital markets by triggering payouts after specified natural disasters, while catastrophe swaps are bilateral agreements exchanging insurance risk between parties. Accurate knowledge helps insurers optimize capital allocation, enhance financial stability, and structure tailored risk mitigation strategies. This distinction ensures better pricing, regulatory compliance, and disaster recovery planning.

Comparison Table

| Feature | Natural Catastrophe Bond (Cat Bond) | Catastrophe Swap (Cat Swap) |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk to investors | Derivative contract exchanging catastrophe risk between parties |

| Risk Transfer | Investor assumes specified natural catastrophe risk | Counterparty assumes specified catastrophe risk |

| Participants | Insurers/reinsurers and capital market investors | Insurers, reinsurers, and financial institutions |

| Risk Trigger | Parametric or indemnity-based event triggering principal loss | Predefined catastrophe event or loss threshold triggers payment |

| Liquidity | Tradable on capital markets but less liquid | Over-the-counter, customized, generally less liquid |

| Duration | Typically 3-5 years | Shorter terms, often 1 year |

| Regulation | Regulated as securities | Regulated as derivative contracts |

| Capital Efficiency | Enhances insurer's risk capital management | Flexible risk transfer, improves capital allocation |

| Cost | Higher issuance and structuring costs | Lower upfront costs but possible counterparty risk |

Which is better?

Natural catastrophe bonds offer investors fixed returns linked to specific disaster events, transferring risk to capital markets and providing insurers with upfront capital. Catastrophe swaps involve bilateral agreements where insurers transfer defined catastrophe risks to counterparties, allowing tailored risk management without accessing public investors. Choosing between the two depends on factors like risk appetite, desired capital structure, cost efficiency, and market conditions influencing liquidity and pricing of these instruments.

Connection

Natural catastrophe bonds and catastrophe swaps are financial instruments designed to transfer the risk of natural disasters from insurers to capital market investors. Both tools help insurance companies manage exposure to catastrophic events by providing alternative risk financing solutions tied to predefined disaster triggers. These instruments enhance the resilience of insurance portfolios by diversifying risk sources and ensuring liquidity following significant natural catastrophes.

Key Terms

Risk Transfer

Catastrophe swaps and natural catastrophe bonds are financial instruments used for risk transfer in disaster finance, with swaps involving the exchange of risk between two parties, often insurers and investors, while catastrophe bonds transfer risk from insurers to investors through bond issuance, triggering payouts upon predefined catastrophe events. Catastrophe swaps typically provide more flexibility in contract terms, whereas catastrophe bonds offer clear exposure limits and attract broader capital market participation. Explore detailed comparisons and suitability to deepen your understanding of risk transfer mechanisms in catastrophic event financing.

Trigger Mechanism

Catastrophe swaps rely on predefined loss triggers tied to actual insured losses, transferring risk between counterparties through indemnity-based triggers. Natural catastrophe bonds use parametric triggers based on measurable event parameters like wind speed or earthquake magnitude, offering quicker payouts without the need to assess actual losses. Explore more about how trigger mechanisms impact risk transfer and payout efficiency.

Investor Protection

Catastrophe swaps offer investors protection by transferring insurer risks through derivative contracts, ensuring quicker payouts but carrying counterparty default risk. Natural catastrophe bonds provide investors with principal risk linked to specific catastrophic events, offering higher yields but exposing capital to loss if defined triggers occur. Explore our detailed analysis to understand which instrument aligns best with your investment protection needs.

Source and External Links

Catastrophe Swap Valuation Based on Stochastic Dam - Catastrophe swaps are special swap contracts that allow insurers or reinsurers to transfer parts of their natural disaster risks, such as from earthquakes or floods, to other parties, exposing investors to catastrophe risks for returns while helping insurers finance and compensate large damages.

Pricing catastrophe swaps: A contingent claims approach - Catastrophe swaps are financial instruments used to transfer catastrophe risk, typically based on a contingent claims pricing model that incorporates stochastic processes to estimate losses and counterparty default risk.

World Bank Executes its Largest Single Country Catastrophe Bond and Swap Transaction to Provide Chile $630 Million in Financial Protection - The World Bank structured a major catastrophe swap transaction alongside catastrophe bonds to provide Chile with $280 million in catastrophe swap coverage as part of $630 million total earthquake insurance protection, demonstrating the use of catastrophe swaps in sovereign financial risk management.

dowidth.com

dowidth.com